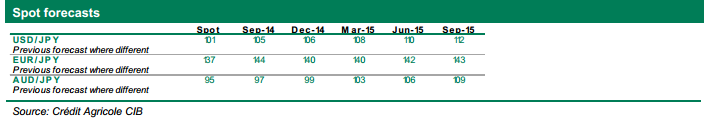

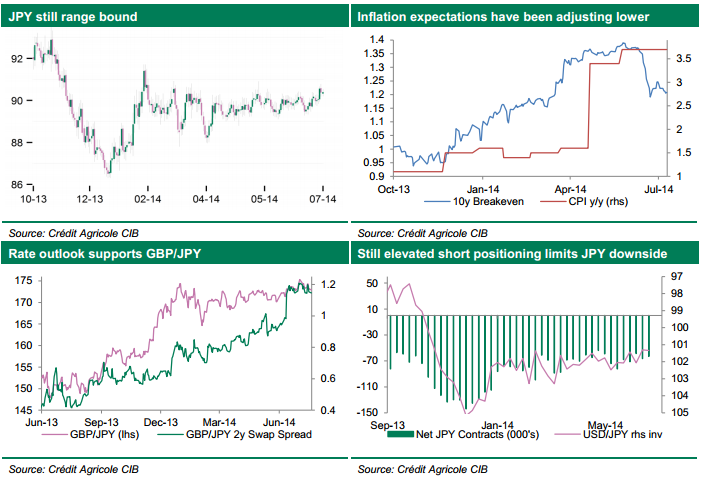

The JPY has been trading within the past few months’ trading range. There is limited room for the BoJ to easing monetary policy further, with still elevated speculative short-positioning that has been keeping currency downside limited during the past few weeks. As the Fed is unlikely to turn more hawkish in the short-term, we do not expect majors such as the USD/JPY to enter a new uptrend anytime soon. However, risk sensitive crosses such as NZD/JPY should remain a buy on dips.

Steadily improving growth and price prospects have been supporting expectations of the BoJ remaining on track to reach its 2% inflation target in time. Accordingly, most central bank members have been suggesting that the current monetary policy stance is appropriate. Indeed, central bank Governor Kuroda just recently reiterated that the BoJ is on its way to meeting its inflation target and that the JPY is no longer excessively strong.

However, irrespective of improving growth and price conditions, inflation expectations as measured by breakeven rates failed to mirror stabilising price developments. This in turn may suggest that uncertainty regarding the central bank’s ability to sustainably deliver price stability remains intact. From that angle it appears unlikely that BoJ easing expectations will normalise further from the current levels.

As a result to the above outlined conditions, the JPY is likely to remain range-bound for longer. However, against currencies such as the NZD or GBP, we expect JPY rallies to remain a sell. Those pairs may benefit from both further diverging monetary policy expectations and improving risk sentiment over the coming few weeks. However, it must still be noted that elevated speculative JPY short positioning is likely to keep carry pairs subject to correction risk.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.