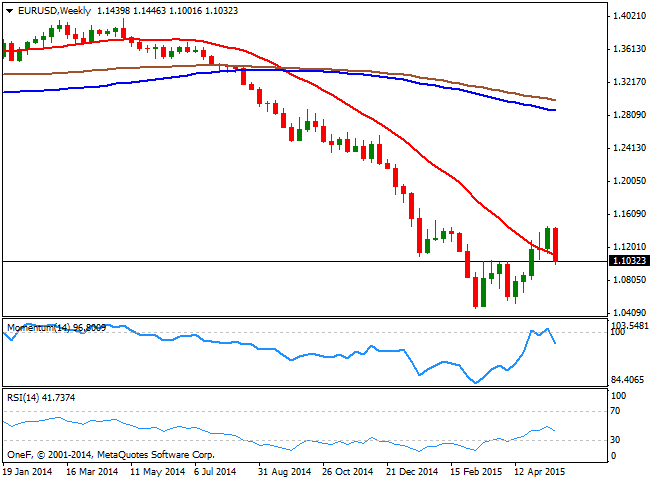

The technical picture suggest the upward corrective movement is complete, as the weekly chart shows that the price is back below a strongly bearish 20 SMA, whilst the technical indicators have turned sharply lower around their mid-lines, resuming their declines after correcting the extreme oversold conditions seen earlier this year. Daily basis, the price is a few pips below its 100 SMA, whilst the technical indicators head south below their mid-lines, also supporting a bearish continuation for the upcoming days. Should the price finally breach the 1.1000 figure, 1.0840 comes as the next possible bearish target, as the pair presents several daily highs and lows in the region. If this last level is also broken, the bearish run can extend down to 1.0650, the next strong static support level.

To the upside, the first strong resistance comes at 1.1120, but 1.1280 holds the key for additional advances as some steady gains above the level can result attractive for bulls, with the next strong resistance and probable bullish target at 1.1390/1.1440.

View live chart of the EUR/USD

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.