Cable unfolded as expected last week confirming the main count and targets are yet to be reached.

Last week, we anticipated that the result of Scottish independence referendum which was considered as good news will not save Cable. This week we are updating the main count which expects Cable to continue its decline and as well adding an alternate count which expects Cable to unfold towards the upside in an upwards corrective phase.

As always we will wait for either count`s confirmation point to be reached to determine the highly probable count.

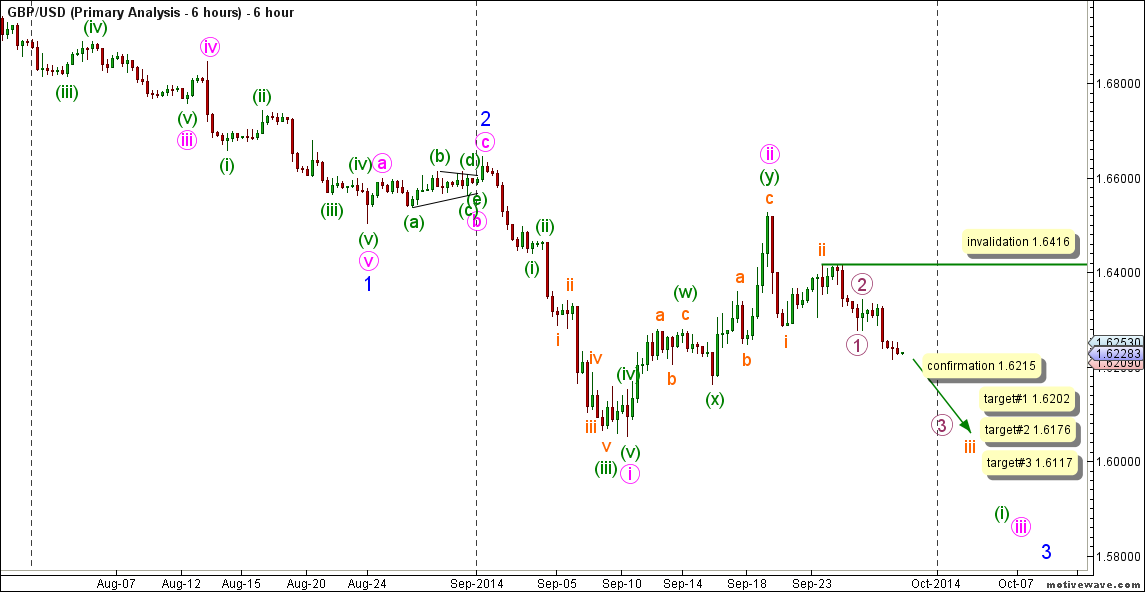

6-Hours Main Count

- Invalidation Point: 1.6416

- Confirmation Point: 1.6215

- Downwards Target: 1.6202 -- 1.6176 -- 1.6117

- Wave number: 3 purple

- Wave structure: Motive

- Wave pattern: Impulse

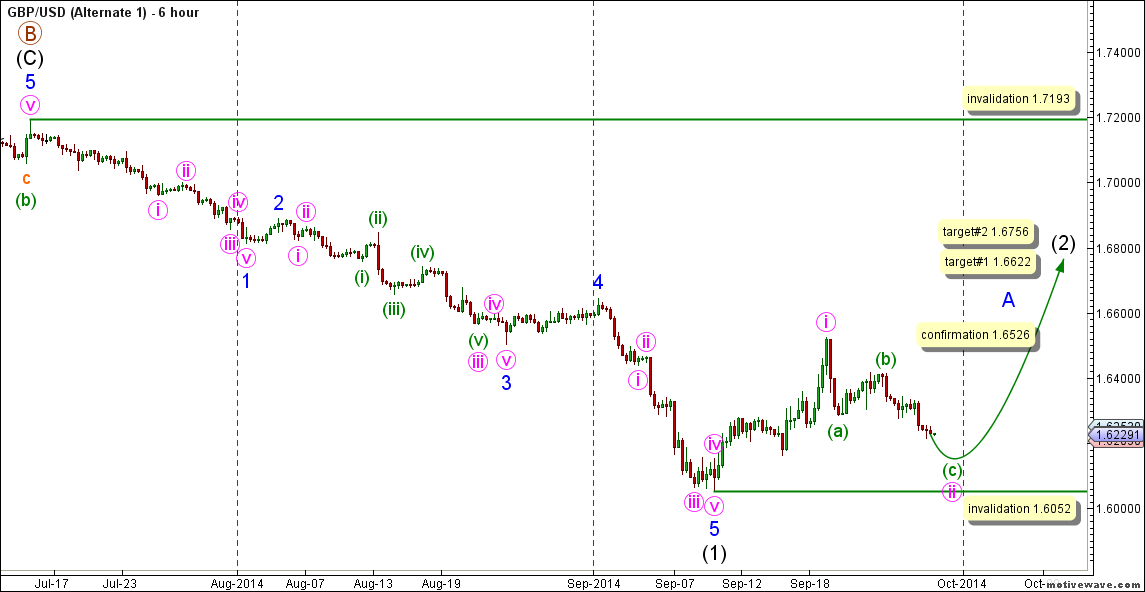

6-Hours Alternate Count

- Invalidation Point: 1.7193 -- 1.6052

- Confirmation Point: 1.6526

- Upwards Targets: 1.6622 -- 1.6756

- Wave number: (2) Black

- Wave structure: Corrective

- Wave pattern: Zigzag

Main Wave Count

This count expects that wave B maroon is complete as a zigzag labeled waves (A), (B) and (C) black and that wave C maroon is starting to unfold towards the downside.

Wave (C) black within wave B maroon unfolded as an impulse labeled waves 1 through 5 blue.

Within wave C maroon wave (1) black is expected to be underway with waves 1 and 2 blue complete and that wave 3 blue is underway.

Wave 1 blue unfolded as an impulse labeled waves i through v pink.

Wave ii pink unfolded as a double combination labeled waves (w), (x) and (y) green.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Wave v pink unfolded as an impulse labeled waves (i) through (v) green.

Wave 2 blue unfolded as a zigzag labeled waves a, b and c pink with wave b pink unfolding as a triangle labeled waves (a) through (e) green.

Within wave 3 blue waves i and ii pink are expected complete and wave iii pink is unfolding towards the downside.

Wave i pink unfolded as an impulse labeled waves (i) through (v) green with wave (iii) green unfolding as an impulse labeled waves i through v orange.

Wave ii pink unfolded as a double zigzag labeled waves (w), (x) and (y) green.

Wave (w) green unfolded as a zigzag labeled waves a, b and c orange.

