EUR/USD has lifted in early Monday morning trade, up 0.25% to 1.1023, but seen profit taking activities after that. When to go long on the EUR/USD?

Euro seen profit-taking after Macron won French election

Not surprisingly, Emmanuel Macron has won the French election of becoming the next French President, beating Marine Le Pen in the Final round of the French Presidential election. EUR/USD has lifted in early Monday morning trade, up 0.25% to 1.1023, but seen profit taking activities after that. Further modest gains in EUR/USD are widely expected at this moment and probably a buy on dips strategy for EUR/USD could be adopted in coming days. Eurozone’s improving economic data as well as low funding costs in Europe, are strong incentives for equity based investment in the Eurozone, which will also support the single currency.

U.S. payrolls data further adds Fed’s rate hike possibility in June

U.S. job growth rebounded sharply in April and the unemployment rate dropped to 4.4 percent, near a 10-year low, pointing to a tightening labor market that likely confirm the case for an interest rate hike next month. Nonfarm payrolls surged by 211,000 jobs last month after a gain of 79,000 in March. April's job growth, which was broad-based, surpassed this year's monthly average of 185,000. However, this strong job data failed to lift the U.S. dollar.

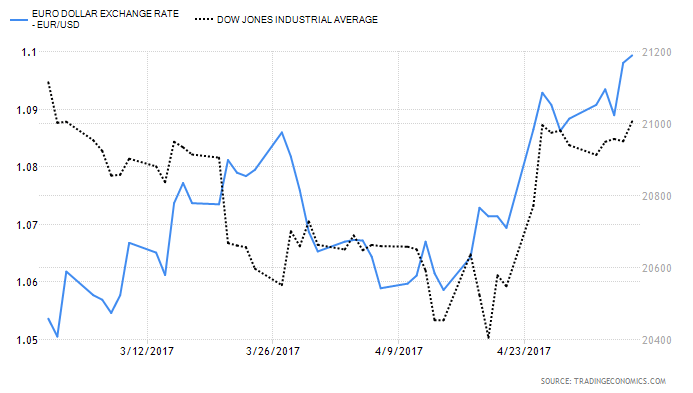

We think the key driver behind the drop in dollar index is that risk sentiment seen largely improved, as sound economic condition and ease in French election encourage investors to park their cashes into euro assets, which its currencies’ fair value is much lower than the U.S. dollar. The chart below shows that moves in euro dollar has been in tandem with Dow index since middle of March when the Fed raised the rate, given euro has over 56% weight in dollar index, improving risk sentiment globally seen a downside risk to the U.S. dollar.

How the rising China FX reserves to potentially influence the direction of dollar moves

China's FX reserves rose in April for a third straight month according to the data released over the weekend, beating market expectations, as capital controls and a pause in the dollar's rally helped staunch capital outflows. Reserves rose $21 billion in April to $3.03 trillion, compared with an increase of $3.96 billion in March to $3.009 trillion. Main reason behind the rising is the weak sentiment in greenback, discouraging the Chinese investors to park the cash overseas.

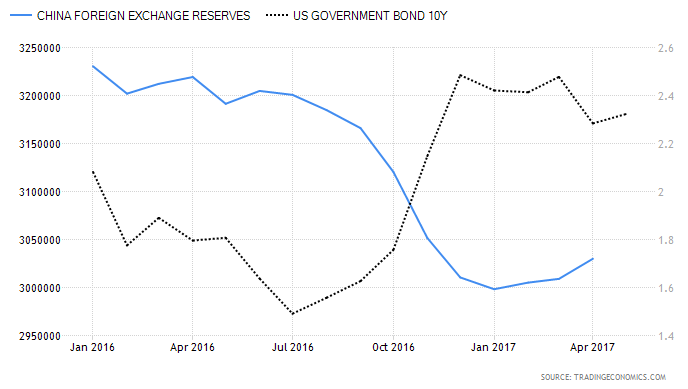

Most importantly, PBOC’s reaction towards the change in FX reserves is likely to change the course of greenback. When China’s capital outflow pressures increase, PBOC may sell its FX reserves to defend its Chinese yuan. In our estimate, there are over 60% of its assets held in U.S. dollar, while most of them are U.S. Treasuries. In other words, increases in China capital outflows could indirectly pressure the U.S. sovereign bonds yield higher. The chart below shows that in the period of second half last time, falling China FX reserves and surges in U.S. 10-year sovereign bond yield occurred at the same time.

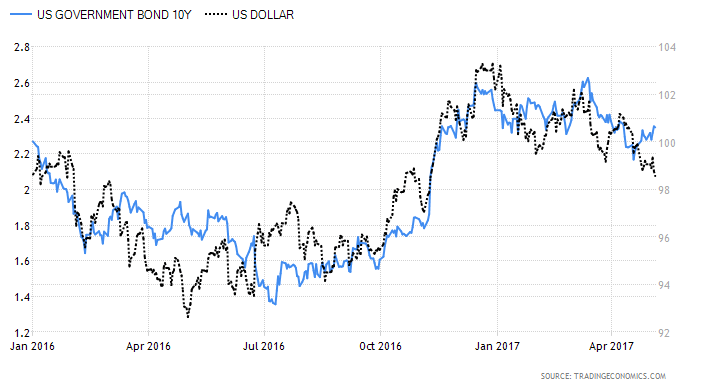

When current situation doesn’t require PBOC to massively dump its reserves, with expectations on Fed to gradually raise its policy rate, there is less risks to induce the U.S. Treasuries yield to move much higher from the current level. A separate chart below shows a high correction between U.S. 10-year yield and dollar index.

