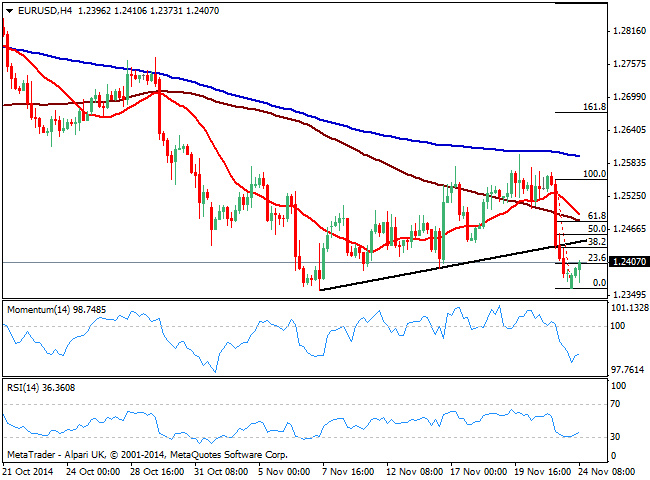

Furthermore the 4 hours chart shows that the pair has broke below a daily ascendant trend line, that today stands a few pips above the 38.2% retracement of the same decline around 1.2435, while indicators aim slightly higher from oversold levels, still deep in negative territory. Later on the day Markit Services PMI in the US can trigger a more interesting move, with a price acceleration above 1.2340 in fact required to see further intraday gains, up to 1.2480 price zone. A decline below 1.2360 on the other hand should expose the pair to a stronger decline, with 1.2320 as probable short term bearish target then.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.