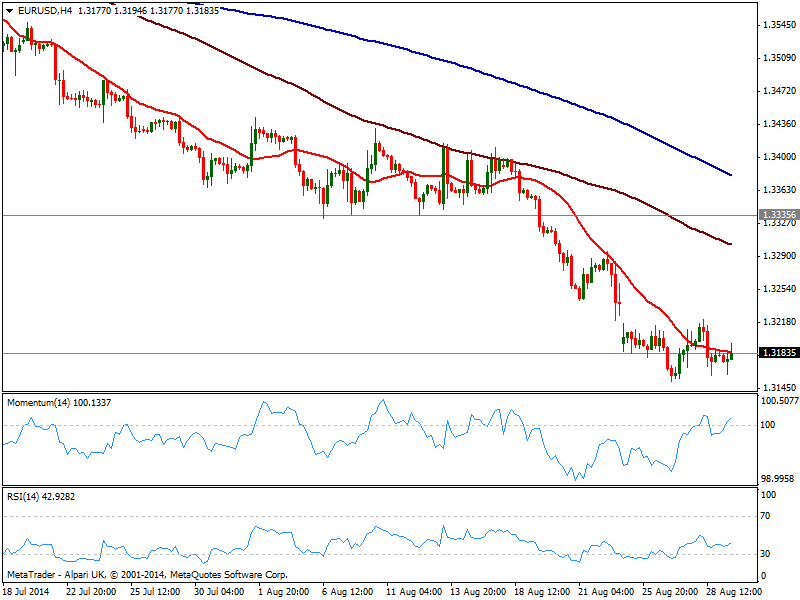

Technically however, it has been a week to forget so far with the EUR/USD confined to a 70 pips range between 1.3150 and 1.3220. The 4 hours chart shows price latest spike being retraced, with price below a flat 20 SMA. Indicators grind higher but momentum stands barely above its midline, and RSI flat in bearish territory, showing no actual strength. Consolidating near its year low, the risk on the pair remains to the downside, with a break below 1.3150 exposing the 1.3100/20 price zone. Steady gains above 1.3220 on the other hand, may see a recovery up to 1.3250 price zone, yet the most likely scenario for today is an extension of the consolidative range ahead of next week Central Banks and US employment figures.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.