EUR/USD Weekly Forecast: Fed and ECB hint at June rate cuts

- The Federal Reserve and the European Central Bank offered cautiously optimistic messages.

- Inflation takes centre stage next week as the US unveils the Consumer Price Index.

- EUR/USD bullish case increased after US data aligned with Fed wishes.

The EUR/USD pair surged to 1.0981, its highest in almost two months, on Friday, ending the week at around 1.0950. Demand for the US Dollar remained subdued, which should have helped the pair run further, but discouraging European news limited Euro gains. By the end of the week, the shared currency stood as the weakest USD rival.

The focus was on central banks, as Federal Reserve (Fed) Chair Jerome Powell testified about monetary policy before the US Congress, while the European Central Bank (ECB) delivered its decision on monetary policy.

Central banks cautiously optimistic

Fed Chair Powell repeated a cautiously optimistic message, saying rates are likely at their peak, adding that policymakers would like to be more confident that inflation is moving sustainably towards the 2% inflation goal to dial back monetary restrictions. Moreover, Powell noted that there was no reason to think the economy was "in or facing a significant near-term risk of recession." Powell refrained from providing a certain date for rate cuts but repeated it would likely be this year.

His words had no positive impact on the USD but on sentiment. Stock markets reverted early weekly losses and resumed their advances. At the same time, government bond yields eased, with the 10-year Treasury note rate down to 4.03% on Friday, its lowest in over a month.

Across the pond, the European Central Bank (ECB) announced its decision on monetary policy. The central bank kept rates on hold for the fourth consecutive meeting, leaving the Rate on Deposit Facility at 4% and the Main Refinancing Operations Rate at 4.5%. Furthermore, policymakers delivered fresh forecasts, downwardly revising growth and inflation perspectives. President Christine Lagarde & co paved the way for rate cuts later this year, noting they had made good progress in bringing down inflation.

It is worth adding that the Fed and the ECB coincide in that they remain data-dependent, leaving a door open to keeping rates at current levels for longer if they believe it would be a better choice.

Growth imbalances on the table

Data-wise, mixed signals came from both shores of the Atlantic. S&P Global released the final estimates of the February Purchasing Managers Indexes (PMIs), with upward revisions in services output lifting the Composite PMI for Germany, the Eurozone and the United States (US). However, the official US ISM Services PMI shrank to 52.6 from 53.4, also missing the expected 53.0. Still, the report indicated expansion in the sector for the fourteenth consecutive month.

In addition, Euro Zone Retail Sales were up 0.1% MoM in January, while the Producer Price Index (PPI) fell 8.6% YoY in the same month. Finally, the EU confirmed no economic growth in the last quarter of 2023, as the Gross Domestic Product (GDP) growth came in at 0% QoQ.

US employment situation

The US Bureau of Labor Statistics (BLS) released the ob Openings and Labor Turnover Survey (JOLTS) report on Wednesday, showing the number of job openings on the last business day of January stood at 8.86 million in January, easing modestly from the 8.88 million posted on December. The latter was previously estimated at 9.02 million, and the downward revision was welcomed by financial markets, as usually, high openings suggest strong demand for labor and tight market conditions while easing figures suggest it’s loosening, something the Fed requires to trim rates.

Additionally, the ADP survey on private job creation showed that 140K new positions were added in February. The figure missed the 150K expected, but it was not bad enough to become a concern.

Finally, on Friday, the country released the Nonfarm Payrolls report. The US economy added 275K new job positions in February, beating expectations of 200K. The January headline reading was downwardly revised to 229K from 353K previously estimated. Furthermore, the Unemployment Rate jumped to 3.9%, while Average Hourly Earnings were up 4.3% on a yearly basis, below the market expectation and January's reading of 4.4%.

The US employment-related figures aligned with the Fed’s requirements to cut rates. As a result, the US Dollar fell further as investors looked for better-yielding options.

