ECB dovish stance

Recently, the ECB adopted more of a dovish stance.

ECB President Christine Lagarde noted that the eurozone’s economy is in a disinflationary process and added that inflation is ‘making good progress’. Lagarde added that they are confident but ‘not sufficiently confident’ and commented that additional data is needed; more will be known in June.

In addition to this, in recent newspaper interviews, we saw ECB's Yannis Stournaras and Robert Holzmann stress the point that the ECB could potentially cut rates by 100bps and be the first to cut ahead of the Fed. This is weighing on the EUR/USD currency pair.

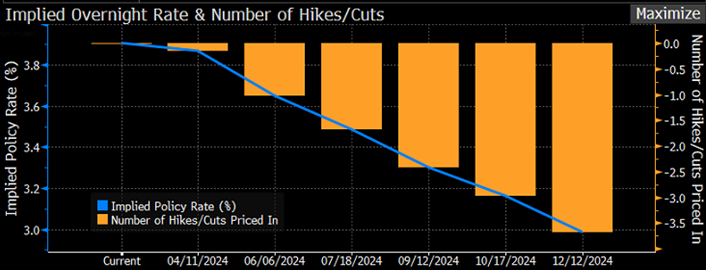

For the ECB, markets are fully pricing in the first 25bp cut in June, with a total of nearly four rate cuts on the table (-92bps) for the year. As of writing, it is doubtful the central bank will cut rates at this month’s policy meeting on 11 April, but a dovish hold is certainly a real possibility, which, by extension, underlines a strong likelihood that the ECB may pull the trigger at June’s meeting.

Euro area inflation ahead

Given the clearer trajectory for euro area disinflation, tomorrow’s CPI inflation print for March will be one to monitor. You may recall that YoY headline inflation slowed to 2.6% in February from 2.8%, weighed down by cooling food, manufactured goods, and energy prices. Expectations heading into tomorrow’s release show both headline and core readings (YoY) down to 2.5% (from 2.6%) and 3.0% (from 3.1%), respectively.

Daily support in view at $1.0739

Technically, this remains a bearish pair. Longer-term studies have maintained a downside bias since 2008. The pullback off September 2022 lows at $0.9536, therefore, could be viewed as a sell-on-rally scenario. The bearish vibe is emphasised on the daily chart in the shape of a possible head and shoulders top formation, though the neckline is taken from the low of $1.0724 and is directed to the downside, which can limit risk-reward for any sellers basing a technical short on this pattern. You may also note that the pair is currently testing support on the daily chart from $1.0739 and will be a key level to keep an eye on heading into tomorrow’s risk event.

Given the ECB's dovish tone, any meaningful deviation to the downside will likely see the euro pulled lower against the majority of its G10 peers. Any upside surprise could underpin the euro but is likely to be short-lived.

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.