Fed pause ECB hike as markets battle bank crisis

The Federal Reserve just helped put together a revolutionary state intervention rescue package for the banking sector. It is well aware that there is actual systemic risk.

Credit Suisse is very likely to survive this. Though it will be badly mauled for many years to come. Anything remains possible.

What we are seeing is a definite un-ravelling of investor confidence across both the Tech and Banking sectors. It is highly unlikely these concerns are going to simply vanish any time soon. Which means we have entered an intensified period of investor nervousness more broadly.

All Bank based economists and strategists will today be speaking of how strong European banks are. This is certainly a case of talking their books, but there is some truth to that. Nevertheless, banks can and do fail. Regardless of balance sheets, a loss of confidence by investors and depositors can bring down any bank.

What I am noticing is the growing populism of the term “isolated case”. I wonder how many ‘isolated cases’ it takes, before a systemic problem of perhaps having over-lent on mis-placed economic rebound optimism in recent years, becomes a recognised sector challenge?

Sentiment in one sector often flows over into other asset classes. Rather than isolated cases, we can already see caution, if not nervousness, sweeping global markets.

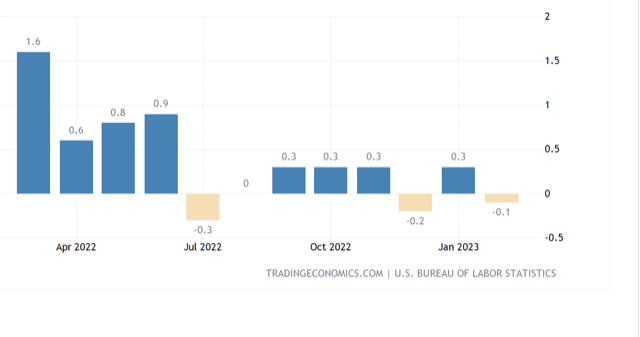

With this backdrop of bank failures, we saw US Retail Sales fall in February by 0.4%. Producer Prices Inflation also fell 0.1%.

These are numbers that allow the Federal Reserve to pause it’s rate hikes at its next meeting. The outcome will be no change, or only 25 point change.

The current banking sector could hardly be felt by the FOMC to be fully resolved and green lighted within this next week. Therefore, with growing evidence that the start of the year was indeed a mere moment of economic stability, and with a full blown banking crisis under-way. the Fed is likely to pause.

The Federal Reserve just helped put together a revolutionary state intervention rescue package for the banking sector. It is well aware that there is actual systemic risk. This is why they took such radical action.

It is therefore unlikely, that they would simply step over the carcass of SVB and act like it is business as usual.

Markets are badly under-estimating the realisation which must be occurring within central banks at the moment. That there is already a lot of stress out there. Not just for consumers and businesses, but for the entire banking system too.

How would the Fed respond to credibility questions were it to raise rates next week, only to be followed by further regional bank closures. Which remain a very real risk.

It is possible the Fed will hike by 25 points. Inflation is still high, but other factors are already front and centre at these organisations.

The Fed will likely leave rates on hold, stressing this is only a temporary measure and the tightening will resume most likely at the following FOMC. I can almost hear the Chairman, “We consider it ‘prudent’ in order to assess the situation more fully, to pause for this most likely one meeting.” Either that, or a pause could occur sooner if banking stresses were to continue.

We were the first to call these much higher Fed levels and beyond. I now believe the market is under-estimating the impact of this latest crisis.

The ECB has an extremely challenging moment right now.

If they keep rates steady for the moment, this could cause investors to panic further. If they raise rates again immediately after this Credit Suisse crisis, they could be seen as reckless and that such a move may be too much for some other banks?

The ECB will most likely seek to reassure markets that it sees no issues of liquidity with the major banks, that they remain sound, and can therefore proceed with another 50 point rate cut to fight inflation. Though a total pause cannot be entirely ruled out.

For markets, the extreme volatility of recent days should subside, but what is next around the corner? Such skittishness of itself will maintain at least heightened volatility for the next 1-3 weeks.

Defensive plays in equity markets remain, as they have since the start of 2022, the most appropriate strategy.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a