EUR/USD Current Price: 1.2123

- US GDP surged to 6.4% in the first quarter of the year, beating expectations.

- Germany and the EU will report on Q1 growth on Friday.

- EUR/USD has lost bullish momentum, but there are no signs of an upcoming slide.

The EUR/USD pair advanced to a fresh monthly high of 1.2145 this Thursday but retreated from the level to finish the day in the 1.2120 price zone. The dollar rose modestly in the American afternoon as Wall Street edged lower, despite upbeat macroeconomic data. Ahead of the close, US indexes bounced back, posting daily gains.

Germany published inflation figures, which were upbeat. According to preliminary estimates, the April Consumer Price Index reached 2% YoY. Meanwhile, the EU April Economic Sentiment Indicator came in at 110.3, largely surpassing the 102.2 expected. In the US, the Q1 Gross Domestic Product posted 6.4% according to preliminary estimates, beating the market’s expectations of 6.1% and indicating substantial economic growth.

On Friday, Germany will publish the preliminary estimate of its Q1 GDP, foreseen at -1.5% QoQ, while the figure for the EU is expected at -0.8%. The US will publish March Personal Income and Personal Spending, and the final reading of the April Michigan Consumer Sentiment Index, expected to be upwardly revised to 87.5.

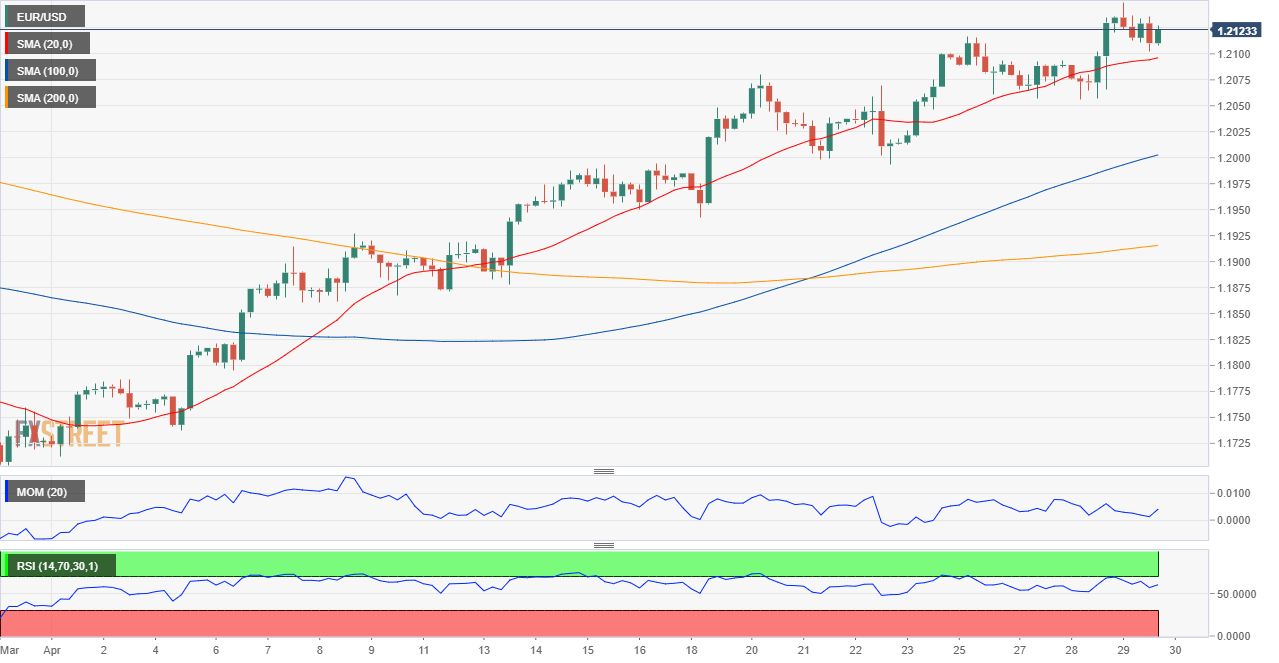

EUR/USD short-term technical outlook

The EUR/USD pair trade has lost bullish strength, but there are no signs of a bearish extension coming soon. The 4-hour chart shows that the pair remains above all of its moving averages, with the 20 SMA providing dynamic support at around 1.2090. The longer moving averages remain below the shorter one, with the 100 SMA maintaining its bullish slope. Technical indicators have retreated from daily highs but remain above their midlines, with the RSI currently flat at around 58.

Support levels: 1.2090 1.2050 1.2005

Resistance levels: 1.2150 1.2195 1.2240

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds steady below 0.6700 after RBA Minutes

AUD/USD is trading flat below 0.7000, a little impressed by the hawkish Minutes of the RBA's May policy meeting. Souring risk sentiment also keep the recovery attempts elusive in the Aussie pair ahead of more Fedspeak.

USD/JPY extends gains to near 156.50, tracking positive US yields

USD/JPY is extending previous gains to test 156.50, despite the comments from Japan's Finance Minister Shunichi Suzuki. The pair stays supported amid an uptick in the US Treasury bond yields and the US Dollar after Fed officials adopted a cautious stance on the inflation and policy outlook.

Gold price extends its upside as investors bet on rate cuts

Gold price extends the rally on Tuesday after retracing from a record high earlier. The renewed gold demand is bolstered by higher bets on interest rate cuts from the US Federal Reserve, ongoing geopolitical tensions, along with the strong demand stemming from central banks and Asian buyers.

New York Attorney General reaches $2 billion settlement with Genesis after claims of fraud

After a lawsuit filed by the New York Attorney General against crypto lender Genesis in late 2023, the company reached a settlement of $2 billion with the AG on Monday.

The market-moving data this week comes from everywhere other than the US

The market-moving data this week comes from everywhere other than the US. We get inflation from the UK, Canada, and Japan, possibly shifting central bank outlooks. The Fed releases FOMC minutes on Wednesday. And we get a slew of PMI’s on Thursday.