EUR/USD Forecast: Gains should accelerate above 1.0840

- A pretty dull session kept EUR/USD around the 1.0830 zone.

- The Dollar alternated gains with losses in line with the global markets.

- Investors’ attention remains on the US inflation tracked by the PCE.

The marginal advance in the Greenback prompted an equally tepid drop in EUR/USD, which gyrated around 1.0830, while the USD Index (DXY) looked sidelined in the low 104.00s.

The ups and downs in spot were accompanied by the generalized negative developments in US and German yields across the curve, while the monetary policy framework remained unchanged.

On the latter, both the Federal Reserve (Fed) and the European Central Bank (ECB) are anticipated to initiate their easing cycles, possibly commencing in June. However, the pace of subsequent interest rate cuts may vary, leading to potentially different strategies between the two central banks. Nevertheless, the ECB is not expected to significantly lag behind the Fed.

Earlier in the week, Atlanta Fed President Raphael Bostic, a voting member of the 2024 FOMC, reiterated his view on the possibility of a rate cut within the year, emphasizing that the Fed "can afford to be patient" as long as the US economy remains robust. In contrast, Chicago Fed President Austan Goolsbee expressed his anticipation of three rate cuts this year. Additionally, Federal Reserve Governor Lisa Cook, who holds a permanent vote on the FOMC, stressed the importance of a cautious approach in determining the timing and magnitude of interest rate cuts.

According to the FedWatch Tool offered by CME Group, the probability of a rate cut in June rose to nearly 64%.

On the other side of the road, ECB’s Board member Madis Muller suggested that the ECB is nearing the stage where it can begin to decrease rates, whereas his colleague Yannis Stournaras pointed out that there appears to be agreement for a rate cut in June.

Overall, the relatively subdued fundamentals of the euro area, coupled with the increasing likelihood of a “soft landing” of the US economy, reinforce expectations of a stronger Dollar in the medium term, particularly as both the ECB and the Fed potentially implement their easing measures almost simultaneously. In such a scenario, EUR/USD could experience a more pronounced correction, initially targeting its year-to-date low around 1.0700 before potentially revisiting the lows observed in late October 2023 or early November near the 1.0500 level.

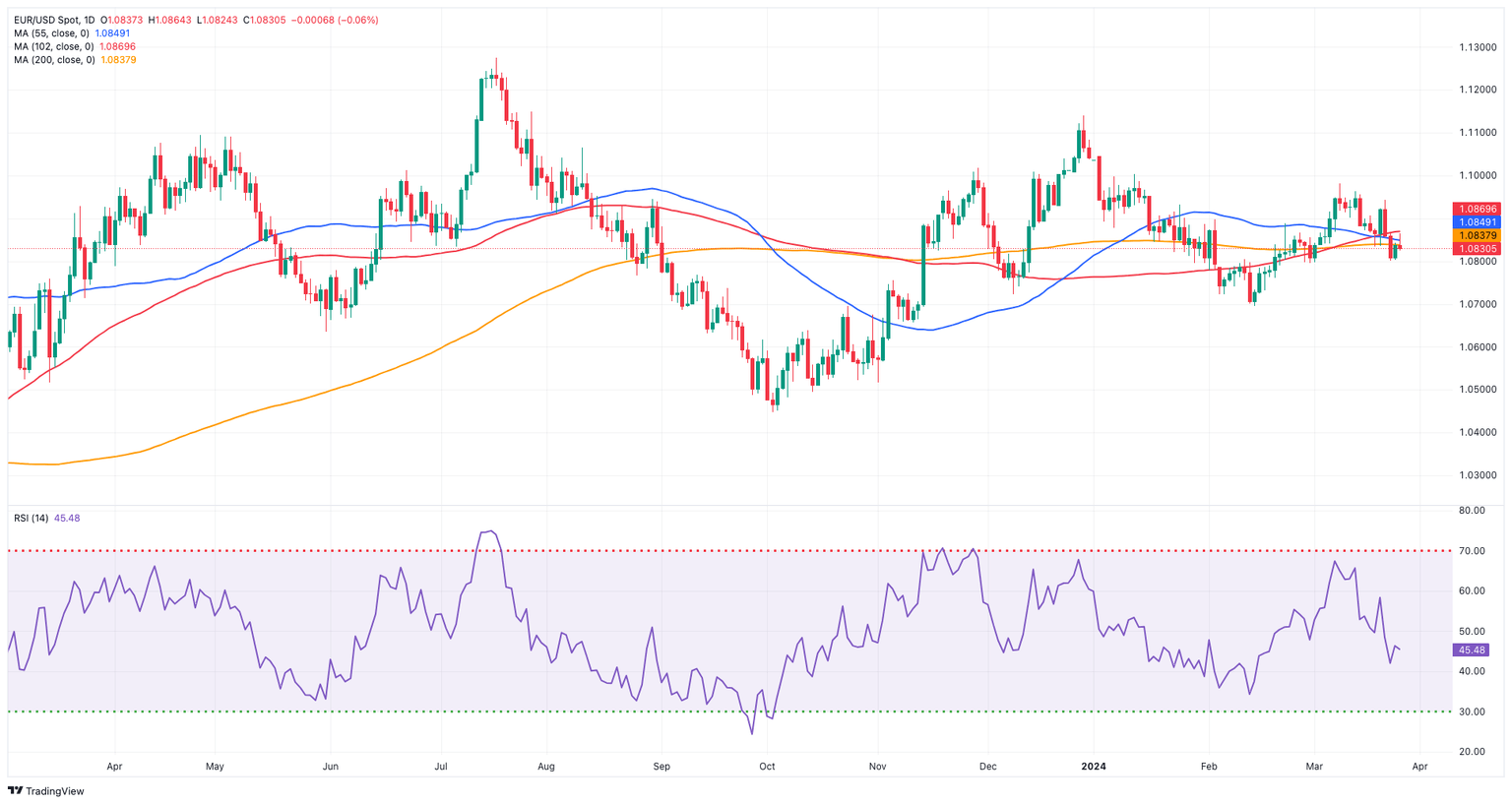

EUR/USD daily chart

EUR/USD short-term technical outlook

On the upside, the EUR/USD is expected to face early resistance at the March high of 1.0981 (March 8), followed by the weekly top of 1.0998 (January 11) and the psychological barrier of 1.1000. Further gains from here could result in a December 2023 peak of 1.1139 (December 28).

On the downside, a sustained break below the critical 200-day SMA at 1.0837 could lead to a deeper slide to the 2024 low of 1.0694 (February 14). After the November 2023 low of 1.0516 (November 1), there is a weekly low of 1.0495 (October 13, 2023), a 2023 low of 1.0448 (October 3), and the round level of 1.0400.

The 4-hour chart shows a marked bounce from recent tops near 1.0870. That said, the initial level of support is 1.0801, which comes before 1.0761. In contrast, the next upward barrier appears to be 1.0942, followed by 1.0963 and 1.0998. The Moving Average Convergence Divergence (MACD) stayed negative, while the Relative Strength Index (RSI) hovered near 45.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.