- EUR/USD has been edging lower amid a mix of hope and fear on several fronts.

- An increase in US coronavirus cases and Fed Chair Powell's caution may tilt the pair lower.

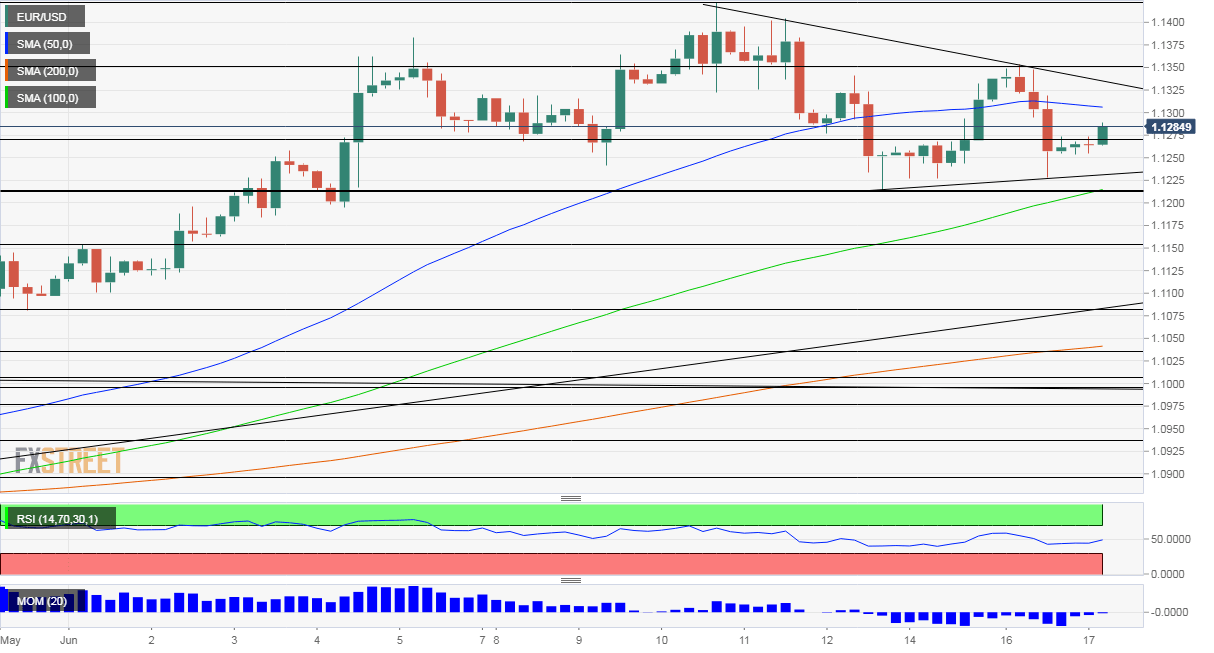

- Wednesday's four-hour chart is painting a mixed picture.

Lower highs and higher lows – the narrowing wedge in euro/dollar triggers the question: where next? The world's most popular currency pair is pushed and pulled by several factors.

The Good

US Retail Sales smashed all expectations with a surge of 17.7% in May – more than double the estimates and painting a V-shape when only observing consumption data for April and May. America goes on a shopping spree that encourages the whole world and weighs on the safe-haven dollar.

Coronavirus infections and cases continue falling in Europe, and preparations to resume additional events are on the rise. Flights from Germany to Spain's Balearic islands are back, just ahead of the summer.

Dexamethasone – a cheap and commonly available steroid has proved effective in reducing coronavirus deaths in a wide, randomized controlled trial conducted by the University of Oxford. A drop of up to a third in mortalities among severely sick patients is encouraging for the whole world.

COVID-19 deaths are dropping in the US, with the greater New York Area leading the way. But that is where America's health optimism ends.

The Bad

Hospitalizations and infections are rising at an accelerating pace in the US Sun Belt. Apart from large Florida and Texas, hot Arizona is also struggling. Ron DeSantis, Florida's Governor and a fan of the president, rejected calls to reimpose restrictions.

Moreover, cases have increased in Oklahoma, where President Donald Trump is set to hold a 20,000-strong indoor rally on Saturday. Local authorities have pleaded him to cancel or change the nature of the event.

Robert Kaplan, the President of the Dallas branch of the Federal Reserve, stressed that the next steps of the economic recovery depend on successfully executing a health strategy, rather than more fiscal and monetary stimulus.

His boss, Fed Chairman Jerome Powell, also said that a full recovery depends on curbing the disease and refused to get carried away by optimism coming from consumption data. Powell continues testifying today and will likely repeat the same messages – potentially dampening the mood and keeping the safe-haven dollar bid.

The Ugly

The dollar may find more demand as geopolitical tensions remain elevated. China – which is dealing with a severe outbreak in Beijing, causing it to restrict transport – is clashing with India. A brawl between soldiers at the remote Himalayan Galwan valley has taken the lives of dozens.

Will the nuclear-armed countries de-escalate tensions? Efforts are underway, but a breakthrough is still not on the cards.

Tensions on the Korean peninsula seem far from calming down. A day after North Korea blew up the liaison office in Kaesong, it is reportedly sending troops to the Demilitarized Zone (DMZ) separating the two Koreas.

Seoul said it would respond with force to any additional military action. Pyongyang expressed anger that activists distributed anti-North Korea propaganda without intervention from the South. Also here, the possession of nuclear arms by the North and by the US-South Korea's ally, means the world is watching.

Overall, there are more reasons to worry than cheer, potentially weighing on EUR/USD.

EUR/USD Technical Analysis

Momentum on the four-hour chart is now balanced. While the currency pair failed to conquer the 50 Simple Moving Average, it trades above the 100 and 200 SMAs. Setting higher lows and lower highs suggest a significant move is brewing, yet the charts do not suggest a clear direction.

Resistance awaits at 1.1350, the weekly high, followed by 1.1425, the three-month peak recorded a week ago. Further up, 1.1495 is the next level to watch.

Support awaits at 1.1270, a support line from mid-June, with more significant support awaiting at 1.1210, Friday's low. Next, 1.1150 and 1.1080 await the currency pair.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.