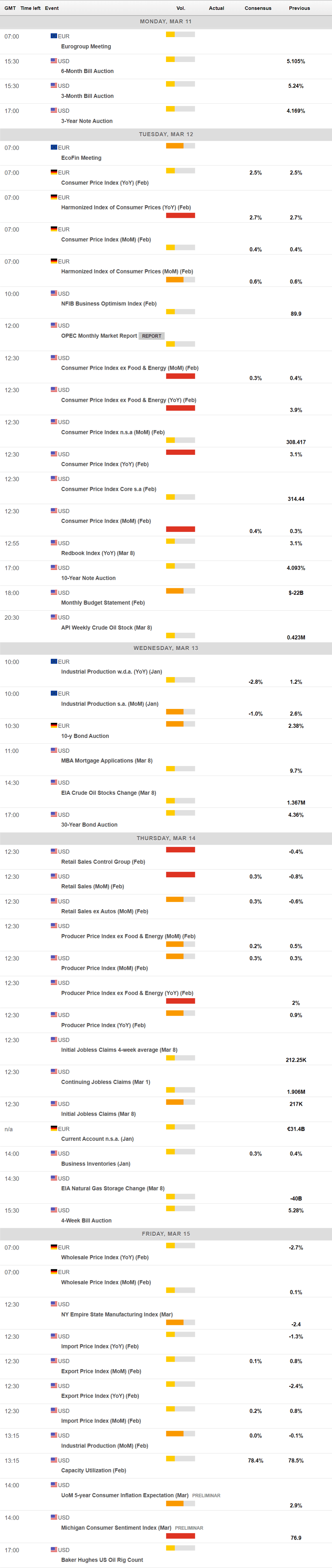

Inflation takes centre stage next week

Whether central banks’ hints towards June rate cuts are likely or not it will be revealed next week, as major economies will release inflation updates. The US will publish the February Consumer Price Index (CPI) next Tuesday, previous rate came at 3.1% YoY. The January core annual inflation reading posted 3.9%, a red flag later cooled by a softer Personal Consumption Expenditure (PCE) Price Index, the Fed’s favorite inflation gauge. On Thursday, the US will unveil February Retail Sales and the February Producer Price Index (PPI), with the previous core annual reading standing at 2%. Finally, the country will release the preliminary estimate of the March Michigan Consumer Sentiment Index on Friday.

Across the pond, Germany will publish the final estimate of the February Harmonized Index of Consumer Prices (HICP), expected to be confirmed at 2.7% YoY. Additionally, the EU will unveil the January PPI, which is expected to have contracted 2.8% from a year earlier.

