This weekend, central bankers are gathered in Jackson Hole Wyoming for the annual Symposium, with Federal Reserve Chair Janet Yellen as the most important absent. Elsewhere, investors’ attention remains on China, oil prices and US data.

While calm in markets seems to have been restored following a sharp slump in Chinese equities, it remains to be seen whether it could be sustainable.

US data has become even more relevant lately given that the Fed has assured the bank will make its decision for or against an interest rate hike strictly based on economic data. Despite improving fundamentals in US, it is not that clear whether the Fed is ready to raise rates as soon as September as inflation remains subdued and well below the central bank's target. This data-dependency maintains investors very expectant of economic releases and incoming indicators could continue to offer volatility.

US gross domestic product revision showed much better data than the initial reading. GDP expanded at a 3.7% annual pace instead of the 2.3% rate reported last month. Next week’s releases include ISM manufacturing PMI on Tuesday, ADP employment report on Wednesday and the key event of the week, the last nonfarm payrolls report before Fed’s September meeting. US economy is expected to add 220,000 new jobs in August and the unemployment rate to stay at 5.3%.

The European Central Bank will hold its monetary policy meeting on Thursday, but no changes are expected at this point and it could easily turn into a non-event.

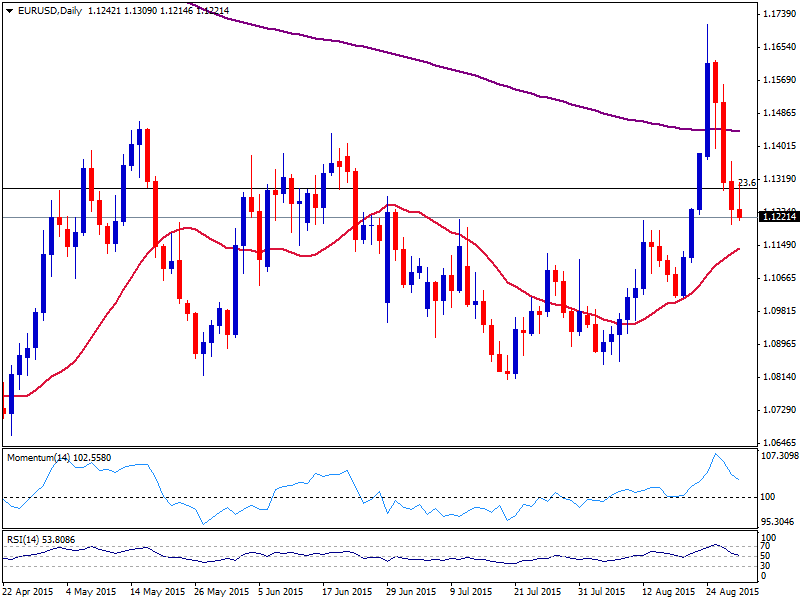

EUR/USD technical perspective

EUR/USD pulled back from 1.1700, back below the 23.6% Fib retracement of the broader 1.3993-1.0462, with a low scored at the 1.1170 area so far.

Technically speaking, the daily chart shows indicators correcting from overbought levels toward their midlines while weekly chart holds a mild bullish tone. EUR/USD needs to sustain gains above 1.1290, mentioned Fibo level, to confirm an upward extension to 1.1470 en route to the 1.1530 region, February highs. However, it would take a strong unexpected boost to lift the pair above 1.1700 in the short-term.

On the downside, the 1.1150/40 zone is next strong support in line with a break below paving the way towards the 1.1100 area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.