Our Picks

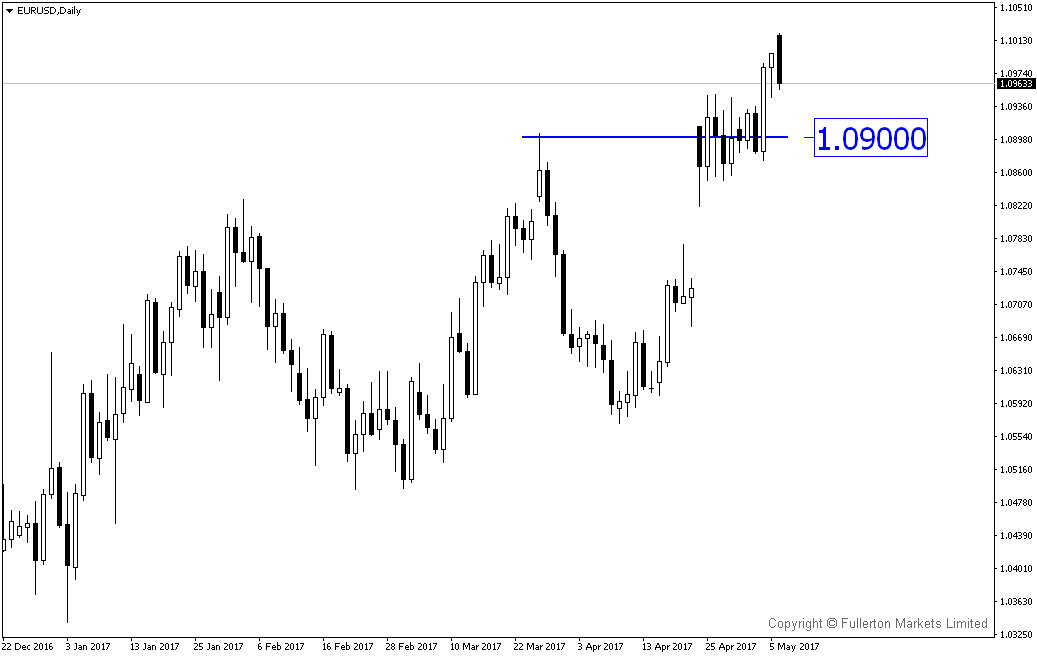

EUR/USD – Slightly bullish. We expect this pair to find support around 1.09 in coming days. Consider going long around this level.

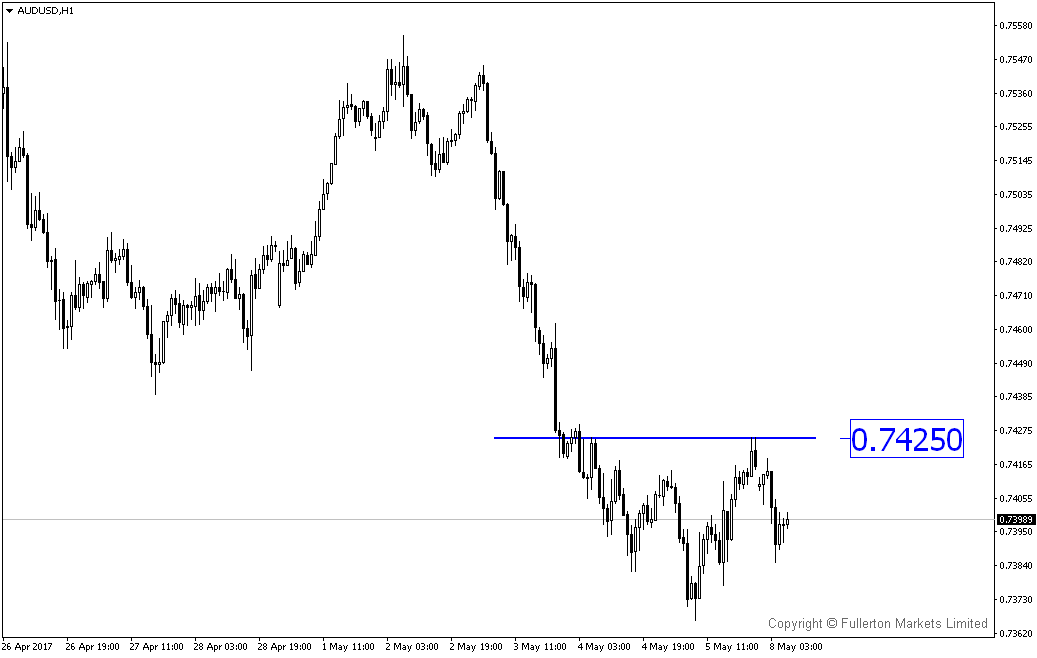

AUD/USD – Slightly bearish. Monetary policy in China tightening could further pressure this pair lower, and various Chinese economic data could not be strong enough to support this pair. Consider going short if price rebounds to next resistance level at 0.7425

Top News This Week (GMT+8 time zone)

China: CPI, Wednesday 10th May, 9.30am.

We expect figures to come in at 1.2% (previous figure was 0.9%).

New Zealand: Cash rate decision. Thursday 11th May, 5am.

We expect rate to remain unchanged at 1.75% (previous figure was 1.75%).

UK: Cash rate decision. Thursday 11th May, 7pm.

We expect rate to remain unchanged at 0.25% (previous figure was 0.25%).

Fullerton Markets Research Team

Your Committed Trading Partner

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.