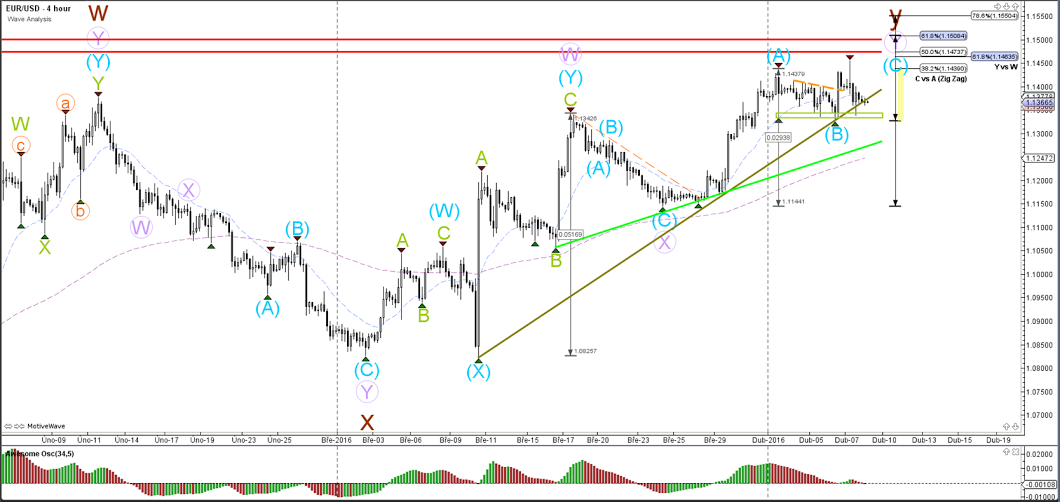

EUR/USD

4 hour

The EUR/USD bullish price action could not break the strong daily resistance zone (red levels) and the psychological round level of 1.15. Price has now moved back to support levels (green), which is a bullish bounce or bearish break spot.

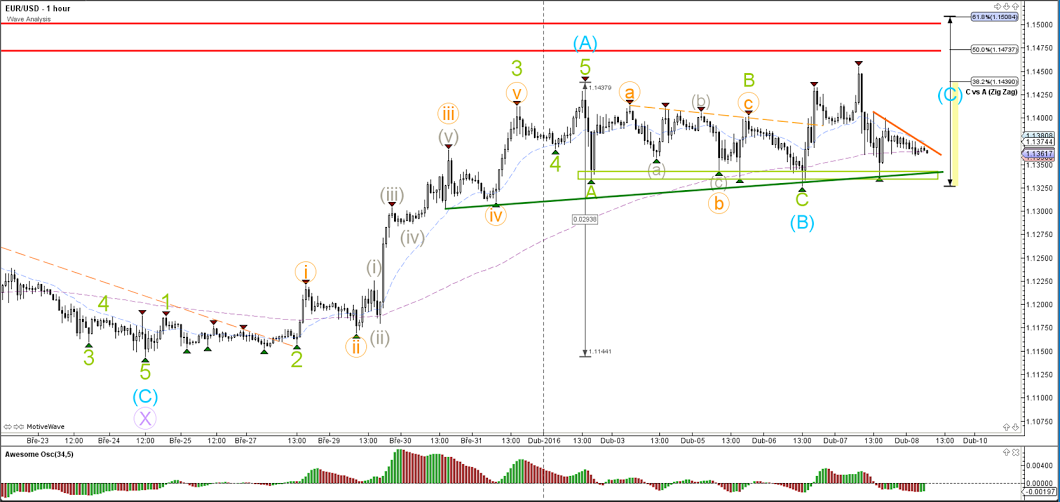

1 hour

The EUR/USD is now caught in between various support and resistance levels. A bearish break could indicate that wave C (blue) is completed and a bullish break could indicate that wave C (blue) is still developing.

