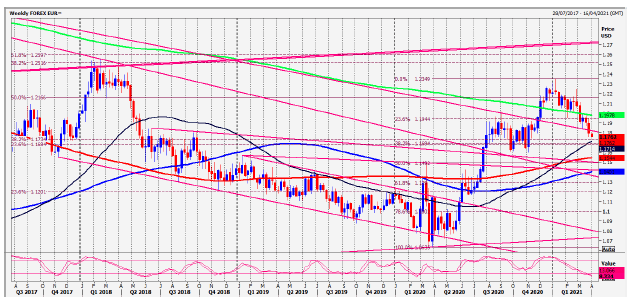

EUR/USD sees a good recovery from the most support for last week

EUR/USD – USD/CAD

EURUSD sees a good recovery from the most support for last week at 1.1700/1.1690 to 1.1785. We could be forming an inverse head & shoulders on the 1 hour chart with neck line at 1.1780/90.

USDCAD dipped as far as 1.2527 & held first resistance at 1.2580/90.

Daily Analysis

EURUSD break above a small inverse head & shoulders neck line at 1.1780/90 is positive for today & can target 1.1820/30, perhaps as far as 1.1850/60 this week.

Minor support at 1.1750/40 (& we bottomed exactly here on Friday). Best support at 1.1710/1.1690 (where we watch for a double bottom bullish pattern). However a break below 1.1675 likely to trigger further losses to 1.1640/30 & perhaps as far as 1.1610/00.

USDCAD retraces about 40% of the recent recovery to hit 1.2527. First resistance at 1.2580/90. A break higher can target last week’s high at 1.2635/45. A break above 1.2650 targets first resistance at 1.2685/95. Bulls then need a break above 1.2700 to trigger further gains.

First support at 1.2540/30 could hold the downside. Below 1.2520 however targets 1.2500/1.2480. Below 1.2460 risks a slide to to 1.2430/20 before a retest of the March low at 1.2370/60.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk