EUR/USD

4 hour

The EUR/USD broke the support trend line (dotted green) and the wave count now shows the ABC (orange) completing the wave Y (green). Whether the bearish break is a reversal for more downside or a retracement for more upside remains to be seen. The purple trend lines could provide an indication of which direction might become more likely.

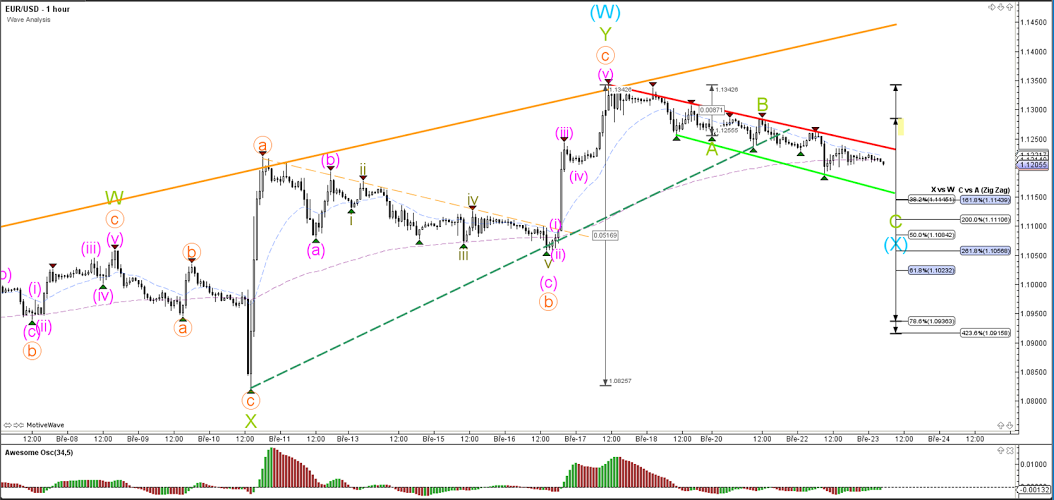

1 hour

The EUR/USD seems to be in a correction. A break below the 50%/61.8% Fibonacci increases the likelihood that price is not retracing but reversing. A break above resistance (red) increases the chance that the bearish price action is a retracement.

GBP/USD

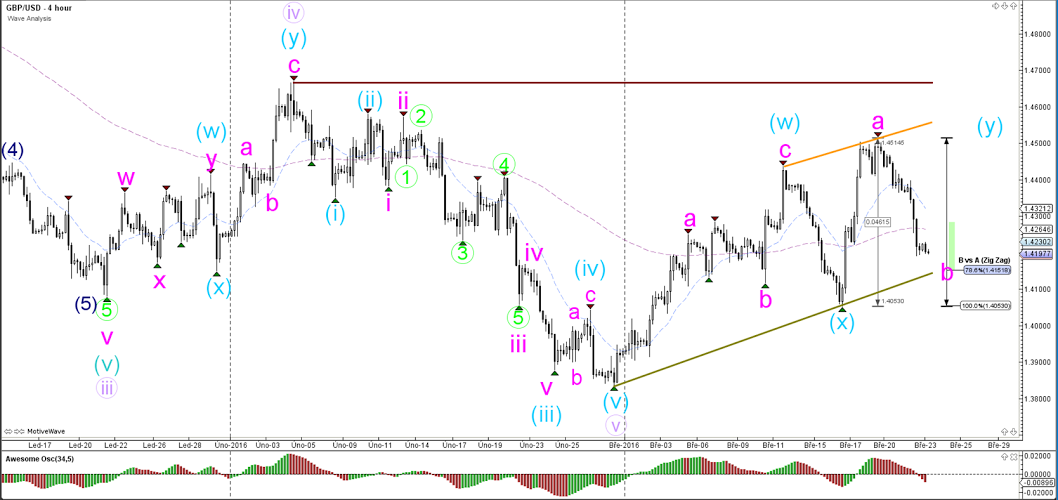

4 hour

The GBP/USD bearish momentum could be an indication of a reversal. A break below the support (green) and 100% Fibonacci level would indicate that the uptrend channel is finished and the wave Y (blue) would move to the recent high. A bullish bounce at support could indicate that the ABC (pink) might indeed take place.

