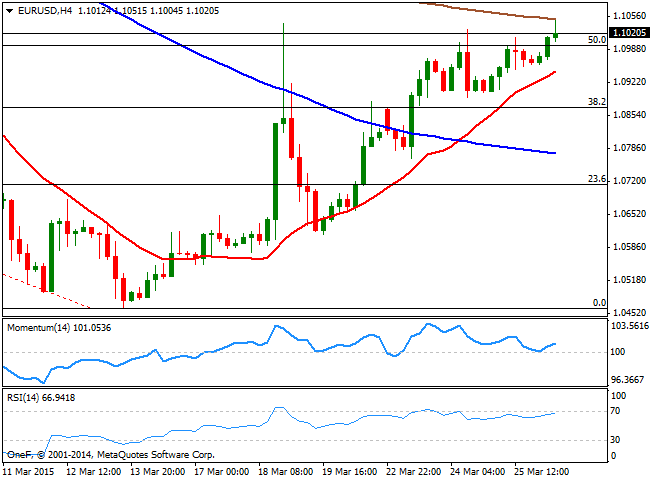

The pair has retreated partially from the mentioned high, but holds to its gains, trading around the 1.1020, and with the 4 hours chart showing a strong upward momentum coming from technical readings: the price develops above a bullish 20 SMA, currently around 1.0940, whilst the Momentum indicator bounced sharply from 100 and the RSI indicator heads higher around 66. The mentioned daily high is now the immediate resistance, with a break above it exposing the 1.1120 price zone, 61.8% retracement of the February/March slide. Further gains are unlikely for this Thursday, although a steady consolidation near the level should signal a probable breakout higher, eyeing then, the 1.1200 area for this Friday.

The 50% retracement of the same rally at 1.0997 provides the immediate intraday support, with a downward acceleration below it exposing the mentioned 1.0940 level.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0700 ahead of key EU inflation, GDP data

EUR/USD is keeping the red near 1.0700, undermined by a broad US Dollar rebound and a mixed market mood early Tuesday. Germany's Retail Sales rebound fail to impress the Euro ahead of key Eurozone inflation and GDP data releases.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.