EUR/USD outlook: Bears crack 1.1800 support and may accelerate on hawkish tone from Fed minutes

EUR/USD

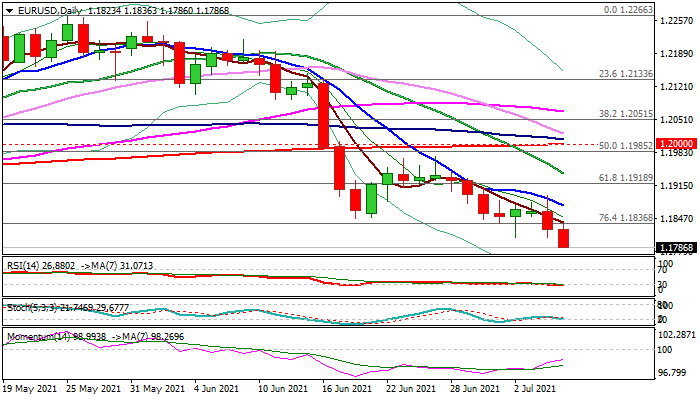

The Euro cracked 1.1800 support as bears attempt to resume downtrend after Tuesday’s upside rejection and close below 1.1836 Fibo support (76.4% of 1.1704/1.2266 ascend) generated bearish signal.

The single currency maintains negative tone on the fact that Fed is well ahead of the ECB on the way towards normalizing monetary policy after coronavirus pandemic, while recent weaker than expected German economic data contributed to the weakness.

Daily technical studies are in bearish setup and favor further weakness, as clear break of 1.1800 handle would likely lead for an extension towards key short-term supports at 1.1704 (Mar 31 low) and 1.1694 (Fibo 38.2 of 1.0635/1.2349 rally, loss of which would signal reversal of med-term 1.0635/1.2349 uptrend.

The minutes of Fed’s June policy meeting is in focus as key event today, with expectations that the central bank would keep its hawkish stance that would further inflate dollar and increase pressure on the single currency.

Broken supports at 1.1836/47 (Fibo 76.4%/former low of June 18) reverted to resistances, followed by falling 10DMA (1.1873) which tracks the downtrend for over one month.

Res: 1.1800; 1.1836; 1.1847; 1.1873.

Sup: 1.1737; 1.1728; 1.1704; 1.1694.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.