EUR/USD technical outlook

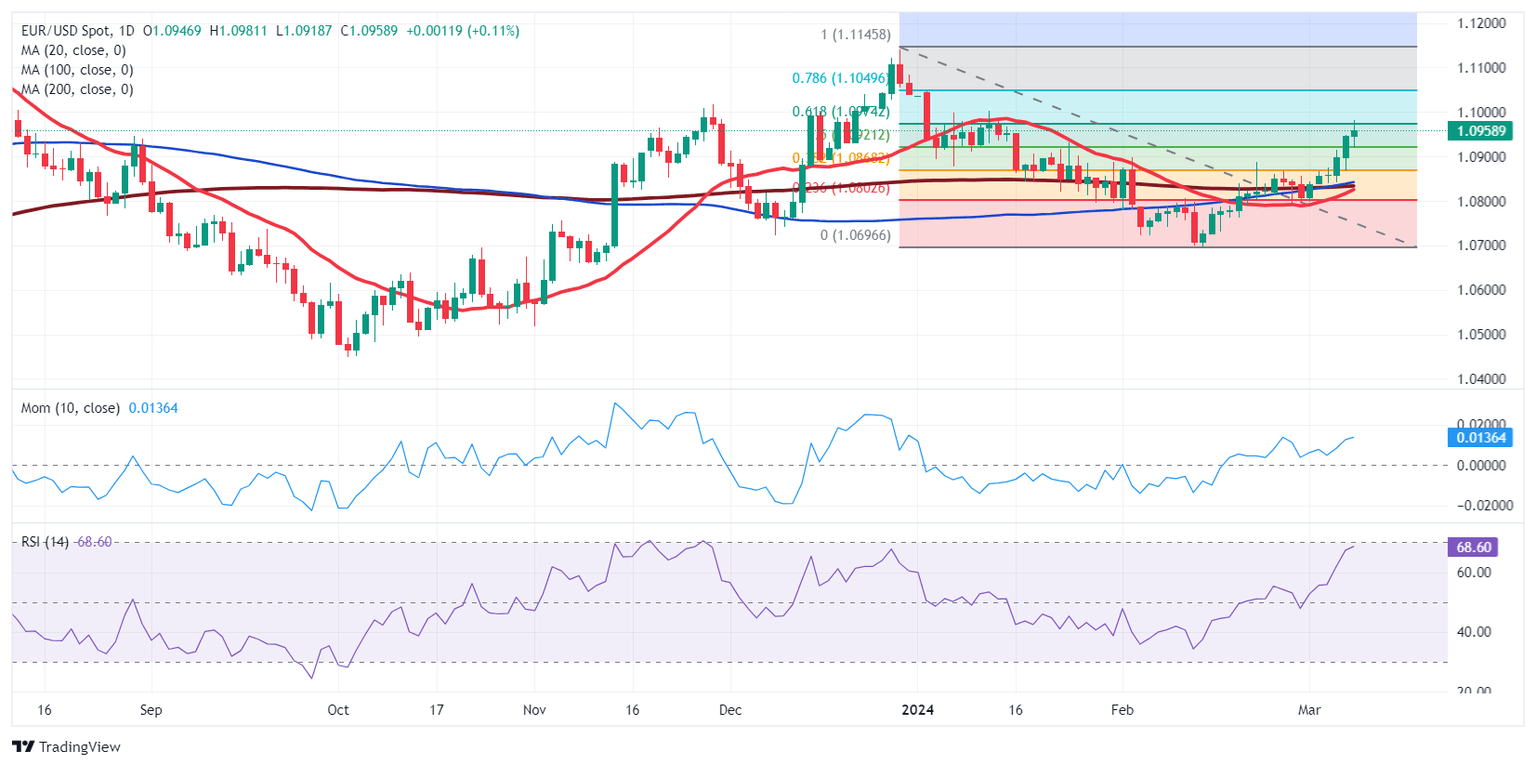

The EUR/USD pair is poised to extend its recovery in the upcoming days. It currently trades just below the 61.8% Fibonacci retracement of the 1.1139-1.0694 daily slide at 1.0971 after meeting buyers at around the 50% retracement at 1.0917 early on Friday.

The weekly chart suggests the pair may extend its recovery in the upcoming sessions as technical indicators turned north, gaining ground above their midlines with uneven strength. The Momentum indicator advances within neutral levels, shedding doubts over additional gains, although the Relative Strength Index (RSI) indicator stands at 57, favoring another leg north. At the same time, the pair is above a bullish 20 Simple Moving Average (SMA), while the 200 SMA stands pat at around 1.1140, reinforcing the resistance area.

On a daily basis, the EUR/USD pair seems poised to extend its advance. It is developing above all its moving averages, which remain confined to a tight 20-pip range. The 20 SMA, however, advances below the longer ones, reflecting increased buying interest. At the same time, technical indicators have partially lost their upward strength near overbought readings, but there are no other signs of bullish exhaustion.

Renewed buying interest beyond 1.0970 should favor a continued advance towards the top of the range at 1.1140, with an interim resistance level at 1.1060. The 38.2% retracement of the aforementioned daily slump is at 1.0865, with a break below it favoring another leg south towards the 1.0800 price zone.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.