- EUR/USD remains under pressure as tensions mount ahead of the all-important ECB decision.

- Fears of the coronavirus disease are boosting the dollar.

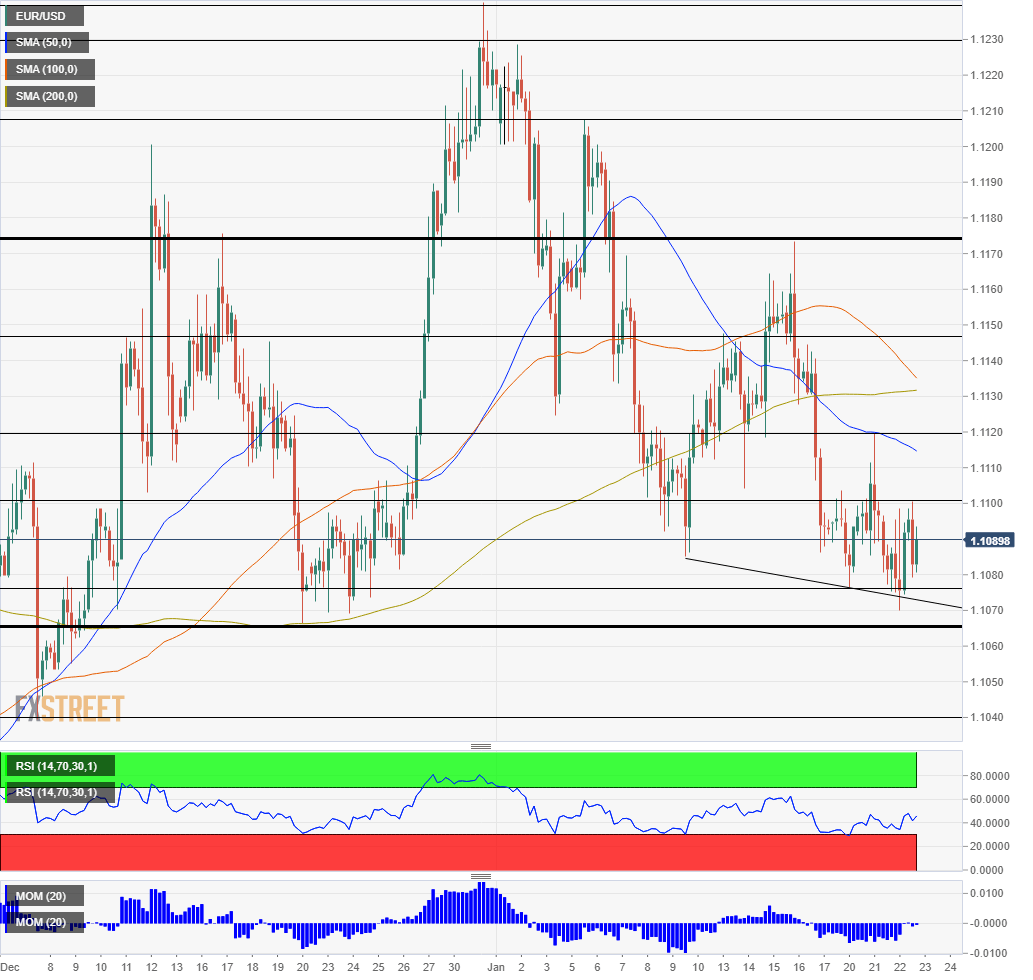

- Thursday's four-hour chart is pointing to further falls for the currency pair.

Giving a green light to euro bulls? The European Central Bank is set to leave its policy unchanged, but may acknowledge the recent green shoots – and also add green considerations to its policymaking. That could unleash the upside, but it all depends on President Christine Lagarde.

The relatively new head of the Frankfurt-based institution received a comfortable legacy. Mario Draghi, her predecessor, cut rates and restarted the bond-buying program in September 2019 amid worsening conditions and rising Sino-American tensions. Since then, the world's largest economies signed a trade deal and recent economic figures – including inflation that the ECB targets – have improved. Acknowledging the better mood may push EUR/USD higher.

These recent encouraging statistics allow Lagarde to remain above the internal battle between the doves and the hawks and be – in her own words – a wise "owl." Without any imminent policy changes on the agenda, she may shed light on the bank's strategic review and a different way to target inflation.

One of the options is to let consumer prices "catch up" and run quickly, compensating for previous years. That could send the euro tumbling down. However, the chances of allowing higher inflation are slim amid opposition from German members.

Another topic that is high on the agenda is the climate crisis. Recent natural disasters and growing demand for action have not been on lost on the ECB. Lagarde may provide some details about how monetary policy – rather than government action – could support green causes. Any cooperation between the central banks and governments to spur investment could turn positive for the common currency.

More ECB Preview: Glass half green or a Lagarde drag on EUR/USD? Three scenarios

Beyond the ECB

The coronavirus outbreak continues gripping headlines as the death toll from the SARS-like respiratory disease is rising. Chinese authorities decided to shut down transport links to Wuhan, a provincial capital that is home to 11 million people. The dramatic decision, coming just before the Lunar New Year, has been weighing on markets. The safe-haven US dollar and yen have benefitted from the decision.

The World Health Organization has, so far, refrained from declaring the coronavirus a health emergency. It is closely monitoring the situation closely and may update its guidance as soon as Thursday.

Luigi di Maio, leader of Italy's Five Star Movement, has announced his resignation from leading the flailing party. His departure raises the odds that the eurozone's third-largest country's government will collapse, triggering early elections. Matteo Salvini's far-right Liga party's lead in opinion polls is worrying investors.

EUR/USD Technical Analysis

EUR/USD continues trading below the 50, 100, and 200 Simple Moving Averages. However, downside momentum has waned. Overall, the picture is marginally less bearish.

Support awaits at 1.1075, which provided support early in the week. Next, we find 1.1065, which was the trough around Christmas. The next level is 1.1040, dating back to early December, and it is followed by 1.0985.

Resistance awaits at 1.11, a round number that capped euro/dollar on Wednesday. Next, we find 1.1120, a swing higher from earlier this week. 1.1145 and 1.1175 are next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.