EUR/USD still ranging after the latest ECB decision

European stocks jumped for the third straight day as fears of the Delta variant eased. In Germany, the DAX index rose by more than 0.8% while the FTSE 100 index rose by more than 0.25% in the UK. The same trend was seen in Asia and the US where the Nikkei 225, Hang Seng, and Dow Jones futures rose. This performance is possible because investors expect that central banks will maintain an easy-money policy for as long as the virus remains a threat. The indices have also been supported by the relatively strong quarterly results from companies like Philip Morris and IBM. Still, some consumer-facing products have been affected by rising costs. Results by Unilever showed that its margins were affected since inflation was bigger than anticipated.

The Bitcoin price stabilized at the $32,000 level as traders reflected on recent statements by Elon Musk. Speaking at the B Word Conference, Musk said that he had personally invested in Dogecoin, Bitcoin, and Ethereum. He also confirmed for the first time that SpaceX has also invested in Bitcoin. Additionally, he said that Tesla was open to the idea of accepting Bitcoin again when miners carbon emissions subside. The news from Elon Musk, coupled with the stabilizing fear and greed index, has helped boost the total market capitalization of all cryptocurrencies to more than $1.3 trillion.

The EURUSD was unchanged after the latest European Central Bank (ECB) decision. The bank decided to leave the deposit facility rate unchanged at -0.50% and pledged to continue supporting the economy. It will also continue with its 1.85 trillion-euro asset purchase program. The decision came two weeks after the bank unveiled its latest strategy that placed the inflation target to 2.0%. It also came at a time when many European countries are struggling with the new coronavirus wave. The 10-year German bond yield declined to -0.40%, the lowest it has been since February. The bank said:

“The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon.”

BTC/USD

The BTCUSD was little changed today after the positive comments by Elon Musk. The pair is trading at 31,890, which is below today’s high of 32,852. On the 4H chart, the pair is inside the descending yellow channel. It is also forming a bullish flag pattern while the Relative Strength Index (RSI) is slightly below the overbought level of 70. It has also formed an inverted head and shoulders pattern. Therefore, the pair will likely bounce higher as traders target the next key resistance at 33,000.

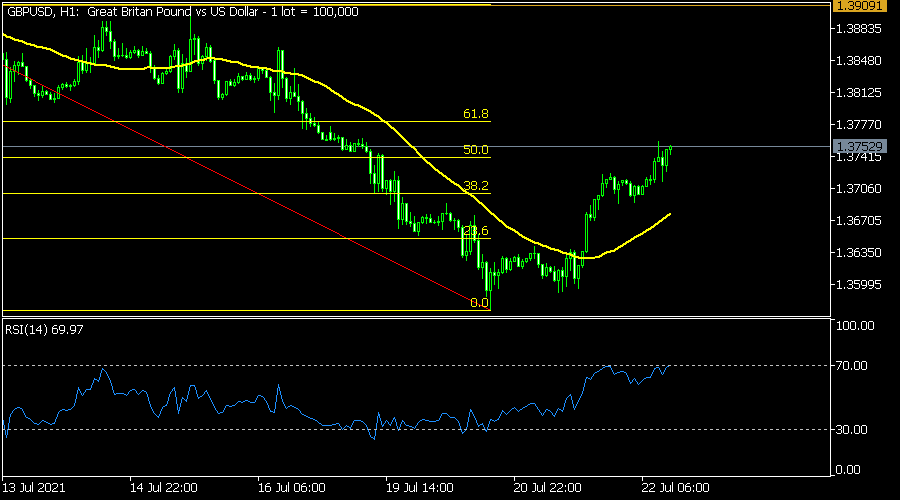

GBP/USD

The GBPUSD pair bounced back as the UK reopened and as fears of the Delta virus eased. The pair is trading at 1.3750, which is slightly above this week’s low of 1.3572. The pair moved to the 50% Fibonacci retracement level on the hourly chart and crossed the 25-day moving average. The Relative Strength Index has also risen to the overbought level of 70. Therefore, the pair’s path of least resistance is to the upside.

EUR/USD

The EURUSD pair was little changed today before and after the ECB decision. It is trading at 1.1790, which is slightly above the 38.2% Fibonacci retracement level. The pair has also moved below the 25-day moving average while it has formed a descending wedge pattern. The signal and histogram of the MACD have also formed a bullish crossover. This is a sign that the pair will likely bounce back higher over the next few days.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.