The last couple of weeks have been tough for the Polish Zloty (PLN) and other emerging markets' currencies. The main reason is the negative global sentiment towards riskier investments with increased risk aversion.The trade war between China and USA is getting nasty although in my opinion it will all end well. Both countries have too much to lose. Also, the presidential and parliamentary elections in Turkey coming up this sunday are making traders nervous. We have to remember about the Fed hiking interest rates and the ECB cutting its QE plan. All of these factors affected the PLN, which has been quickly depreciating since mid march. The last 2 weeks we have a seen a corrective movement but this past week the PLN has been one of the worst performers among EM currencies. The global sentiment is the main driver but also the published local macro data was below expectations. Average wages in may increased by 7% (yearly basis) while decreased 3% on a monthly basis. Industrial production grew by only 5.4% in may (yearly basis) while the PPI stood at 2.8%. It has to be noticed, that worse macro data is not a trend. The economy is doing fine and is expected to grow. So while analyzing the PLN, we need to focus mainly on the external factors. Currently, the global situation is nervous and it caused both the EUr/PLN and the USD/PLN to reach crucial resistance levels.

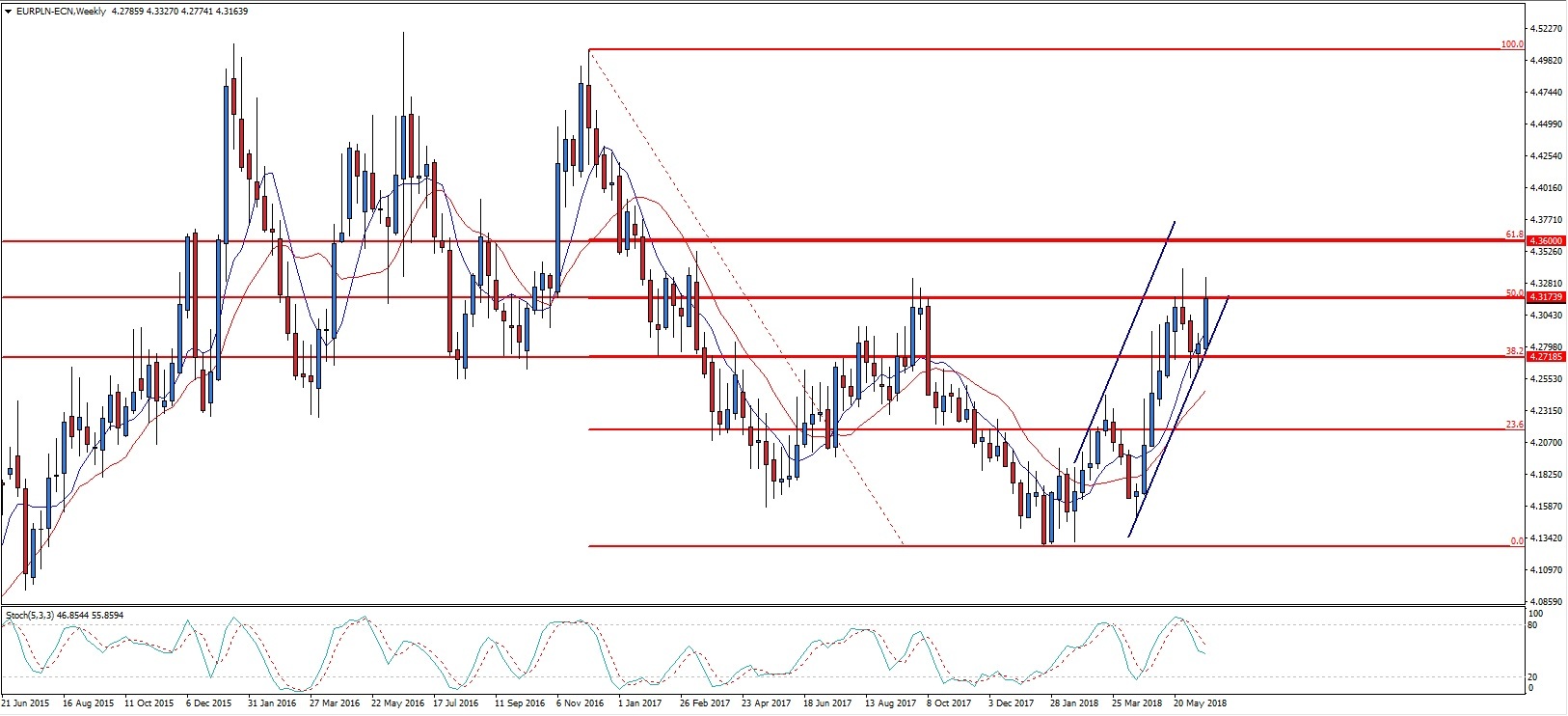

The EUR/PLN bounced from the 4.27 support and is currently fighting at the 4.32 - 4.33 resistance. This level has already been touched in may but the market retreated. If the EUR/PLN breaks this resistance level, it could possibly jump to the next target - 4.36, which is the 61.8% retracement level of the last long term downward move. I expect the market will calm down though. In my opinion, next week we will see the EUR/PLN at lower levels, maybe heading towards 4.27. This scenario will be denied if sunday's elections in Turkey create turmoil on the market.

