The following are the latest technical setups for EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD as provided by the technical strategy team at Barclays Capital

EUR/USD: We are bearish and would use upticks towards 1.0765 as an opportunity to sell at better levels. Our targets are near 1.0520 and then the 1.0460 year-to-date lows.

USD/JPY: Monday’s small topping candle signals a breather within the context of the overall rising trend. A move below 122.20 would risk a squeeze lower in range towards 120.80 before buyers resume. For now we would look to buy dips against 122.20 for a move higher through 123.75 towards our targets near the 125.30/125.85 highs.

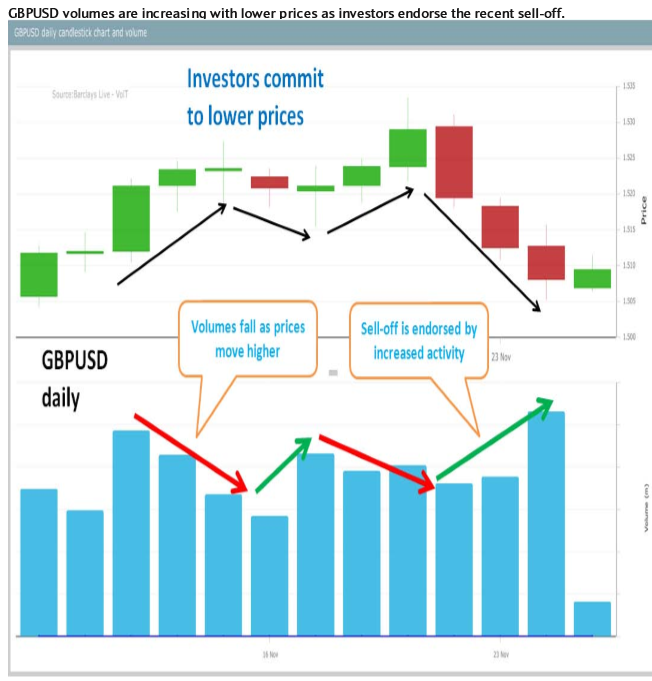

GBP/USD: A move below our initial targets are near the 1.5025 November lows would encourage our bearish view. Our next targets are towards the 1.4860 area.

AUD/USD: Yesterday’s strong close negates Monday’s topping candle and signals a squeeze higher towards 0.7310 before sellers can emerge ahead of the 0.7385 range highs. We are overall bearish against the 0.7440 lower high and look for a move back below 0.7070 towards targets near 0.7015 and then the 0.6935/0.6895 lows.

NZD/USD: Tuesday’s inside day signals a breather. Overall, we are bearish and would look to sell upticks towards 0.6610 for a move lower through 0.6430. Our targets are near 0.6375 and then the 0.6235 year-to-date lows.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.