EUR/USD Forecast: Risk aversion boost the greenback after an uneventful ECB

EUR/USD Current Price: 1.2005

- The European Central Bank left rates unchanged, maintained a cautious outlook.

- Markit will release on Friday the preliminary estimates of its April PMIs.

- EUR/USD turned bearish in the near-term, could approach the 1.1900 area.

The greenback surged in the American session, posting gains against most of its major rivals. The EUR/USD pair hit an intraday high of 1.2069 to close the day in the 1.2000 area after the European Central Bank monetary policy meeting failed to trigger some action. The ECB maintained rates unchanged as widely estimated, while President Lagarde repeated well-known concepts. European policymakers acknowledged signs of economic improvement but conditioned further progress to the pandemic developments. She also noted that the central bank didn’t discuss reducing the PEPP and that they will continue buying bonds at a faster pace.

US data was mixed. Initial Jobless Claims decreased to 547K in the week ended April 16, beating the expected 617K. The Chicago Fed National Activity Index improved to 1.71 in March, also better than forecast. However, Existing Home Sales plunged 3.7% in March against an expected 0.8% advance. On Friday, the focus will be on the preliminary estimates of April Markit PMIs for the EU and the US. Business expansion is seen contracting in the EU but expanding in the US.

EUR/USD short-term technical outlook

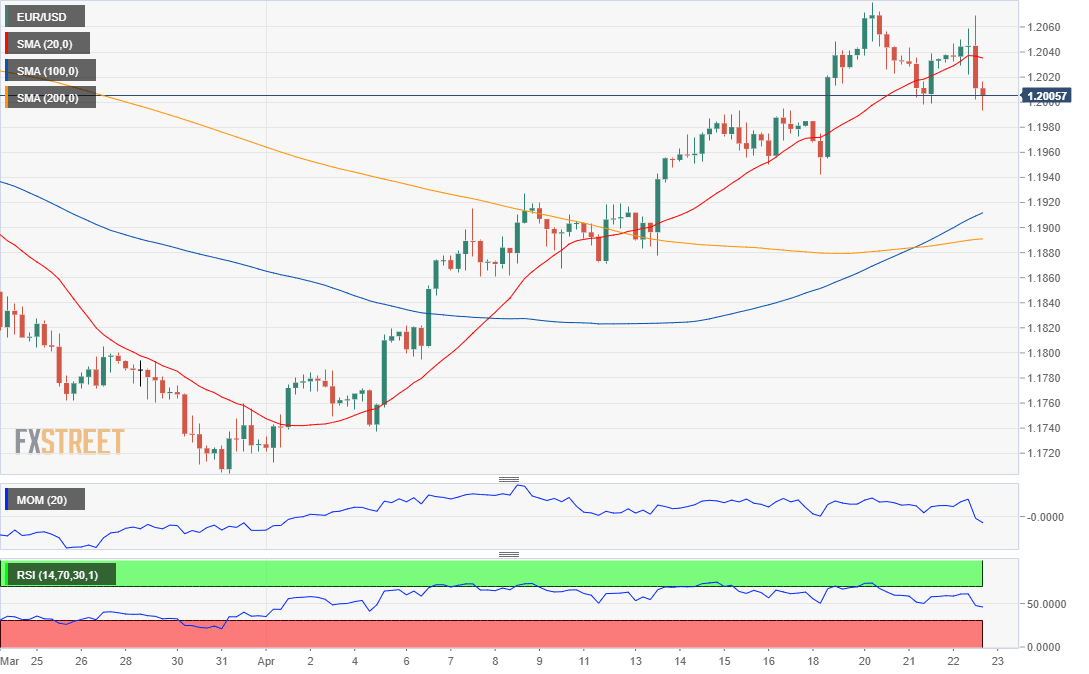

The EUR/USD is down within range, developing just below the 1.2000 level as risk aversion dominated the final trading session of the day. The near-term picture is bearish, as the pair is extending its decline below a 20 SMA that has lost directional strength. The longer moving averages remain well below the current level, and with the 100 SMA advancing above the 200 SMA. Technical indicators, on the other hand, hold within negative levels, with the Momentum aiming to recover but the RSI heading south around 45. Another leg south should be expected on a break below the 1.1990 region, where the pair met intraday buyers several times this week.

Support levels: 1.1990 1.1950 1.1910

Resistance levels: 1.2045 1.2085 1.2130

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.