EUR/USD Forecast: Move beyond 1.1900 mark to pave the way for additional gains

- EUR/USD gained traction for the fourth consecutive session on Thursday.

- The post-FOMC USD selloff remained unabated and drove the pair higher.

- Stronger flash German CPI underpinned the euro and remained supportive.

The EUR/USD pair built on its post-FOMC positive move and scaled higher for the fourth successive session on Thursday. The momentum allowed the pair to recover further from multi-month lows, around mid-1.1700s touched last week and was sponsored by sustained US dollar selling bias. The Fed Chair Jerome Powell's dovish remarks on Wednesday continued weighing heavily on the greenback. During the post-meeting press conference, Powell emphasised that they were some ways away from substantial progress on jobs. Powell was also cautious about tapering and said that it will take a few more meetings before the Fed starts slowing its massive monetary support.

Apart from this, a slight recovery in the global risk sentiment was seen as another factor that further acted as a headwind for the safe-haven greenback. The market fears over the impact of China's regulatory crackdown on various sectors eased after authorities held a call with executives from global investors on Wednesday. According to people familiar with the matter, the hastily arranged call was to reassure the groups that the education policies were not intended to hurt companies in other industries. The news boosted investors' appetite for perceived riskier assets, which was evident from a generally positive tone around the equity markets.

The key USD Index fell to one-month lows and was further pressured by disappointing US macro releases. The Advance second-quarter US GDP report or the first estimate showed that the world's largest economy expanded by 6.5% annualized pace during the April-June period. This was well short of consensus estimates pointing to a growth of 8.5%. Adding to this, the US Initial Weekly Jobless Claims and Pending Home Sales data also missed market expectations. Nevertheless, the data reaffirmed expectations that the Fed will retain its ultra-lose monetary policy stance for a longer period and did little to provide any respite to the USD bulls.

Meanwhile, the shared currency got an additional boost following the release of hotter-than-expected German consumer inflation figures. The flash version of the report indicated that the headline CPI jumped 3.8% YoY in July as against the 3.3% expected. This further contributed to the pair's strong positive move back closer to monthly swing highs. That said, concerns about the potential economic fallout from the fast-spreading Delta variant of the coronavirus kept a lid on any further gains. The pair edged lower during the Asian session on Friday as traders look forward to the flash Eurozone CPI report for some trading opportunities. Later during the early North American session, the US Core PCE Price Index might also provide some impetus on the last day of the week.

Short-term technical outlook

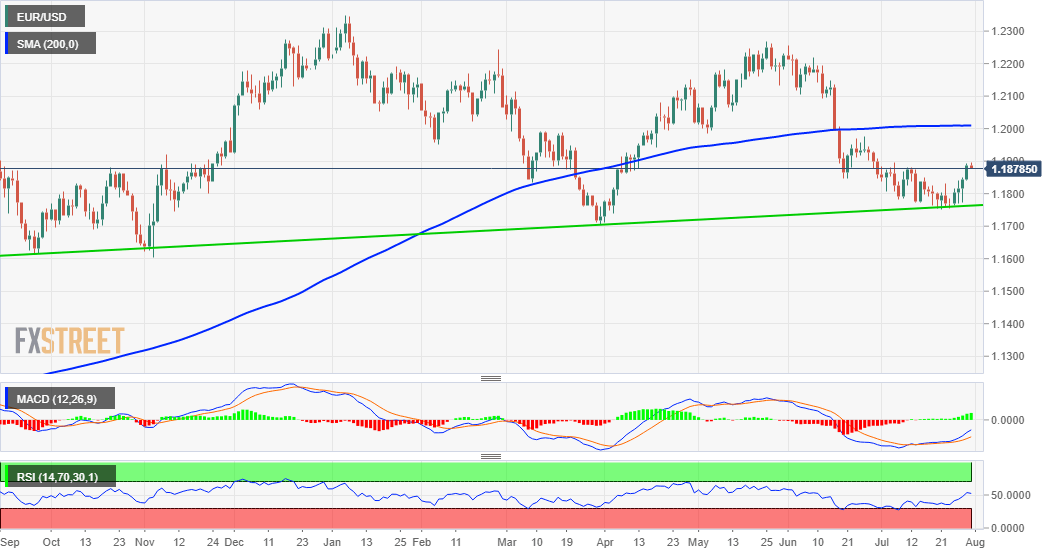

From a technical perspective, the recent rebound from support marked by a short-term ascending trend-line stalled just ahead of monthly swing highs, around the 1.1900 neighbourhood. The mentioned handle should now act as a key pivotal point for traders, which if cleared decisively should pave the way for additional gains. The subsequent short-covering move has the potential to lift the pair back towards the 1.2000 psychological mark. This coincides with the very important 200-day SMA and a sustained breakthrough will shift the near-term bias firmly in favour of bullish traders.

On the flip side, the 1.1850-45 region now seems to protect the immediate downside ahead of the 1.1800 mark and the 1.1770-60 region. The latter marks the ascending trend-line support extending from September 2020 swing lows. A convincing break below should pave the way for a fall towards YTD lows, around the 1.1700 mark touched in March. Some follow-through selling has the potential to drag the pair further towards the next relevant support near the 1.1610-1.1600 horizontal zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.