EUR/USD Forecast: Another drop to 1.0800 should not be ruled out

- Further weakness prompted EUR/USD to revisit 1.0810.

- The Dollar managed to remain bid amidst thin volatility.

- Investors’ attention stays on the release of US PCE.

The modest uptick in the US Dollar (USD) led to a similarly humble decline in EUR/USD, with the pair revisiting the 1.0810 zone, and the USD Index (DXY) flirting with the top of the recent range near 104.50.

The fluctuations in spot were accompanied by overall negative developments in both US and German yields across the curve, all amidst an unchanged monetary policy framework.

Regarding monetary policy, there are expectations that both the Federal Reserve (Fed) and the European Central Bank (ECB) will begin their easing cycles, potentially starting in June. However, the pace of subsequent interest rate cuts may differ, leading to potentially divergent strategies between the two central banks. Nevertheless, it is anticipated that the ECB will not significantly lag behind the Fed.

Around the ECB, board member Cipollone noted earlier in the session that moderating wage growth in the euro bloc lends support to the case for a rate cut, further underscoring that even after an interest rate reduction, the bank’s policy would remain substantially restrictive.

Back to the Fed, and according to the FedWatch Tool provided by CME Group, the likelihood of a rate cut in June ticked a tad lower to arouund 58%.

Overall, the relatively subdued economic fundamentals in the euro area, combined with the growing probability of a "soft landing" for the US economy, strengthen expectations of a stronger Dollar in the medium term, particularly as both the ECB and the Fed potentially implement their easing measures almost simultaneously. In such a scenario, EUR/USD could experience a more notable correction, initially targeting its year-to-date low around 1.0700 before possibly revisiting the lows observed in late October 2023 or early November near the 1.0500 level.

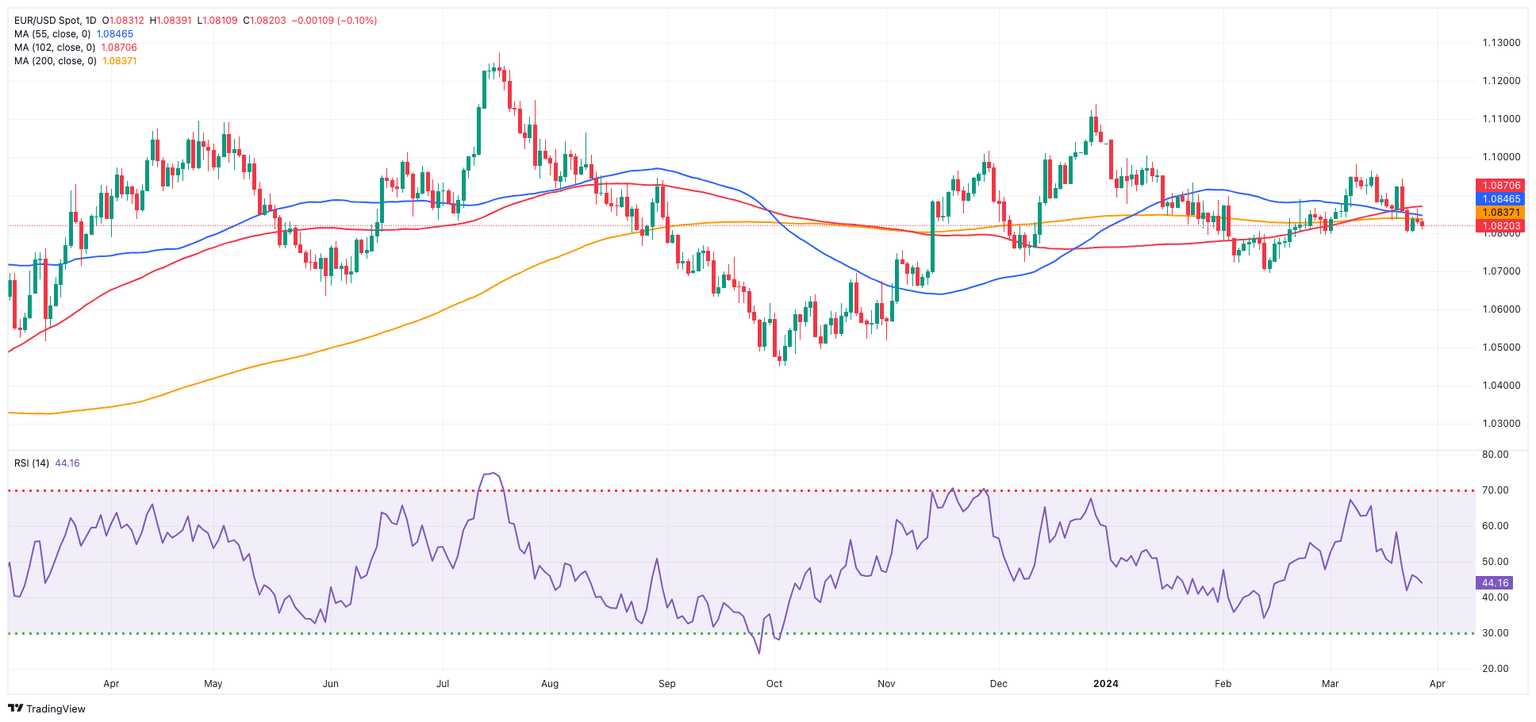

EUR/USD daily chart

EUR/USD short-term technical outlook

On the upside, EUR/USD is projected to encounter early resistance at the March high of 1.0981 (March 8), then the weekly top of 1.0998 (January 11) and the psychological barrier of 1.1000. Further advances from here might lead to a test of the December 2023 peak of 1.1139 (December 28).

However, a sustained break below the crucial 200-day SMA at 1.0836 could trigger a deeper retracement to the 2024 low of 1.0694 (February 14) ahead of the November 2023 low of 1.0516 (November 1). The loss of this region exposes the weekly low is 1.0495 (October 13, 2023), seconded by the 2023 low of 1.0448 (October 3), and the round level is 1.0400.

The 4-hour chart shows the resurgence of the downward bias. That said, the initial level of support is 1.0801, before 1.0761. In contrast, the next visible upward barrier looks to be 1.0942, followed by 1.0963 and 1.0998. The Moving Average Convergence Divergence (MACD) remained negative, with the Relative Strength Index (RSI) climbing to around 42.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.