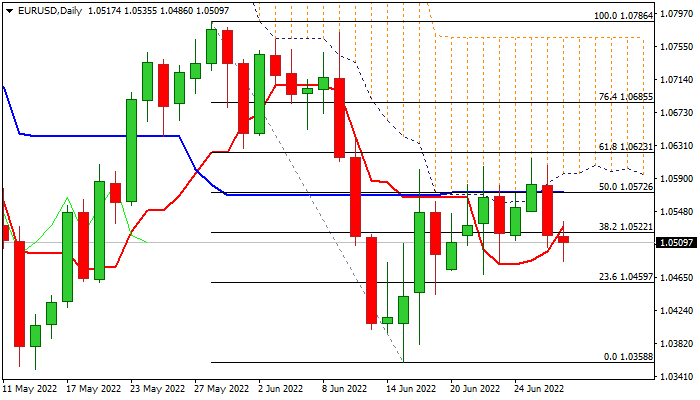

EUR/USD

Repeated failure at the base of a daily cloud and subsequent drop on Tuesday (0.6%) that registered a marginal close below 10DMA (1.0537) generated initial signal of recovery stall, though the action on Wednesday is again without direction.

Fresh bears were partially offset by mixed, but with prevailing optimism EU member countries data that kept the single currency afloat for now, though the downside is expected to remain at risk if the pair makes another daily close below 10DMA.

The Euro is additionally weighed by increased month-end demand for dollar, while negative daily studies add to bearishly aligned near-term outlook.

Repeated close below 10DMA would require extension and close below 1.0486 (50% retracement of 1.0358/1.0614) to confirm negative signal and open way for further easing.

Conversely, bounce above 10DMA would ease immediate downside risk, however the action is to remain directionless while below 1.0596 (the base of narrowing daily cloud.

Res: 1.0537; 1.0554; 1.0565; 1.0596.

Sup: 1.0486; 1.0456; 1.0419; 1.0358.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.