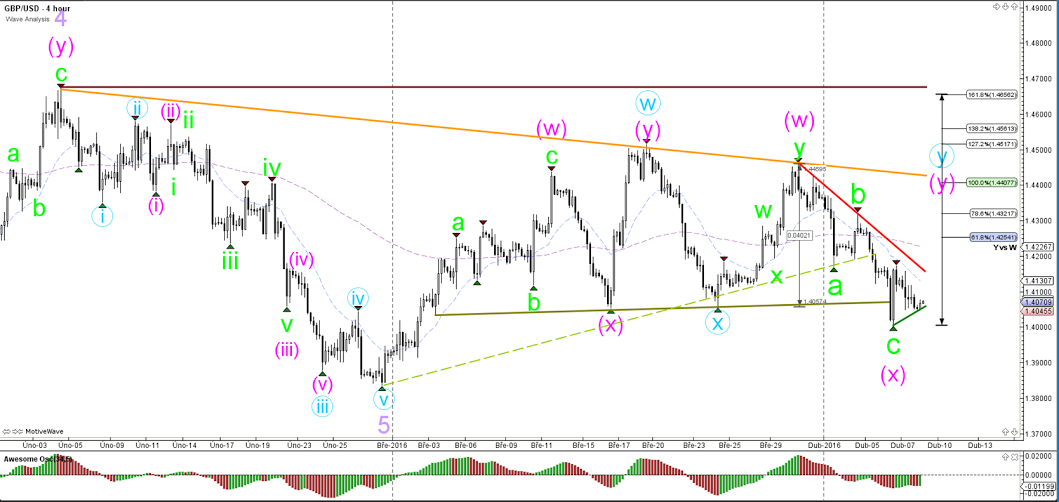

GBP/USD

4 hour

The GBP/USD has support (green) and resistance (red) levels that mark clear boundaries. A break of the resistance could see the continuation of waves Y (pink, blue). A break below support could indicate the continuation of the downtrend which would invalidate wave X (pink).

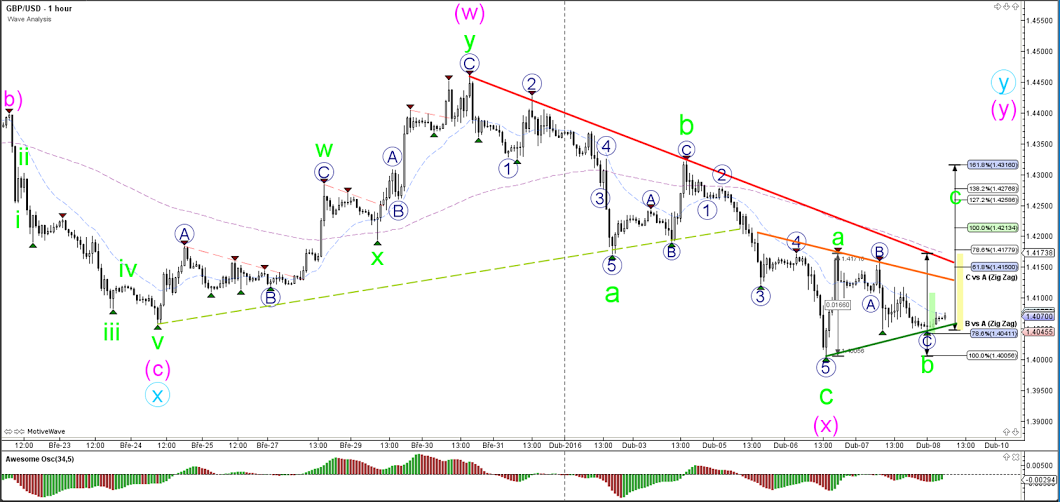

1 hour

The GBP/USD is building a small triangle (green/orange). and made one more bearish fall. If the bullish zigzag takes place then the Fibonacci levels of wave B and C (green) could turn out to be key levels.

USD/JPY

4 hour

The USD/JPY continued with its strong bearish momentum yesterday. Price could continue to lower Fibonacci targets if price stays below the resistance trend line (red).

1 hour

The USD/JPY completed a wave 3 (orange) and could now be building a wave 4 (orange) correction. The Fibonacci retracement levels could be turning spots for such a potential wave 4.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.