- EUR/USD has been on the back foot as US coronavirus deaths rise and Biden bashes Wall Street.

- Speculation about the EU summit and updated COVID-19 statistics are eyed.

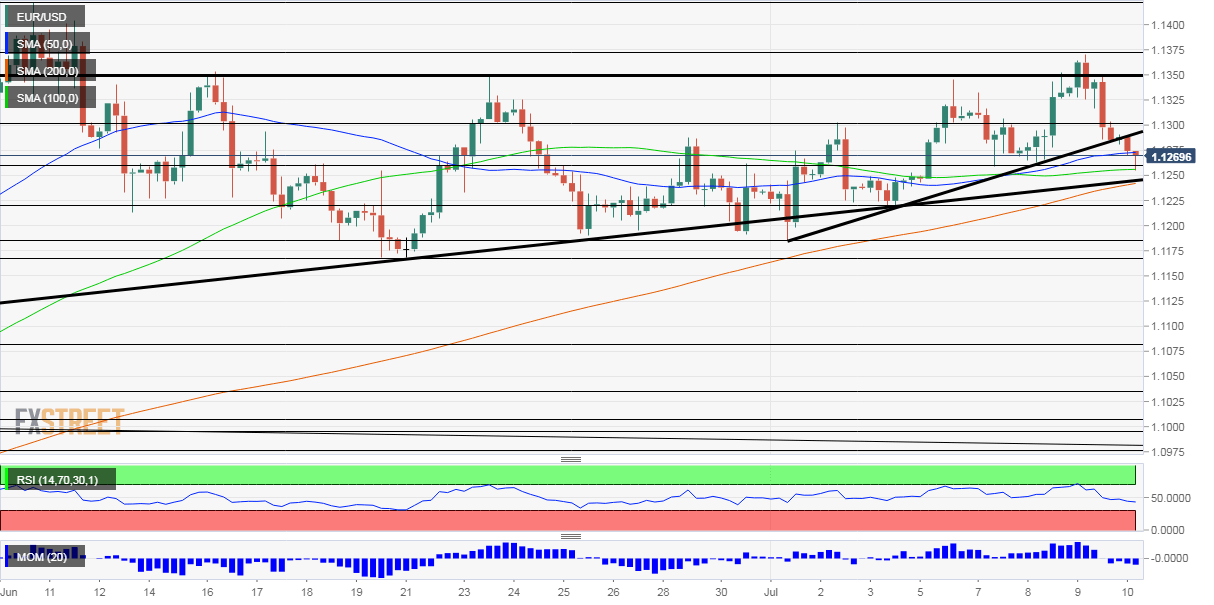

- Friday's four-hour chart is showing a worsening picture for bulls.

"Wall Street CEO did not build America" – these words by Joe Biden, the presumptive Democratic nominee sent shivers down investors spines, and supported the safe-haven US dollar. President Donald Trump continues trailing Biden by a formidable margin of nine points and the challenger's statement that "the era of shareholder capitalism is set to end" have not helped either.

More:

- 2020 US Elections: China is rooting for Trump, five reasons and market implications

- The foreign policy and market impact of a Biden administration: China, Iran and the West

The current occupant of the White House has not been helping his reelection chances. Trump insisted on opening schools as soon as possible and also threatened to punish those that do not do so. His eagerness to return to normal is at stark contrast with the rapid deterioration in America's coronavirus crisis.

