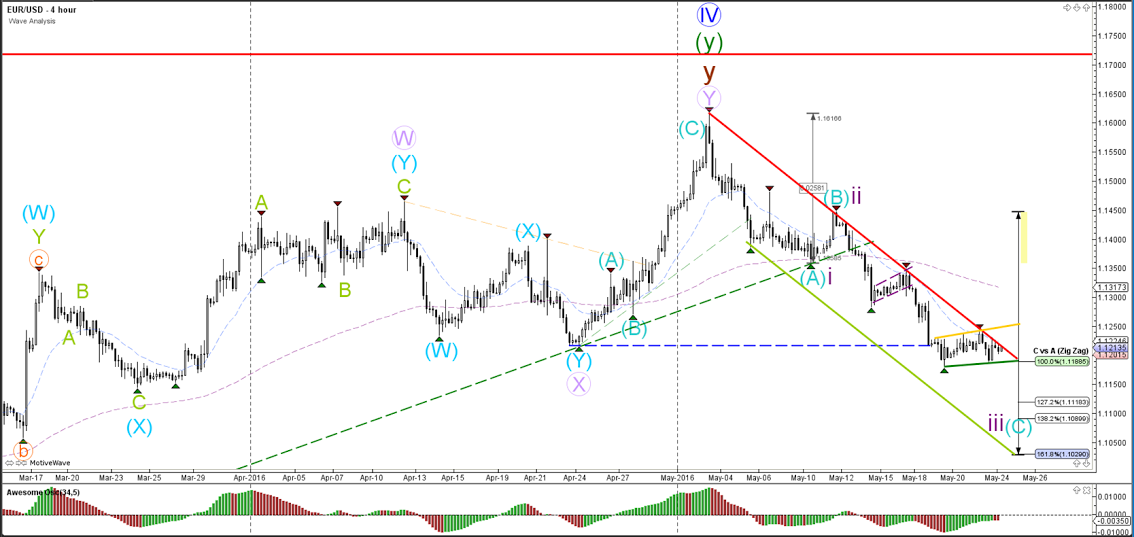

EUR/USD

4 hour

The EUR/USD is pausing at the 100% Fibonacci level of wave C versus wave A. Wave C (blue) corrections are typically equal to the length of wave A so a break below the 100% Fib target increases the likelihood of a potential wave 3 (purple). A break above the channel does not necessarily mean the end of the downtrend channel as price could expand the sideways corrective (see 1 hour chart).

1 hour

The EUR/USD could be expanding the wave 4 (grey) or wave 4 (green). For the moment the wave 5 (grey) has been marked completed at the double bottom. A break below the support trend line (solid green) could spark the bearish breakout for wave 5 (orange or green). The Fibonacci levels of wave 4 (green) could act as resistance.

