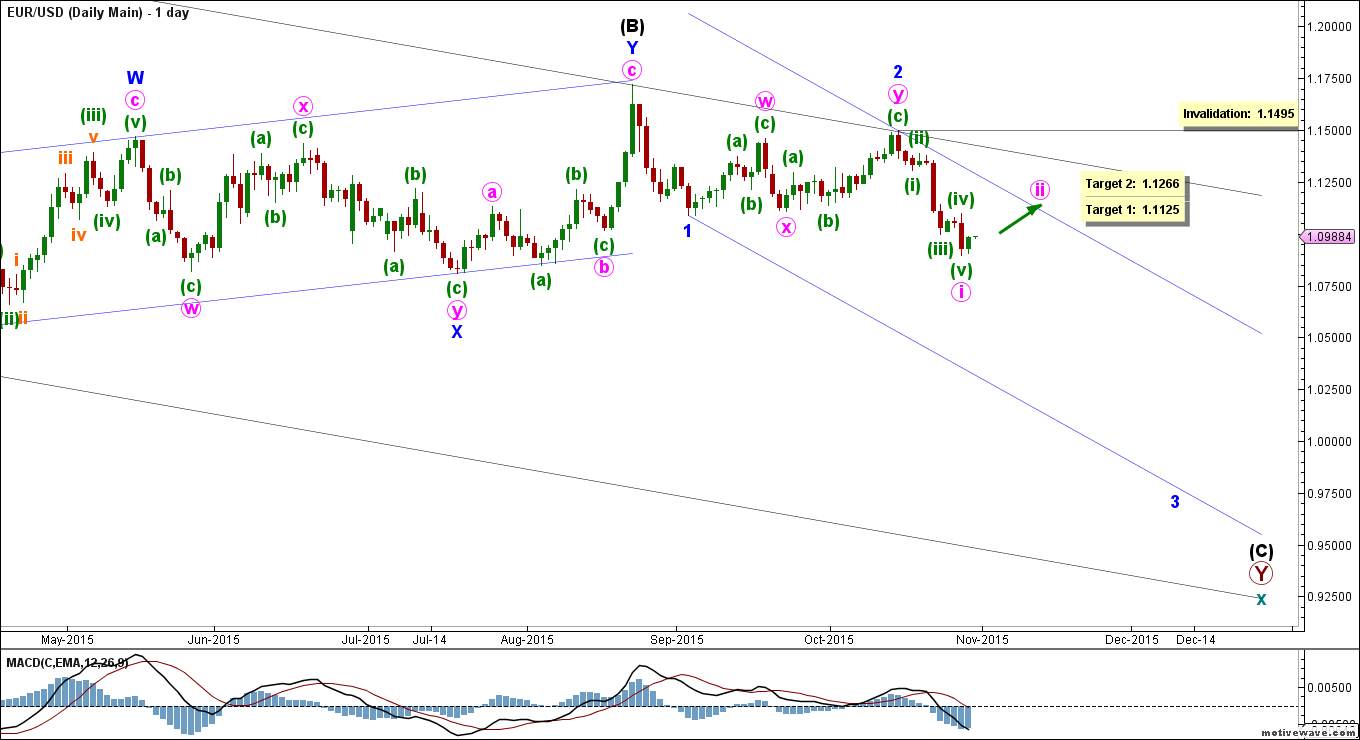

Last week we expected the euro to start falling again, which was exactly what happened. Price came crashing through our confirmation point, and then continued downwards to come 33 pips short of reaching our first target.

This price drop occurred in 5 waves, which strongly confirms our view that the downtrend is back in play. But as we know by now, every completed 5-wave sequence needs to be countered by a corrective move in the opposite direction, which is what we expect to see during this week.