Wave (y) green unfolded as a zigzag labeled waves a, b and c orange.

Within wave iii pink waves i and ii orange are expected complete and wave iii orange is underway with waves 1 and 2 purple complete and wave 3 purple is unfolding towards the downside.

This count would be confirmed by movement below 1.6215.

At 1.6202 wave 3 purple will reach equality with wave 1 purple, at 1.6176 wave iii orange will reach equality with wave i orange and the final target is at 1.6117 as at that level wave 3 purple will reach 1.618 the length of wave 1 purple.

This count would be invalidated by movement above 1.6416 as wave 2 purple may not retrace more than 100 % the length of wave 1 purple.

Alternate Wave Count

This count expects that wave (1) black within wave C maroon is complete and that wave (2) black is unfolding towards the upside and wave A blue is underway within wave (2) black.

Wave (1) black unfolded as an impulse labeled waves 1 through 5 blue.

Wave 1 blue unfolded as an impulse labeled waves i through v pink.

Wave 3 blue unfolded as an impulse labeled waves i through v pink with wave iii pink extending into waves (i) through (v) green.

Wave 5 blue unfolded as an impulse labeled waves i through v pink.

Within wave (2) black wave A blue is underway likely as a leading diagonal labeled waves i through v pink with wave i pink complete and wave ii pink is at its late stages.

Wave ii pink is unfolding as a zigzag labeled waves (a), (b) and (c) green with waves (a) and (b) green complete and wave (iii) green is underway.

This count would be confirmed by movement above 1.6526.

At 1.6622 wave (2) black will reach 50 % the length of wave (1) black and at 1.6756 wave (2) black will reach 0.618 the length of wave (1) black.

This count would be invalidated by movement above 1.7193 as wave (2) black may not retrace more than 100 % the length of wave (1) black and as well this count would be invalidated by movement below 1.6052 as wave ii pink may not retrace more than 100 % the length of wave i pink within wave A blue and it should be noted that the invalidation point will be moved to the end of wave ii pink once we have confirmation on the 6-hourly chart that wave iii pink is underway.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.