EUR/USD Forecast: Bulls won’t give up easily

EUR/USD Current Price: 1.1968

- German inflation was confirmed at 1.7% YoY in March, matching the preliminary estimate.

- US Retail Sales jumped to 9.8% in March, beating the market’s expectations.

- EUR/USD retreating just modestly from near 1.2000, still bullish.

The EUR/USD pair advanced to 1.1992 this Thursday, a fresh April high, as risk appetite persisted throughout the first half of the day. The dollar posted a modest advance ahead of US data releases, although other high-yielding assets retained their strength. Meanwhile, the dollar fell even against safe-haven gold and yen.

Earlier in the day, Germany published March inflation figures. The annual Consumer Price Index matched the expected 1.7% YoY. As for US data, March Retail Sales sharply recovered, printing at 9.8%, much better than the 6.3% anticipated. Initial Jobless Claims contracted to 683K in the week ended April 9, also beating expectations, while the Philadelphia Fed Manufacturing Survey came in at 50.2 in April. The country will later publish March Industrial Production and Capacity Utilization.

EUR/USD short-term technical outlook

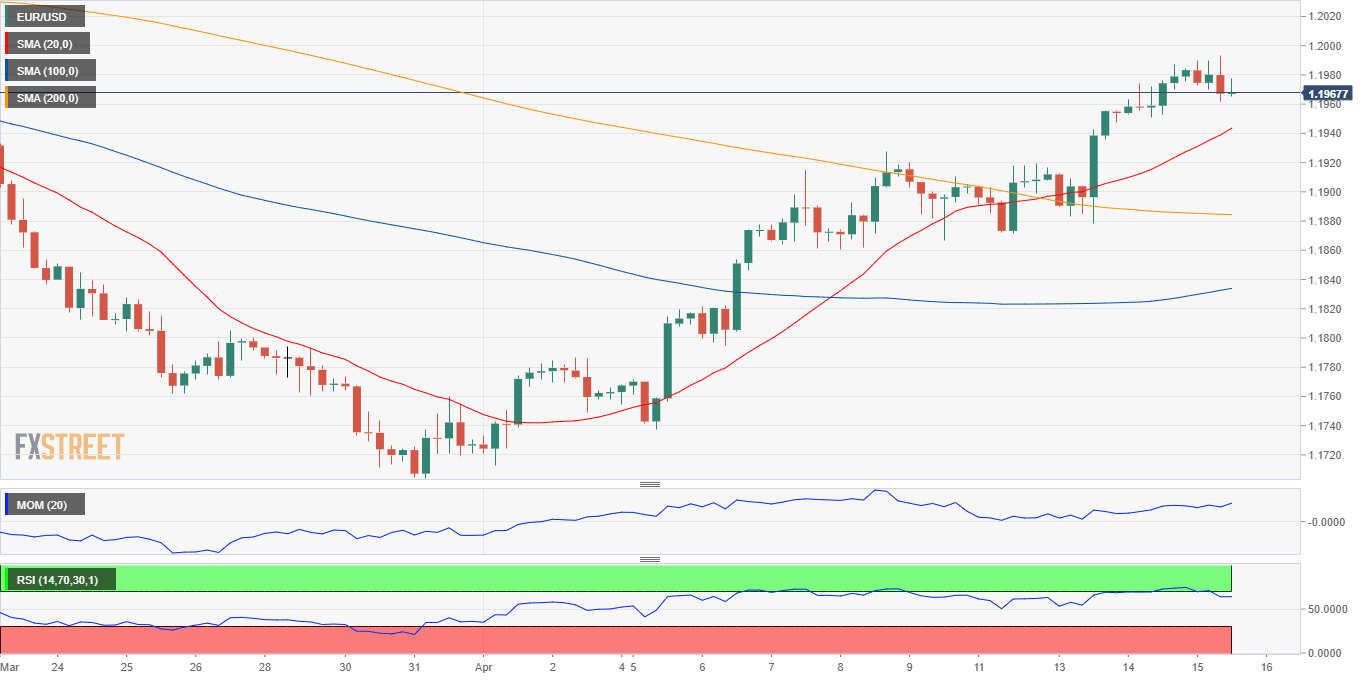

Upbeat US data fueled the dominant optimistic mood, helping EUR/USD to bounce some. From a technical point of view, the pair retains its near-term bullish stance, as it consolidates at the upper end of its monthly range. The 4-hour chart shows that the 20 SMA is bullish, advancing above the longer ones and providing dynamic support at around 1.1940. Technical indicators retreat from intraday highs but hold well above their midlines. A corrective decline could come on a break below the mentioned support, while bulls will retake the lead on a break above 1.2010.

Support levels: 1.1940 1.1900 1.1860

Resistance levels: 1.2010 1.2045 1.2090

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.