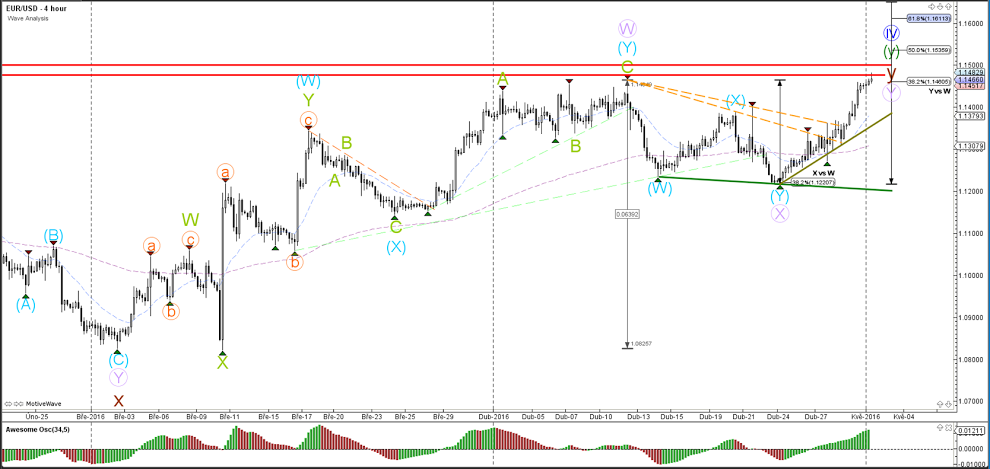

EUR/USD

4 hour

The EUR/USD has indeed showed a continuation of the uptrend within the waves Y as indicated last week. Price is now reached a heavy resistance zone (red). A break above it could see price continue towards the Fibonacci targets.

1 hour

The EUR/USD broke above the resistance trend line (dotted orange) and made a strong bullish impulse which seems best explained by a wave 3 (grey). Price could retrace for a wave 4 (grey) but must not retrace deeper than the 61.8% Fibonacci level otherwise the wave count is invalidated.

GBP/USD

4 hour

The GBP/USD remains in an uptrend as long as price stays above the support trend line (green). Price is showing signs of struggle now at the horizontal resistance (red).

1 hour

The GBP/USD is showing choppy price action since the break of the inner resistance line (dotted orange), which can be explained by an ending diagonal (purple 5 wave). Whether wave 5 has been completed remains to be seen and price could push higher if it stays above the support trend line (green). A bearish break could lead to a bearish ABC (orange) or 123.

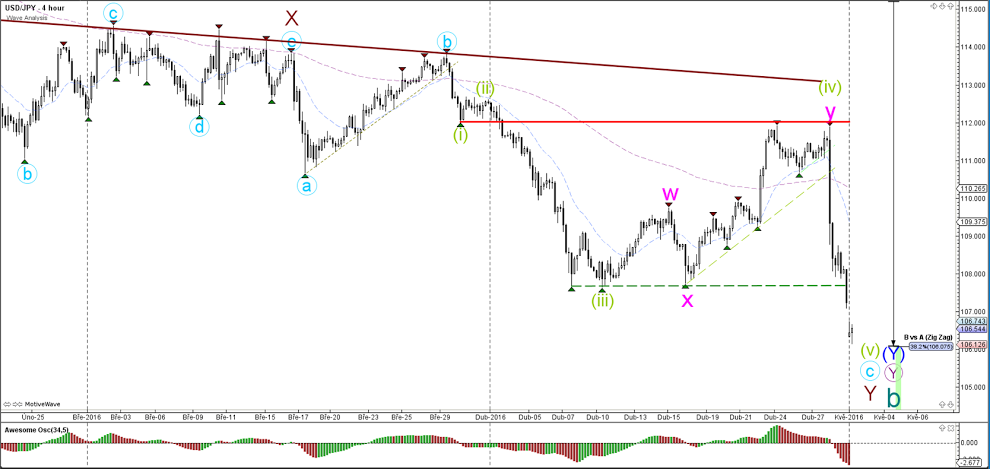

USD/JPY

4 hour

The USD/JPY has reached a large 38.2% Fibonacci retracement level of wave B (sea green), which could initiate a bullish rally or a correction.

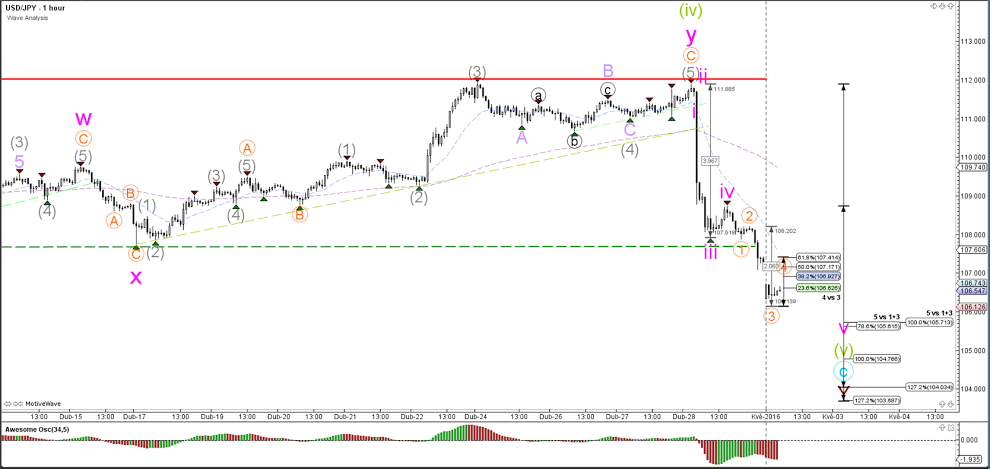

1 hour

The USD/JPY could extend the 5th wave with an extension due to strong bearish momentum and lack of divergence via a wave 4 and 5 (orange). A break above the 61.8% of wave 4 makes the current wave count unlikely.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.