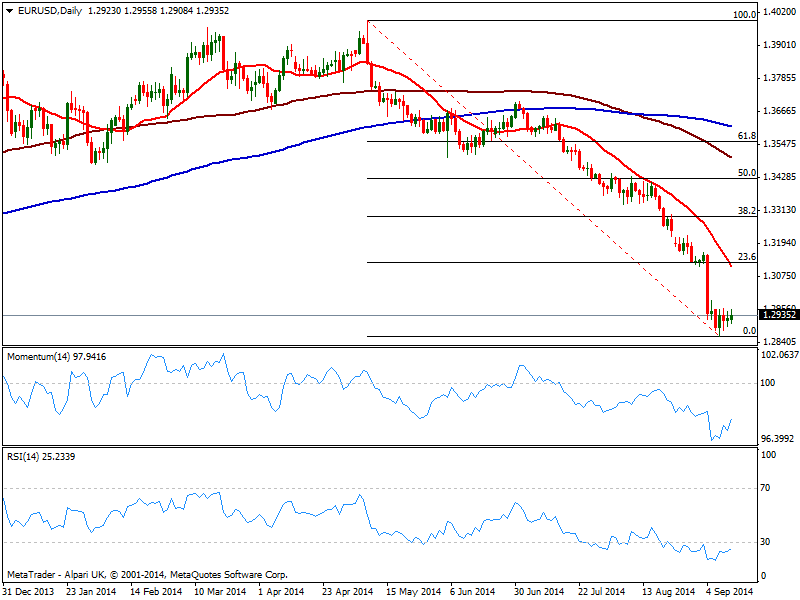

In the same daily chart, 20 SMA converges with the mentioned Fibonacci level, reinforcing the strength of the resistance, and turning it into a critical breakout point for current bearish trend, as if price manages to reach it yet retraces, risk will remain to the downside, with fresh lows anticipating a test of the critical support area at 1.2740, where the pair presents multiple highs and lows in bigger time frames.

A steady recovery above 1.3120 on the other hand may see a stronger upward corrective movement, pointing then to a test of the 1.3300 area, 38.2% retracement of the same bearish rally. But from a fundamental side, there is little support for such a strong recovery; dollar strength is quite undeniable considering the greenback stands at multi-months highs against JPY, AUD and CAD.

Anyway, if fundamentals align with the dominant bearish trend, the EUR/USD will remain condemned despite extreme technical readings, with a weekly close below mentioned 1.2740 level exposing the pair to a test of 1.25 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.