The following are the intraday outlooks for EUR/USD, USD/JPY, EUR/GBP, and Brent Crude as provided by the technical strategy team at SEB Group.

EUR/USD: Still in range and still a bearish bias: Nothing really new. The pair remains inside a 1.1155/1.1245 range with a negative bias - which rhymes with backdrop downtrend. Below 1.1155 there is nothing (but the current stretch at 1.1125) really standing between the market and the yearly low of the 1.1098.

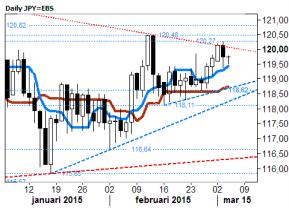

USD/JPY: Only a modestly bearish candle added. The intraday drop below 119.50 was partially mended so the daily candle became only modestly bearish, showing respect to the rising 8day high/low average aka 'Tenkan-Sen'. The print would be further undermined by a rise through 119.92 again. Stronger resistance however prevails at 120.27/48 (for now blocking the path towards prior 120.82 & 121.86 peaks) Support thickens down at 118.62/11. Current intraday stretches are located at 119.10 & 120.30.

EUR/GBP: Look for another step higher. The bullish engulfing candle printed Monday still argues that at least this down sequence has been completed and that an upside reaction is lurking around the corner. The short term pattern suggests buying at the current level (with a stop below 0.7260) targeting 0.7326 or even 0.7367).

Brent Crude: Between a rock and a hard place. Yesterday revealed little or nothing to help answering the question whether we have put a double top in place or not. The price is currently trapped between the target range and the 55d ma band and either must be broken in order to get new directional information.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.