Pic. 1 EUR/PLN W1 Source: Meta Trader 4 Supreme Edition. Admiral Markets.

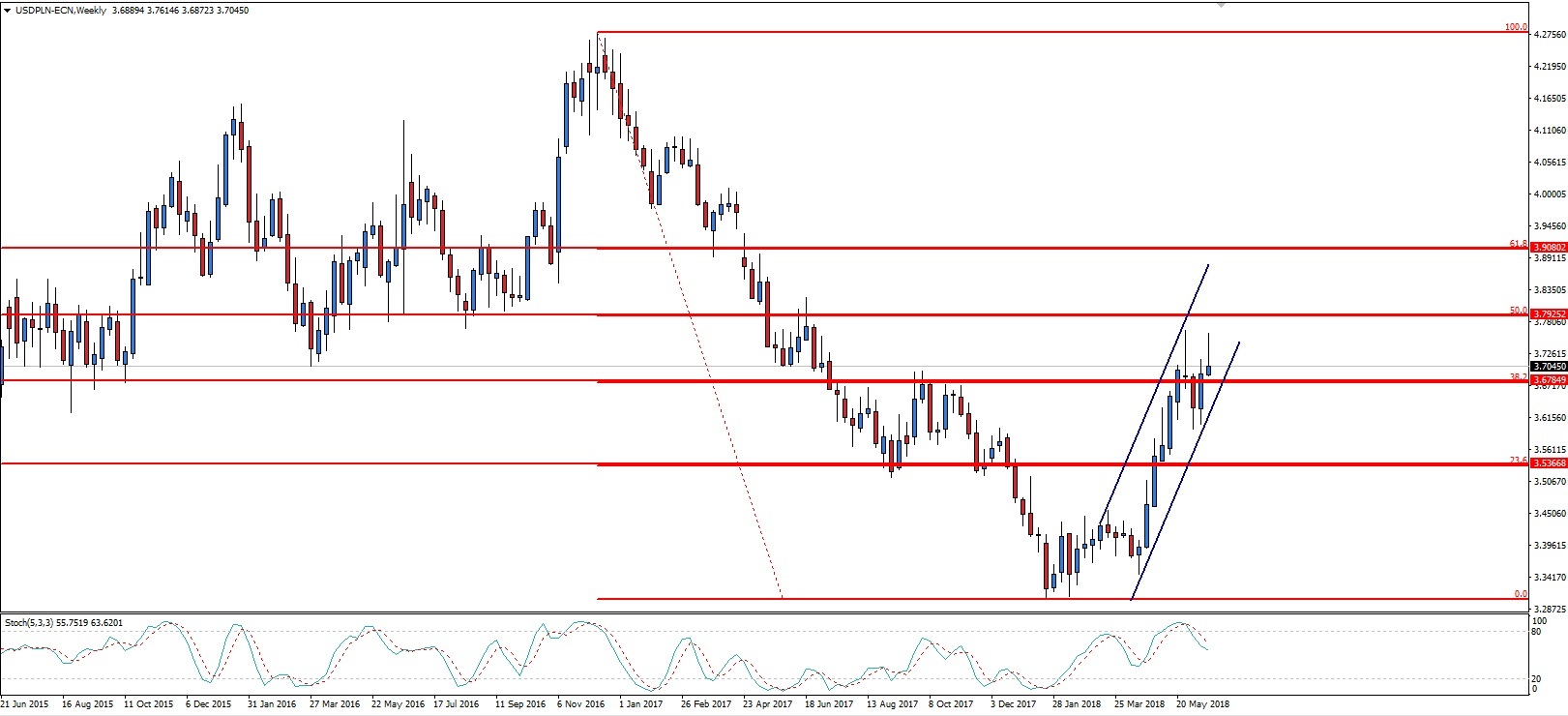

The USD/PLN trades in a similar pattern like the EUR/PLN although with small differences. The market actually broke the 3.68 resistance (38.2% retracement level of the last long term downward move) but is unable to follow the upward movement. Like in may, the USD/PLN reached local highs of 3.75 but is giving up the gains. It seems the target for the market is 3.79. I believe though that like with the EUR, the Polish Zloty will regain some ground agains the USD and next week the USD/PLN could be trading at levels below 3.68 (again, watch out for Turkey).

Pic. 2 USD/PLN W1 Source: Meta Trader 4 Supreme Edition. Admiral Markets.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.