Fed Brainwashing on Net Wealth in One Picture

The Fed released it "Z1" report today on Household Net Worth and Domestic Nonfinancial Debt. Let's dive in on wealth.

Please consider the Fed's Z1 report on Recent Developments in Household Net Worth and Domestic Nonfinancial Debt.

Hooray for Bubbles!

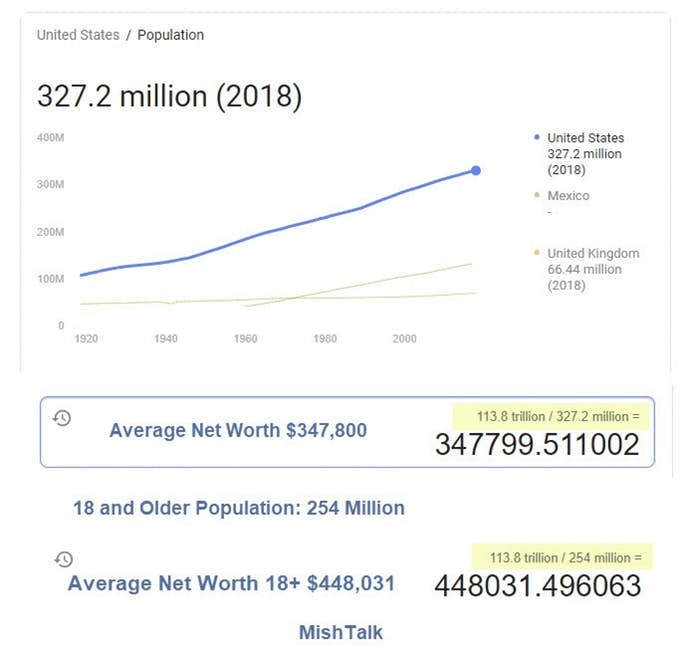

"The net worth of households and nonprofits rose to $113.8 trillion during the third quarter of 2019. The value of directly and indirectly held corporate equities decreased $0.3 trillion and the value of real estate increased $0.2 trillion."

The Fed offers an Interactive Chart on Wealth.

Assets vs Liabilities

- Assets: $130 Trillion

- Liabilities: 16.4 Trillion

- Net Worth $113.8 Trillion

Aggregates Mislead

Median Net Worth

The average net worth is $347,800. The average net worth of those 18 and older is $448,031.

The median net worth of those 18 and older is about $100,000.

The median net worth is skewed by the biggest stock market bubble in history. It's also skewed by a housing bubble.

Unlike Elizabeth Warren, I am not proposing wealth redistribution schemes.

Rather I am pointing out problems with the rosy-looking picture.

What the Chart Does Not Say

The chart paints a rosy picture. Liabilities are low. Hooray.

But what the chart does not say is where the wealth is and where the liabilities are.

The assets are concentrated in the hands of the top 10%. The liabilities are concentrated in the bottom 90%.

Bubble Blowing Tactics

Most of the country isn't prepared for retirement. And many who think they are prepared do so only because of inflated asset prices, unlikely to last.

This is a result of bubble-blowing tactics ongoing for decades. Escalation took off when Nixon closed the Gold Window in 1971.

For discussion, please see Nixon Shock, the Reserve Currency Curse, and a Pending Currency Crisis.

Nixon Shock coupled with irresponsible Fed policies are to blame for widely reported "wealth gaps".

Meanwhile, if you do not feel wealthy, then most likely it's because you aren't.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc