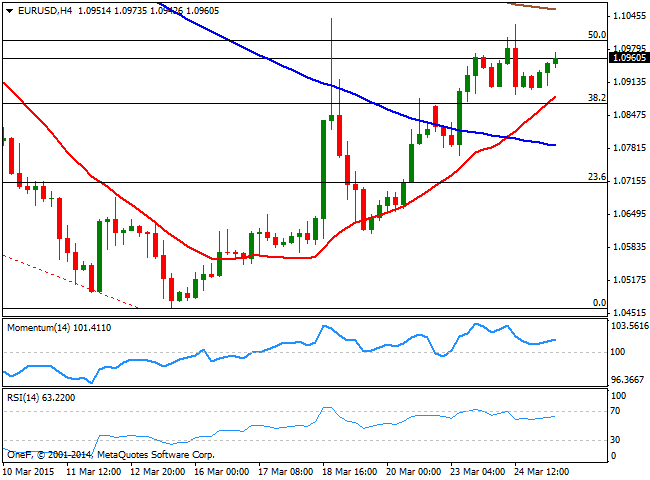

Nevertheless, the intraday technical picture continues to favor the upside, with the price above a strongly bullish 20 SMA and the technical indicators regaining the upside in positive territory. The immediate resistance continues to be the 1.1000 price zone, with renewed buying interest above the level probably signaling a retest of this month high at 1.1040. If the price manages to extend above this last, an approach to 1.1100 comes next.

On the other hand, the immediate short term support comes at 1.0930, with a break below it exposing the pair to a steady decline towards the 1.0865 price zone, 38.2% retracement of these last two months bearish run.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD holds positive ground above 0.6500 on weaker US Dollar

The AUD/USD pair extends recovery around 0.6525 during the early Asian session on Thursday. The Federal Reserve held its interest rates steady at 5.25–5.50% at its meeting on Wednesday, citing a “lack of further progress” in getting inflation back down to its 2% target.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.