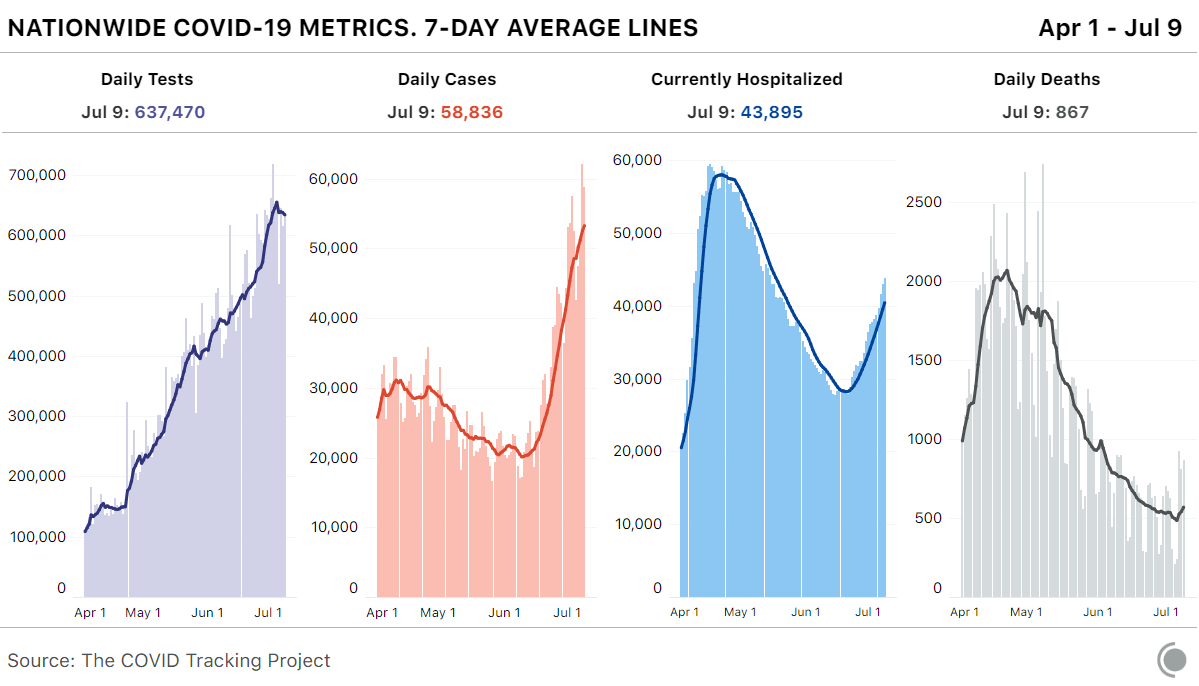

Daily cases remain close to the peak at around 60,000 – and may be held back due to a lack of testing capability in several states. Laboratories and hospitals are strained in Arizona and elsewhere. Moreover, the number of deaths is also on the rise, nearing 1,000 daily.

See:

OK, our daily update is published. States reported 637k tests. Today’s case count is the second-highest in our data; the record was set yesterday. Hospitalizations kept moving upward, and states reported 867 deaths. pic.twitter.com/yHiWEpz8IK

— The COVID Tracking Project (@COVID19Tracking) July 9, 2020

These figures may deter consumers and may trigger more restrictions – or at least a halt to reopening that Trump wants. The gloomier prospects are seen in high-frequency data but not in standard economic publications. Initial jobless claims dropped to 1.314 million, beating expectations while continuing ones are at 18 million. Nevertheless, these are still dire figures.

US producer prices will likely show some stability, leaving the focus on new coronavirus figures, starting from Florida, and continuing across the US. Opinion polls may also be of interest.

In the old continent, coronavirus seems under control, and the focus is on fiscal policy. Pascal Donohue, Ireland's finance minister, has been nominated as the President of the Eurogroup. Will he help push leaders to approve the recovery plan?

Christine Lagarde, President of the European Central Bank, cast doubt about the upcoming EU Summit and any agreement on the ambitious program. The EU Commission, backed by Germany and France, included €500 billion in mutually funded grants. That is currently unacceptable to the "Frugal Four" – Austria, the Netherlands, Denmark, and Sweden.

The ECB is set to leave its policy unchanged next week, but will likely urge action from leaders.

See European Central Bank Preview: EUR/USD depends on Lagarde's fearless nudging of the Frugal Four

Overall, various concerns are set to move euro/dollar.

EUR/USD Technical Analysis

On its way down, EUR/USD slipped below the steep uptrend support that had accompanied it since early July. It is still holding above the more moderately shaped uptrend support that dates back to May.

One gone, another one to go?

Momentum on the four-hour chart has turned negative and EUR/USD dropped below the 50 Simple Moving Average. Nevertheless, it is holding above 100 and 200 SMAs.

The moderate uptrend support line awaits around 1.1250. It is followed by 1.1220, a stepping stone on the way up. The 1.1190 level cushioned EUR/USD several times last week and it is followed by the mid-June trough of 1.1160.

Resistance is at 1.13, the round level that capped it last week. The former triple-top of 1.1350 is next, and July's high of 1.1375 follows.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.