On Tuesday, the EUR/USD pair rallied hard and jumped back to the level it was before ECB's dovish tapering action. The shared currency was helped by upbeat EZ data, including better-than-expected German GDP print that came in to show a quarterly growth of 0.8% in the third quarter.

Meanwhile, the US Dollar remained under intense selling pressure and failed to benefit from hotter-than-expected US PPI figures for October. With December Fed rate hike action nearly priced in the market, mounting concerns over the US tax reform plan overshadowed the upbeat data and did little to provide any immediate respite for the USD bulls.

The pair now seems to have entered a consolidation phase and traded just below the 1.1800 handle on Wednesday as investors look forward to the release of US consumer inflation and monthly retail sales data, later during the North American session.

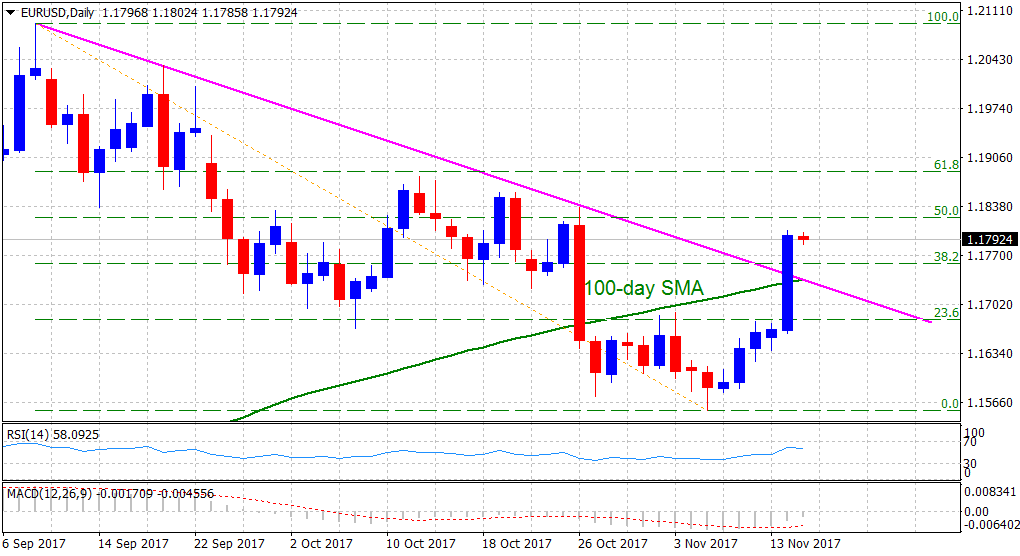

From a technical perspective, the pair decisively broke through the 1.1670-80 supply zone and took along stops placed at an important confluence resistance near the 1.1735-40 region, comprising of the 100-day SMA and a short-term descending trend-line. Hence, bulls would now be aiming for some follow-through buying interest beyond the 1.1820 area, representing the 50% Fibonacci retracement level of the 1.2092-1.1554 downslide, above which the pair is likely to dart towards 1.1855-60 intermediate resistance before eventually aiming to test the 61.8% Fibonacci retracement level hurdle near the 1.1880 region.

On the flip side, any profit taking slide below the 1.1780-75 zone could get extended but is likely to be limited by the confluence resistance break-point, now turned strong support, near the 1.1740 region.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.