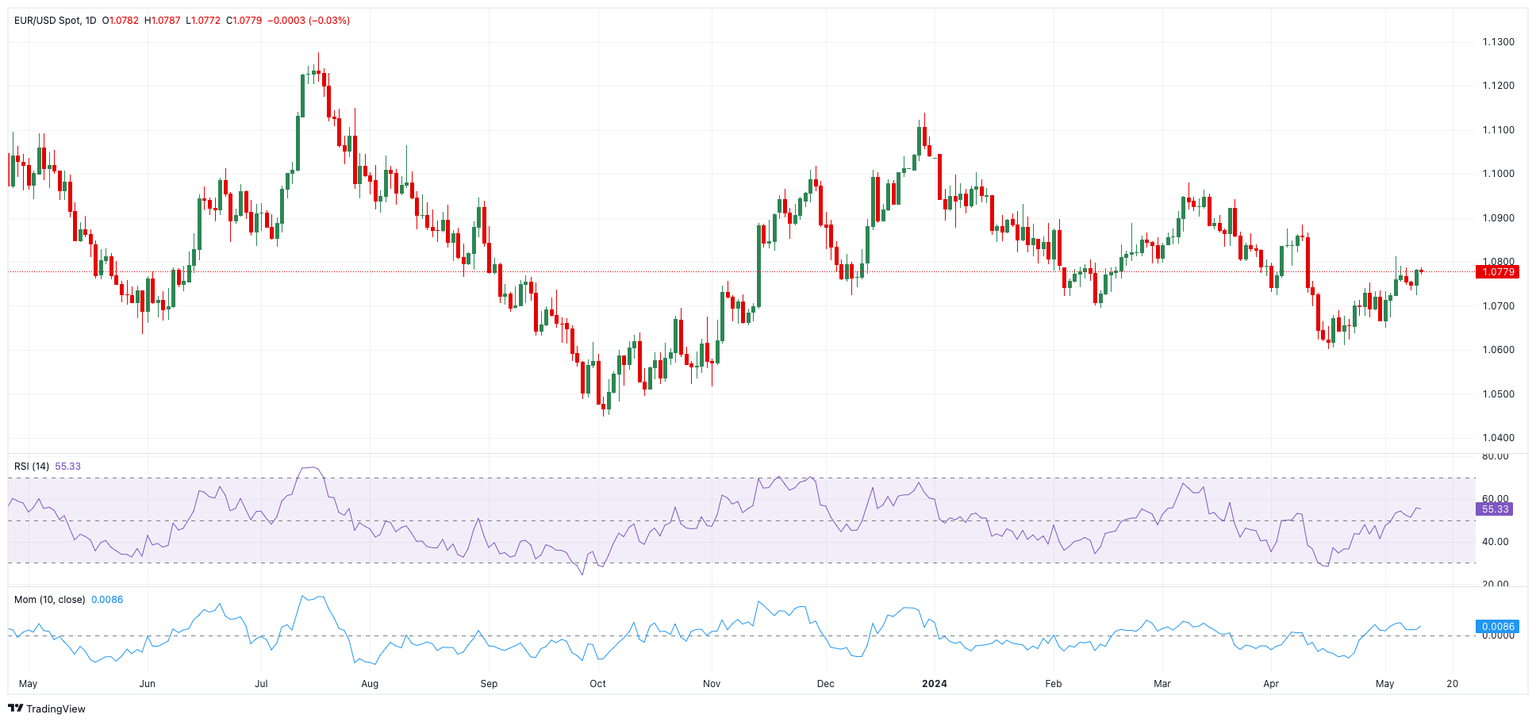

EUR/USD Forecast: Immediate target appears at the 200-day SMA

- EUR/USD navigates an inconclusive range near 1.0780.

- The Dollar picks up a mild pace ahead of data, Fedspeak.

- Investors continue to assess the policy divergence ahead of US CPI.

EUR/USD struggles to regain impetus after Thursday’s marked advance, while a test of the key resistance area around 1.080 still remains elusive. In the meantime, spot is expected to maintain a cautious trade ahead of the key publication of the flash Michigan Consumer Sentiment for the month of May and speeches by Fed’s Bowman, Barr and Goolsbee.

Around the Federal Reserve, San Francisco Fed President Mary Daly commented on Thursday on the persisting policy restrictiveness, noting the potential need for additional time to bring inflation down to the Fed's target level. Earlier on Friday, Atlanta Fed President Raphael Bostic hinted at a possible economic slowdown, although the timing for rate cuts remains uncertain.

Still around the Fed, FOMC Governor Michelle Bowman, Chicago Fed President Austan Goolsbee and FOMC Governor Michael Barr are all due to speak.

Meanwhile, the narrative surrounding the monetary policy divergence between the Fed and the rest of its G10 peers continues to dominate the macro scenario in the FX universe.

On this, the FedWatch Tool tracked by CME Group sees the probability of a Fed’s rate reduction in September nearly 70%.

EUR/USD technical outlook

On the upside, EUR/USD is likely to face first resistance at the May high of 1.0812 (May 3), which comes before the intermediate 100-day SMA of 1.0829 and the April top of 1.0885 (April 9). North of here is the March peak of 1.0981 (March 8), which precedes the weekly high of 1.0998 (January 11), all before the psychological threshold of 1.1000.

Looking south, a break of the 2024 bottom of 1.0601 (April 16) might mean a return to the November 2023 low of 1.0516 (November 1). Once this zone is cleared, spot may test the weekly low of 1.0495 (October 13, 2023), which is ahead of the 2023 low of 1.0448 (October 3) and the round level of 1.0400.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.03% | 0.07% | -0.19% | -0.03% | -0.16% | -0.32% | -0.12% | |

| EUR | 0.03% | 0.09% | -0.18% | -0.02% | -0.14% | -0.31% | -0.09% | |

| GBP | -0.07% | -0.09% | -0.27% | -0.11% | -0.23% | -0.38% | -0.18% | |

| JPY | 0.19% | 0.18% | 0.27% | 0.07% | -0.02% | -0.15% | 0.06% | |

| CAD | 0.03% | 0.02% | 0.11% | -0.07% | -0.13% | -0.27% | -0.07% | |

| AUD | 0.16% | 0.14% | 0.23% | 0.02% | 0.13% | -0.14% | 0.05% | |

| NZD | 0.32% | 0.31% | 0.38% | 0.15% | 0.27% | 0.14% | 0.20% | |

| CHF | 0.12% | 0.09% | 0.18% | -0.06% | 0.07% | -0.05% | -0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.