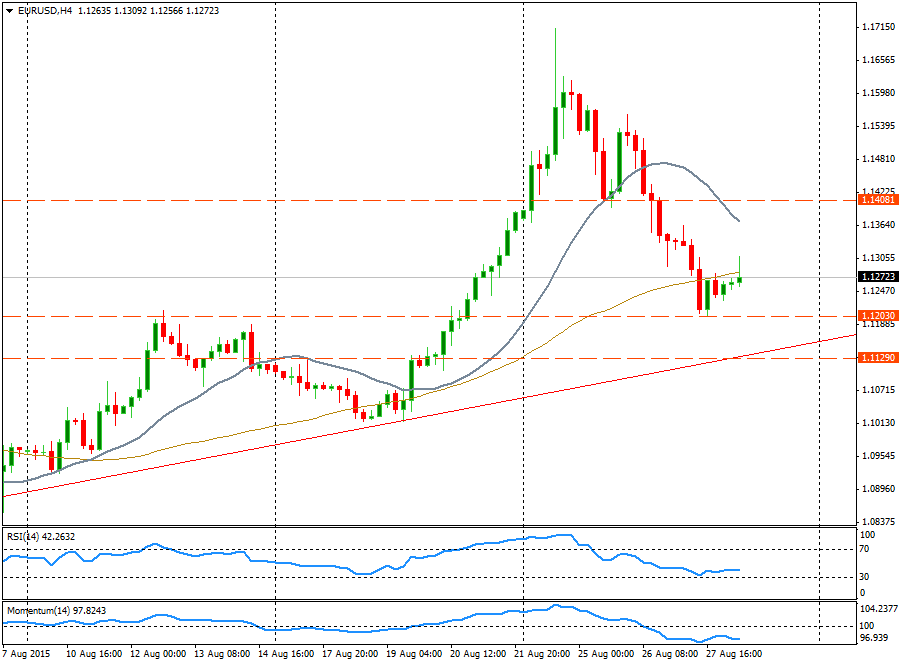

The EUR/USD pair is rising modestly on Friday, still headed toward a weekly loss, unthinkable on Monday when it was trading above 1.17000. It was a very volatile week for EUR/USD. After surging and then plummeting, it appears to be stabilizing.

Greenback lost strength after reaching 1.1200 during Thursday’s American session. Now the pair is holding a slightly bullish bias, with price above the hourly 20-SMA the stands around 1.1250/55; if it drops below, another test of 1.1200 seems likely.

The upside remains limited by 1.1300 today. If it breaks higher it could extend the rally to 1.1360/70. Around 1.1400/10 is where the key resistance is seen, likely to stop the upside on Friday; a consolidation on top would bring strength to the euro and support for further gains.

On a wider perspective, the decline from 1.1700 so far found support at 1.1200. The area located between 1.1150 and 1.1200 is an important and a strong zone. In the mentioned zone we could see an uptrend line and the daily 20-SMA. If the pair falls below and post an important close under, more slides are likely with a possible target around 1.1000.

Recommended Content

Editors’ Picks

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.