Acquisitions of public debt as part of the QE programme will come to almost 0.8 trillion euros; in other words, almost 14% of all sovereign bonds with maturities between 2 and 30 years. At first sight, this ratio does not seem to suggest the supply of bonds will be an obstacle to implementing QE. On the one hand, it is lower than the ratio observed in other countries with similar programmes (purchases in the US accounted for 17% of all eligible bonds) while it is also sufficiently far from the purchase limits set by the ECB. Specifically, debt acquisitions cannot exceed 25% of the issuance of a specific bond or 33% of all assets with maturities between 2 and 30 years from the same issuer.

This margin provided by the large stock of European public debt counters some doubts expressed regarding QE's ability to meet its purchase targets. One of these is the relative small net issuance of public debt planned in the euro area for 2015. Specifically, the nominal value of new bonds issued by euro area Treasuries this year (discounting maturing debt) represents 33% of the total purchases planned by the QE, a smaller percentage than that in the US or in the UK during their respective programmes. Similarly, the possible reticence of some holders of public debt (such as banks or pension funds) to reduce their investments in public debt, although they may be important in determining the trend in bond yields, is not expected to be critical either.

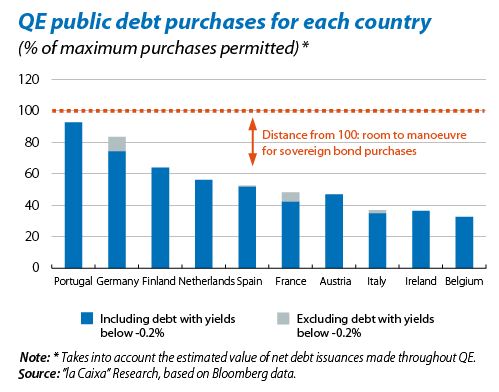

Another restriction that could limit the supply of sovereign bonds is the exclusion from eligible bonds of those whose yield is below that of the ECB's deposit facility (currently –0.2%). Taking data from mid-March as our reference, around 10% of the euro area's public debt with maturities between 2 and 30 years falls below this threshold.

The graph highlights the scope of this new restriction. The countries most affected are France and Germany where, in mid-March, 14% of the government bonds issued with maturities between 2 and 30 years had yields below –0.2%. As can be observed, excluding these bonds from the range of eligible assets, purchases of German bonds (established by the QE according to the capital provided by each country to the ECB's balance sheet) would go from 74% to 83% of the purchase limit (from 43% to 48% in the case of France). Although further falls in sovereign yields would amplify this impact, the large stock of eligible debt observed in most countries provides enough room to manoeuvre. In fact, only in Portugal are bond purchases close to their corresponding limit.

In short, the euro area's government bond market is broad enough to meet the target of QE purchases. However, the need to extend this programme beyond September 2016 or even the use of other public debt purchase programmes by the ECB such as OMTs (outright monetary transactions), designed to reduce excessive pressure on debt markets, could call this statement into question. That is why the best way to dispel doubts regarding QE is to ensure that its monetary stimulus is effectively passed on to the real economy.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.