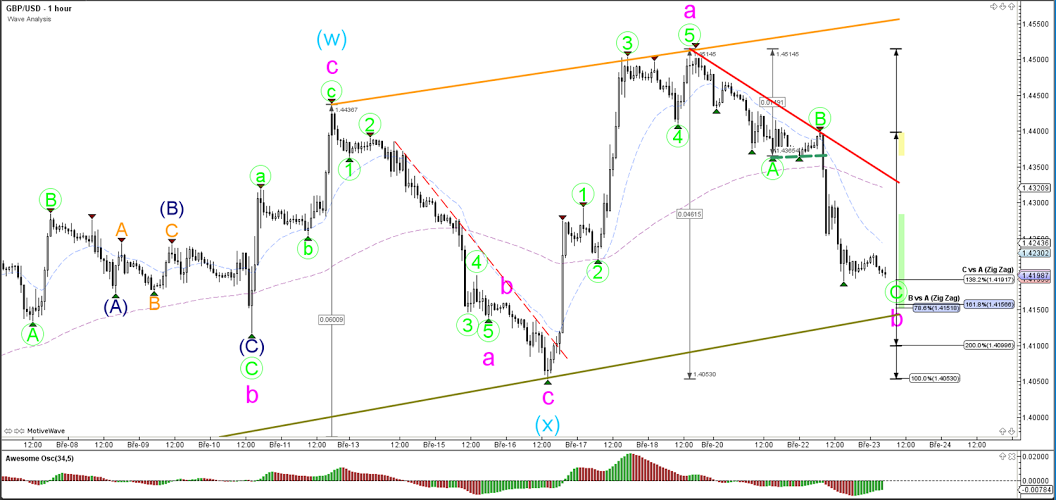

1 hour

The GBP/USD is approaching a decision spot where price will either display a bullish bounce or a bearish break.

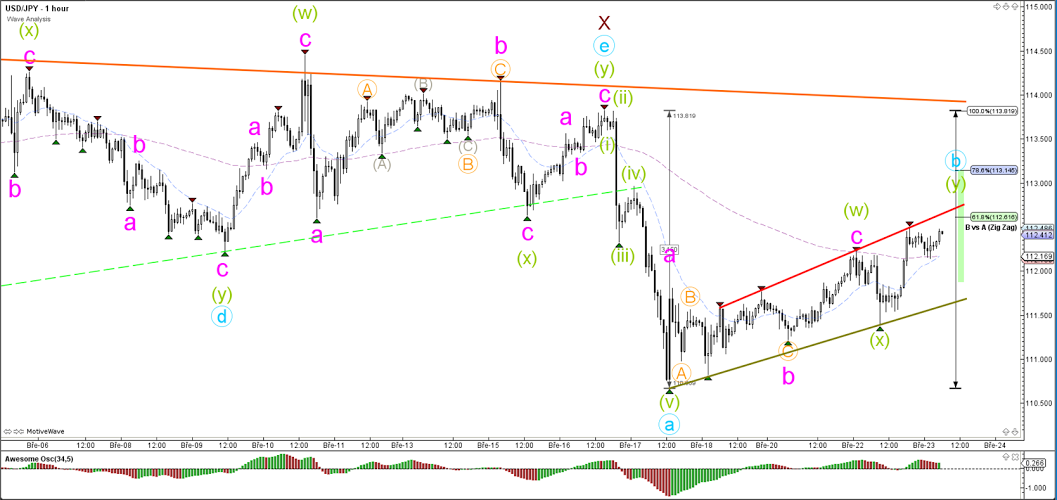

USD/JPY

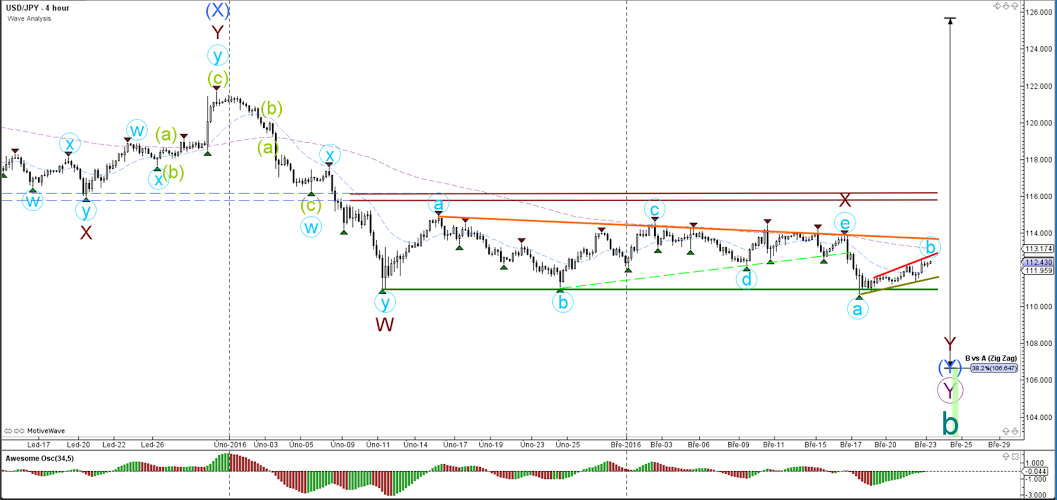

4 hour

The USD/JPY remains in a sideways consolidation zone (orange/green). A break below the support trend line (green) could indicate a continuation of the ABC (blue) towards the 38.2% Fibonacci level of the bigger wave B (green).

1 hour

The USD/JPY used the support trend line (green) for a bullish bounce. Price is now approaching a new resistance zone which consists of the Fibonacci retracement levels and the trend line (red). A bearish turn could indicate that wave B (blue) is completed. A break above the 100% level indicates the invalidation of the potential ABC.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.