The EUR/USD pair turned lower to 1.1080 levels after ECB’s Draghi, in his press conference, said the bank was expecting higher growth numbers. However, the losses were erased quickly and the pair rose to an intraday high of 1.1235 after Draghi said yields could move higher on higher inflation and growth numbers.

At present the currency pair is trading in the band of 1.11200-1.1210 levels. With the ECB out of the way, the next key events for the week are Greece loan payment to the IMF on June 5, followed by US monthly non-farm payrolls figure on the same day.

The question now is whether the pair could extend gains to 1.15 levels or fall back to 1.10 levels in the short-term. At the moment, a sell-off in the EUR/USD to 1.10 levels appears possible only in the case of Greece missing its June 5 payment and does not get an extension from the IMF and its international creditors. A better-than-expected non-farm payrolls in the US on Friday could also hurt the pair, although, the data by itself may not be able to push the pair below critical technical supports between 1.1050-1.1080.

Scope for German yields to rise further

The doors are officially open for the German 10-year bund yield could rise further. The ECB President expressly stated today that the policymakers are not concerned about the volatility in the bond markets and that the yields are likely to move higher on improving inflation and growth numbers.

Moreover, the German yield curve has improved – bonds up to 3 year maturity have negative yields as compared to negative yields on 8-year bond a month earlier. The 1-year bonds have almost qualified to be a part of the ECB’s QE program (yield at -0.21%, ECB deposite rate -0.20%). Consequently, the odds are in favour the EUR/USD pair extending gains to 1.15 levels.

Markets anticipate a temporary solution to Greece issue

At present, the markets are not worried about the Greek deal saga. Moreover, most of the traditional safe haven assets hardly reacted to the ongoing Greece issue, which says a temporary solution is expected. A last minute “kick the can down the road” deal is expected by Friday. Hence, the EUR could extend gains towards 1.14 levels.

Risk of a strong US Non-farm payrolls

The pair could come under pressure in case of a better-than-expected US non-farm payrolls report in the US. The markets are expecting the NFP report to show the US economy added 225K jobs in May. A better-than-expected print could push the pair lower by 100-150 pips. However, at present, it appears that even a better-than-expected data may not be able to push the pair below the support zone of 1.1050-1.1080.

This means, a sharp sell-off in the EUR/USD could be seen only if the Greece issue somehow flares up. In such a case, the first indication would be - Fall in German yields and sharp rise in periphery bond yields

EUR/USD – Break above 1.1190 is bullish

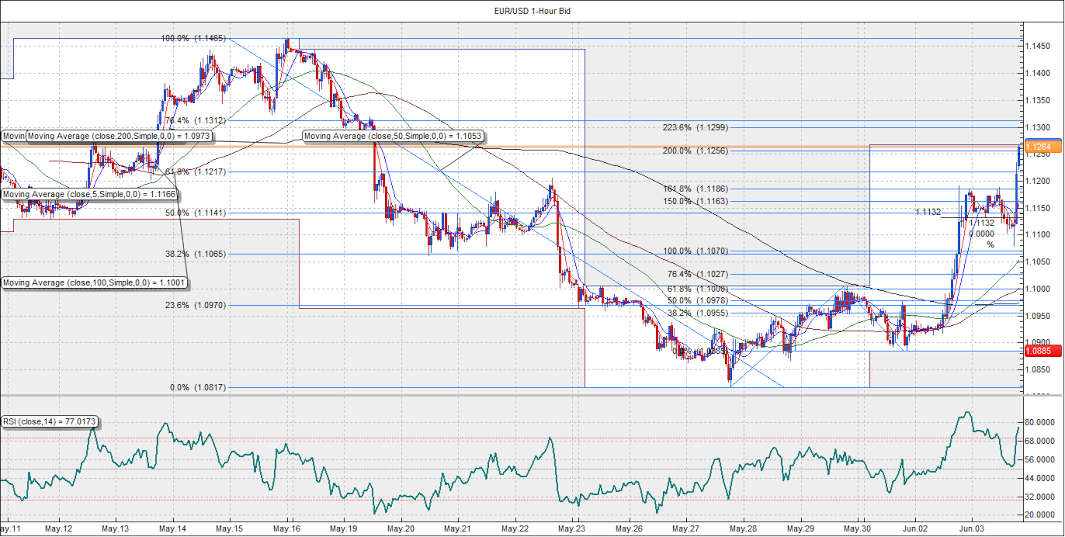

The hourly chart shows, a break above 1.1190, which is the inverted head and shoulder neckline level. Consequently, we have an upside technical target of 1.1563.

The latest cyclical high stands at 1.1465. A strong upside momentum could ensure the rally gets extended to the psychological level of 1.15 levels.

A Fib expansion of 1.0817-1.1004-1.0885, shows immediate resistance at 1.1256 (200% Fib expansion). A daily close above the same open doors for 1.1312 (76.4% Fib R of 1.1465-1.0817).

However, as per technical studies, the pair could extend gains to 1.15 only in case of a daily close above 1.1293 (23.6% Fib R of 1.3991-1.0461).

Meanwhile, on the downside, only a daily close below 1.1190 could being in fresh offers and push the pair down to 1.1132.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.