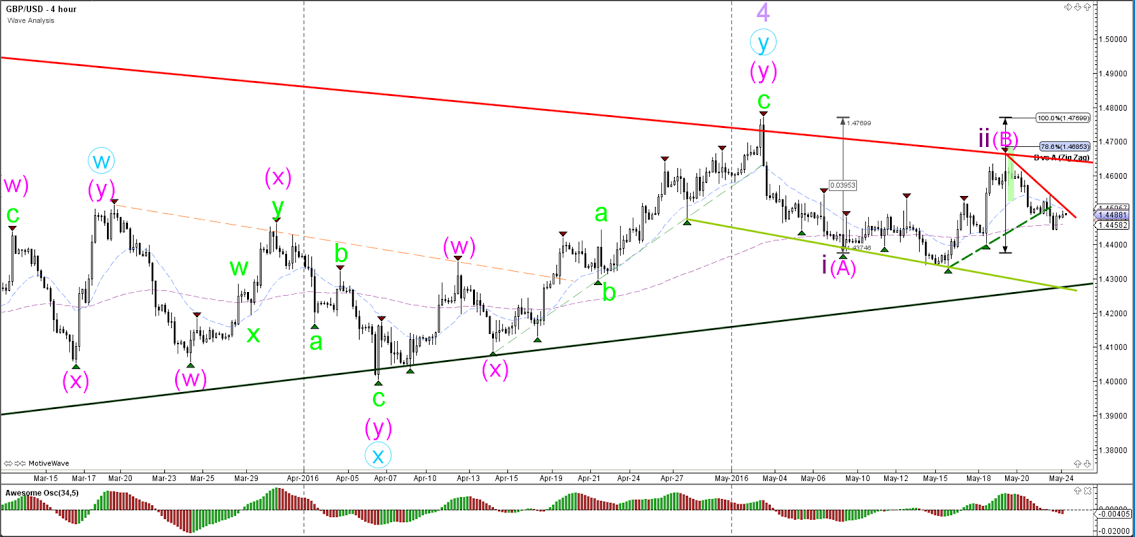

GBP/USD

4 hour

The GBP/USD is building a contracting triangle between support (green) and resistance (red). A break above the long-term resistance trend line (red) and the 100% Fibonacci level invalidates the current wave count where a bigger bearish ABC (pink) or 123 (purple) is expected.

1 hour

The GBP/USD broke a support trend line yesterday (dotted green) to complete a potential wave 5 (blue), which could complete a wave A or wave 1 (green). A break above the inner resistance (red) increases the chance of a retracement within wave 2 (green). A break below the support trend line (olive green) could expand the bearish wave 1 (green).

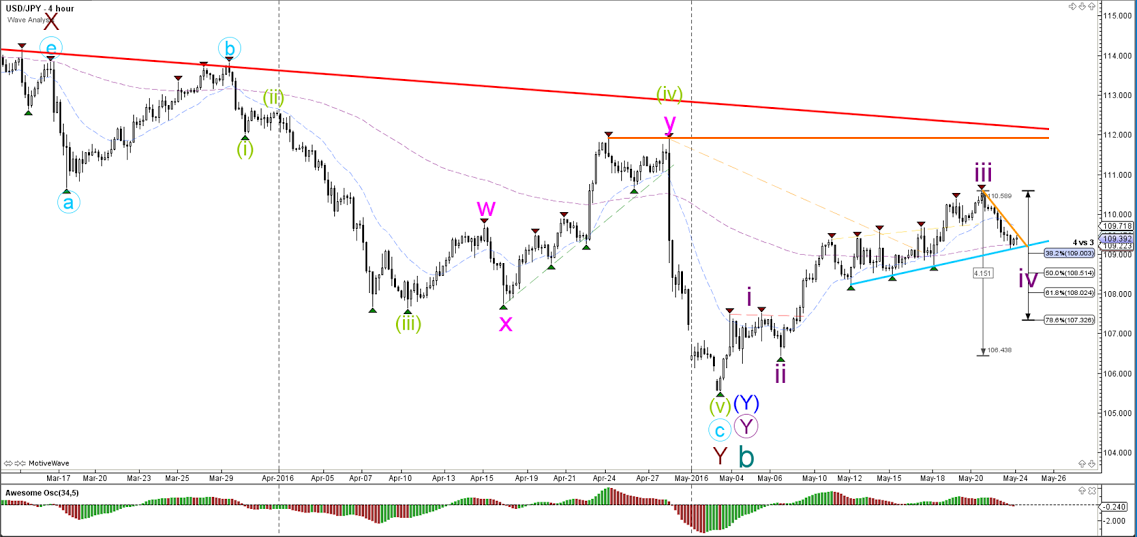

USD/JPY

4 hour

The USD/JPY seems to have completed a wave 3 (purple) and is now retracing back as part of a wave 4 (purple). Typical wave 4 retracements are the 23.6% and 38.2% Fibonacci levels. A break below the 50% Fib level makes a wave 4 (purple) less likely.

1 hour

The USD/JPY is in a bearish zigzag (orange) which has taken price down to the trend line and 38.2% Fibonacci level.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.