This week the pound unfolded as expected under the alternate count reaching and exceeding the first target and failing short of the second target by 2 pips before reversing directions and moving towards the upside.

As we discussed in the latest analysis, the pound made new highs for the year and this week`s analysis expect the pound to continue -eventually- to register new highs.

We are modifying the main count according to the latest price action and the main count expects downwards corrective movement before continuing moving towards the upside while the alternate count expects that corrective movement to be complete and that wave c orange is underway.

It should be noted that MACD readings on the 6-hours chart does not provide enough data to confirm or refute the main count`s view.

As always we will let price action decide for us which count is the highly probable count by waiting for either count`s confirmation point to be reached.

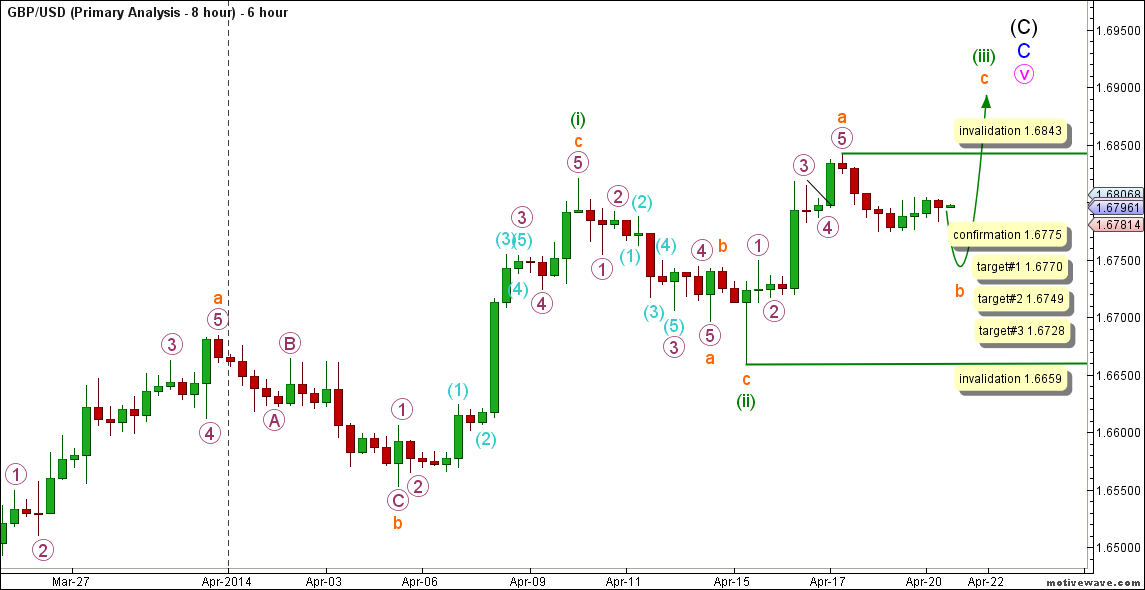

6-Hours Main Count

- Invalidation Point: 1.6659 -- 1.6843

- Confirmation Point: 1.6775

- Downwards Targets: 1.6770 - 1.6749 -- 1.6728

- Wave number: b orange

- Wave structure: Corrective

- Wave pattern: Zigzag

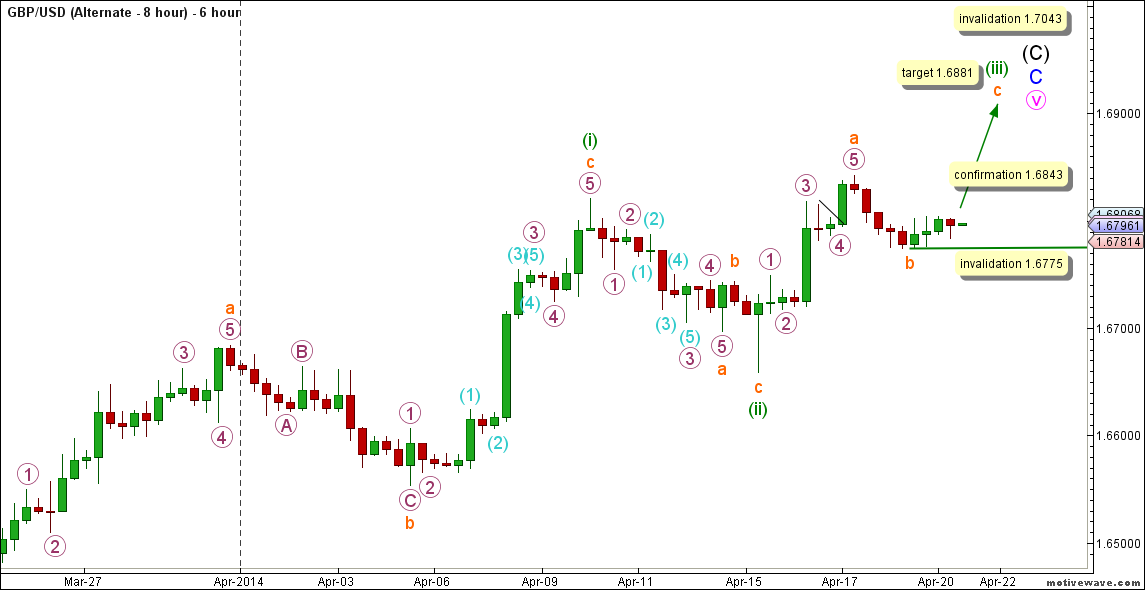

6-Hours Alternate Count

- Invalidation Point: 1.6775 -- 1.7043

- Confirmation Point: 1.6843

- Upwards Target: 1.6881

- Wave number: c orange

- Wave structure: Motive

- Wave pattern: Impulse/Ending diagonal

Main Wave Count

This count expects that wave B maroon is unfolding as a triangle labeled waves (A) through (E) black with waves (A) and (B) black complete and wave (C) black is unfolding towards the upside.

Within wave (C) black waves A and B blue are complete and wave C blue is unfolding towards the upside.

Wave C blue is unfolding as an impulse labeled waves i through v pink with waves i through iv pink complete and wave v pink is unfolding towards the upside.

Wave iv pink unfolded as a double zigzag labeled waves (w), (x) and (y) green and this count expects that wave v pink is unfolding towards the upside.

Wave v pink is expected to be unfolding towards the upside likely as an ending diagonal labeled waves (i) through (v) green with waves (i) and (ii) green complete and wave (iii) green is unfolding towards the upside.

