EUR/USD Forecast: Bears now await a break below 1.1065 confluence support

- EUR/USD remained under pressure for the second consecutive session on Friday.

- Some follow-through USD strength turned out to be a key factor exerting pressure.

- The focus now shifts to this week’s ECB policy meeting, flash Eurozone PMI prints.

The EUR/USD pair witnessed some aggressive follow-through selling for the second consecutive session on Friday and tumbled to levels below the 1.1100 round-figure mark amid some follow-through US dollar buying interest. The greenback remained well supported by the previous session's upbeat Retail Sales and got an additional boost from signs that the consumer remains in good shape. Data released on Friday showed the University of Michigan's preliminary consumer sentiment index for January edged down to 99.1 from a seven-month high of 99.3 in December.

Adding to this, housing starts rose 16.9% to a seasonally adjusted annual rate of 1.61 million units in December and largely offset a 3.9% decline in building permits to a rate of 1.42 million units. The incoming economic releases added to growing expectations that the US economy will continue to expand and might have also reduced the likelihood of any further interest rate cuts by the Fed. This comes on the back of the latest optimism over the US-China phase one trade-deal and allowed the US Treasury bond yields to tick higher, which eventually underpinned the USD.

The pair finally settled near the lower end of its weekly trading range but once again managed to find some support near monthly lows, around the 1.1085 region. The pair managed to regain some positive traction on the first day of a new trading week as the focus now shifts to this week's key event risk – the latest monetary policy update by the European Central Bank (ECB) on Thursday. This will be followed by the flash version on Eurozone Manufacturing and Services PMI prints, which will play a key role in influencing the sentiment surrounding the shared currency and provide a fresh directional impetus.

Short-term technical outlook

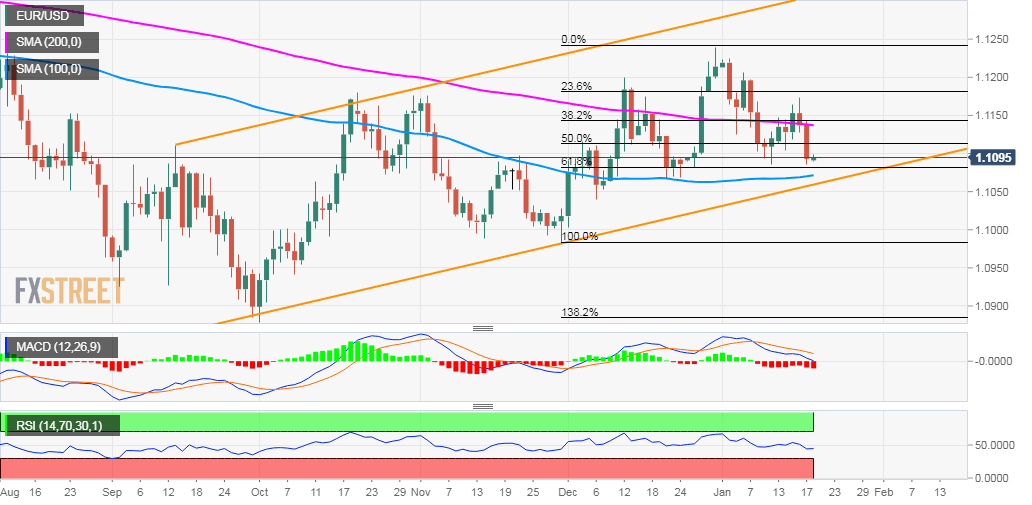

From a technical perspective, the pair, so far, has held a support marked by 61.8% Fibonacci level of the 1.0981-1.1239 positive move. This is closely followed by the 1.1065 confluence region, comprising of the lower end of near four-month-old ascending trend-channel and 100-day SMA, which if broken will set the stage for a further near-term depreciating move. Below the mentioned support, the pair is likely to accelerate the slide towards challenging the key 1.10 psychological mark before eventually sliding to November monthly swing lows support near the 1.0980 region.

On the flip side, immediate support is now pegged near the 1.1110 region (50% Fibo. level), above which the positive move could get extended back towards the 1.1140-50 supply zone – nearing 38.2% Fibo. level. Any subsequent strength might continue to confront some resistance near the 1.1175-80 region (23.6% Fibo. level), which if cleared might negate the near-term bearish outlook. The pair then seems all set to surpass the 1.1200 handle and aim towards retesting late December swing high resistance near the 1.1240 region. The momentum could further get extended towards the 1.1300 round figure mark en-route a resistance marked by the top end of a multi-month-old ascending trend-channel, currently near the 1.1320 region.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.