USD/JPY dropped sharply in response to the BoJ’s policy inaction in April. The outcome eroded the market’s belief that the BoJ will be easing anytime soon, if at all, and may argue for further JPY appreciation.

We still think that policy divergence could remain a USD/JPY driver even if it has to rely on only one engine for now – the Fed tightening policy from here.

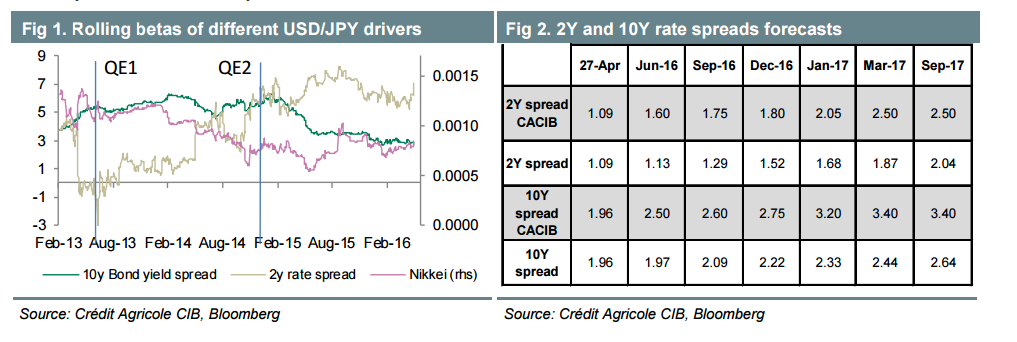

Below we assess the impact on USD/JPY of the persistent widening of the USD-JPY rate spreads expected by us and the (more dovish) market consensus. Our results point at sustained USD/JPY strength ranging from 3% to 6% by year-end 2016 and 10% to 12% by the end of 2017.

The results suggest that the policy divergence implied from our rates forecasts could push USD/JPY at 116 by end-2016 and 121 by end-2017. When using the consensus expectations, the result is a very gradual appreciation to 111 by end- 2016 and 119 by end-2017.

If we were to relax the above assumption and add some stock market outperformance, presumably on the back of more government stimulus and/or further BoJ easing, this changes the results to a degree. Assuming that Nikkei revisits its recent highs around 18000 – a fairly conservative assumption – it could lift our projections for USD/JPY to 118 by end- 2016 and 123 by end-2017. When using the consensus rates forecasts, we arrive at 113 by end-2016 and 121 by end-2017.

'This content has been provided under specific arrangement with eFXnews.'

Advertisement

Advertisement

For a live simulators for bank trade positions and forecasts, sign-up to eFXplus

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.