Wave (i) green unfolded as a zigzag labeled waves a, b and c orange.

Wave a orange unfolded as an impulse labeled waves 1 through 5 purple.

Wave c orange unfolded as an impulse labeled waves 1 through 5 purple with wave 3 purple extending into waves (1) through (5) aqua.

Wave (ii) green unfolded as a zigzag labeled waves a, b and c orange.

Wave a orange unfolded as an impulse labeled waves 1 through 5 purple with wave 3 purple unfolding as an impulse labeled waves (1) through (5) aqua.

Wave (iii) green is unfolding as a zigzag labeled waves a, b and c orange with wave a orange complete and wave b orange is unfolding towards the downside.

Wave a orange unfolded as an impulse labeled waves 1 through 5 purple with wave 4 purple unfolding as a triangle.

As far as MACD study goes, The lack of a divergence -so far- between waves a and b orange does not confirm or refute the main count`s view.

This count would be confirmed by movement below 1.6775.

At 1.6770 wave b orange will reach 0.382 the length of wave a orange and at 1.6749 wave b orange will reach 0.5 the length of wave a orange and finally at 1.6728 wave b orange will reach 0.618 the length of wave a orange.

This count would be invalidated by movement above 1.6843 as within wave b orange no B wave may retrace more than 100 % the length of an A wave, as well this count would be invalidated by movement below 1.6659 as wave b orange may not retrace more than 100 % the length of wave a orange.

Alternate Wave Count

The only difference between both main and alternate counts is within the subdivisions of wave b orange as the subdivisions within wave b orange is not very clear, therefore we are presenting this alternate count which expects that wave b orange is complete and that wave c orange is unfolding towards the upside.

This count would be confirmed by movement above 1.6843.

At 1.6881 wave (iii) green will reach 0.618 the length of wave (i) green.

This count would be invalidated by movement above 1.7043 as within a contracting triangle, wave (C) black may not exceed the end of wave (A) black, as well this count would be invalidated by movement below 1.6775 as within wave c orange no second wave may retrace more than 100 % the length of the first wave.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.