During the past week, the negotiations on the third 85-billion-euro Greek bailout program have finally started. The nation’s Prime Minister Tsipras has managed to make the rebellious lawmakers of his party agree to hold extraordinary congress in September after Greece is expected to have sealed a new bailout deal with its international creditors. Still, tensions are not over. The IMF has made it clear that it will not contribute to another bailout for Greece without debt relief and real economic reforms. German finance minister Wolfgang Schaeuble even proposed Greece a “temporary” exit from the euro area.

As a result, we are sure that further Greek talks will be very difficult. The euro lacks bullish drivers, while the US dollar, on the contrary, has strong upside potential.

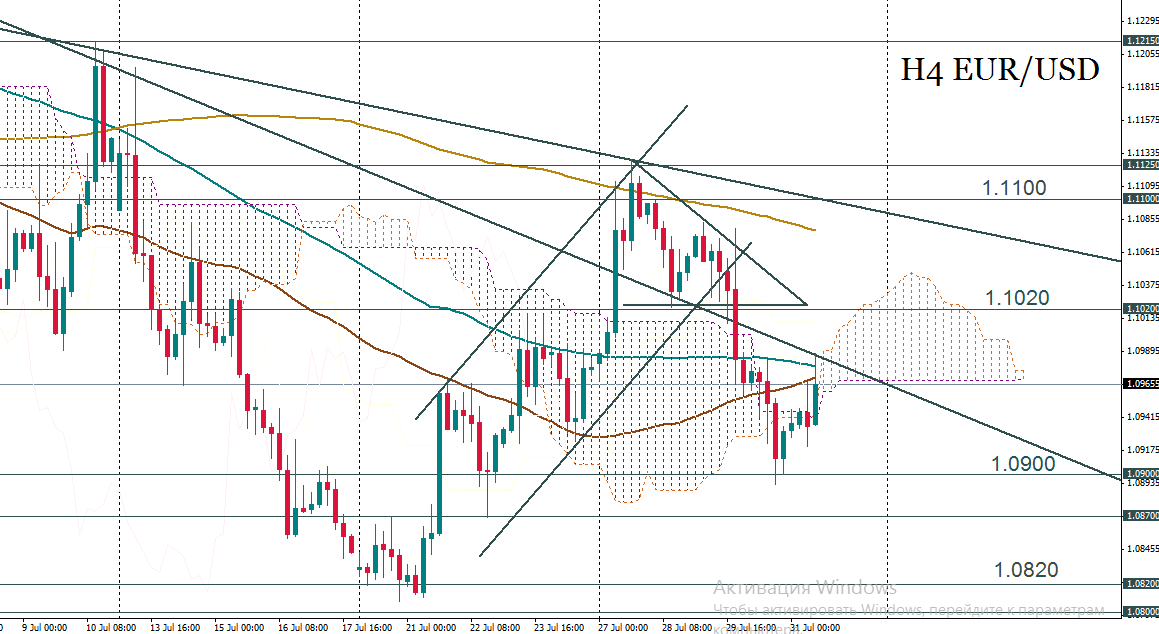

There are no important events in the euro zone, which could drive the euro in the week ahead, so the focus will be on American releases. Note, though, that despite optimism about the US GDP, EUR/USD has managed to hold above 1.0900. The key support is lower, in the 1.0820/00 zone (bottom of the 3-month range). The general downtrend is still in place, and we will look to sell on increases to resistance in the 1.1000/1020 area.

EUR/USD, H4

Recommended Content

Editors’ Picks

RBA keeps interest rate steady at 4.35%, as expected

The Reserve Bank of Australia board members decided to keep the Official Cash Rate unchanged at 4.35% after its May monetary policy meeting on Tuesday. The policy announcement was widely expected by the markets. The RBA extended its pause for the fourth meeting in a row.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.