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

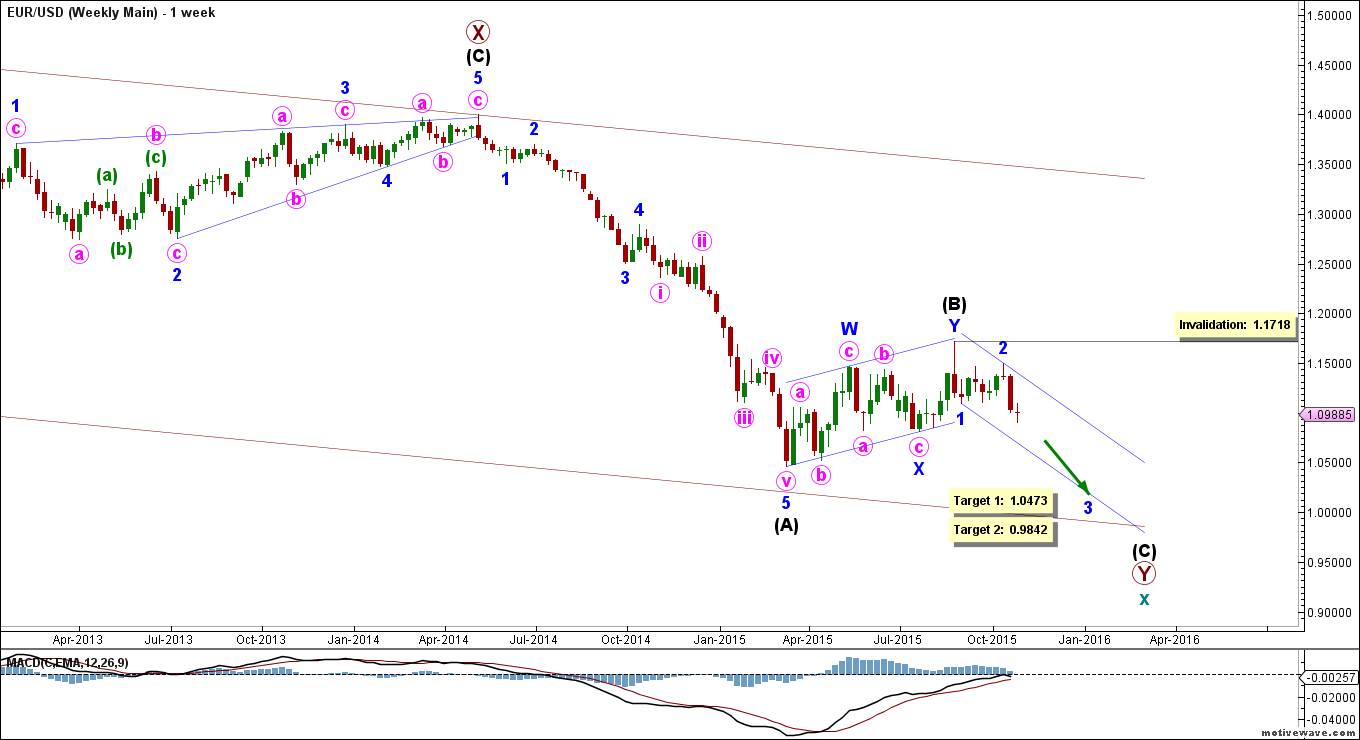

Weekly Main Count

– Invalidation Point: 1.1495

– Confirmation Point: 1.1096

– Upwards Target: 1.1125 – 1.1266

– Wave number: Minute ii

– Wave structure: Corrective

– Wave pattern: Zigzag, Flat, or Combination

Big Picture

The bigger picture sees that the euro is moving towards the downside in cycle wave x, which is forming a double zigzag labeled primary waves W, X and Y.

Primary wave Y is forming a zigzag labeled intermediate waves (A), (B) and (C).

Intermediate wave (A) formed an impulse labeled minor waves 1 through 5.

Within it, minor wave 3 reached 261.8% the length of minor wave 1.

Minor wave 5 extended as an impulse labeled minute waves i through v, reaching 161.8% the length of both minor waves 1 and 3.

Intermediate wave (B) formed a double zigzag labeled minor waves W, X and Y, retracing a little less than 38.2% of intermediate wave (A).

Intermediate wave (C) is most likely forming an impulse labeled minor waves 1 through 5.

Within it, minor wave 1 is complete.

Minor wave 2 retraced just over 61.8% of minor wave 1, and it’s most likely complete.

This count expects the euro to be moving towards the downside in minor waves 3. This will be confirmed by movement below 1.1087.

At 1.0473 minor wave 3 would reach 161.8% the length of minor wave 1, then at 0.9842 it would reach 261.8% of its length.

This wave count is invalidated by movement above 1.1718 as minor wave 2 may not move beyond the start of minor wave 1.

Main Weekly Wave Count

The main count sees that minor wave 2 formed a double combination labeled minute waves w, x and y, each forming a zigzag labeled minuette waves (a), (b) and (c).

Minor wave 3 is forming an impulse labeled minute waves i through v.

Within it, minute wave i formed an impulse labeled minuette waves (i) through (v), and it’s most likely complete.

This count expects the euro to start moving towards the upside in minute wave ii. This will be confirmed by movement above 1.1096.

At 1.1125 minute wave ii would retrace 38.2% of minute wave i, then at 1.1266 it would retrace 61.8% of its length.

This wave count is invalidated by movement above 1.1495 as minute wave ii may not move beyond the start of minute wave i.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.