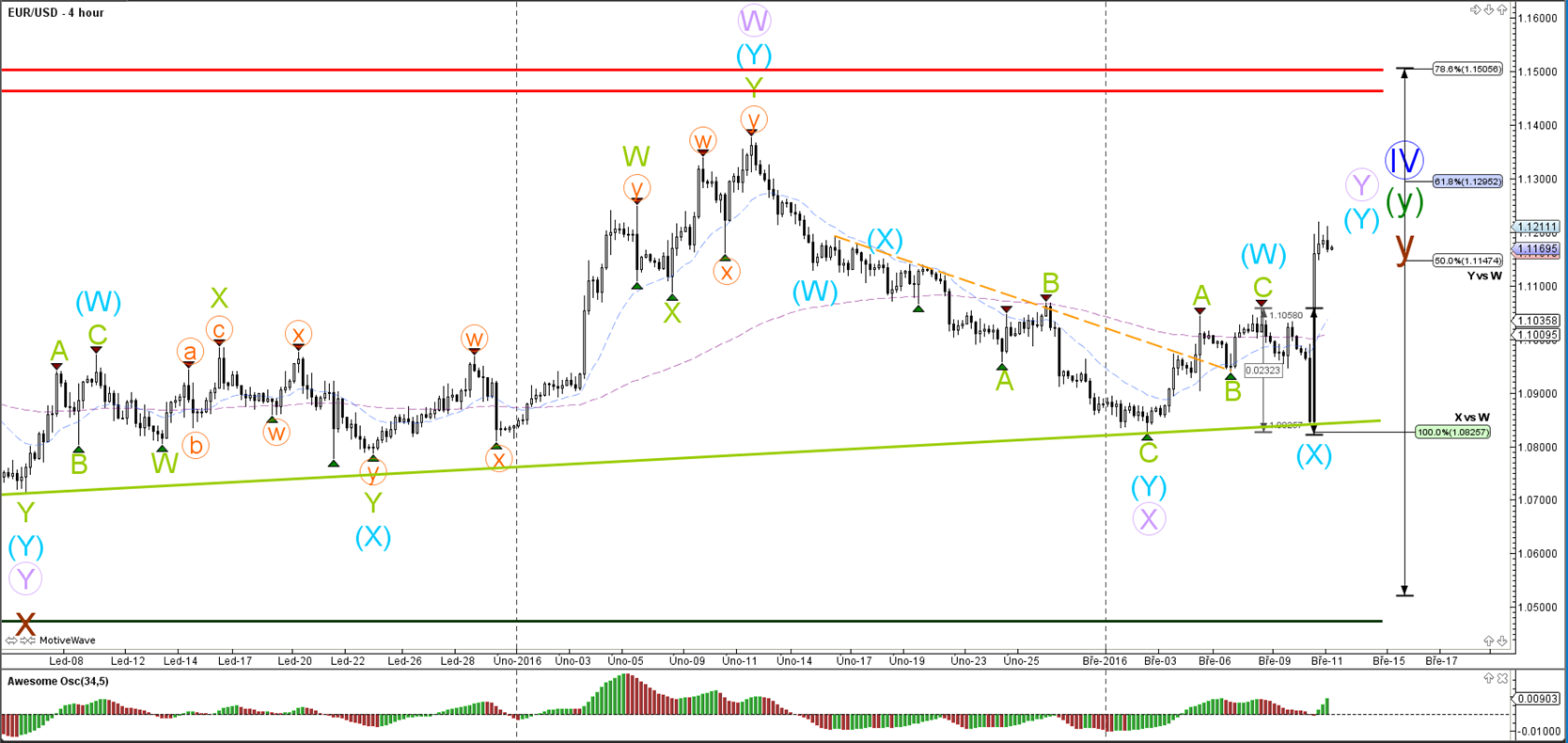

EUR/USD

4 hour

The EUR/USD made a deep bearish retracement but eventually price did show a large 400 pip bullish bounce at the 100% Fibonacci level taking price from 1.0825 to 1.1225. A bullish continuation could see price expand towards the waves Y.

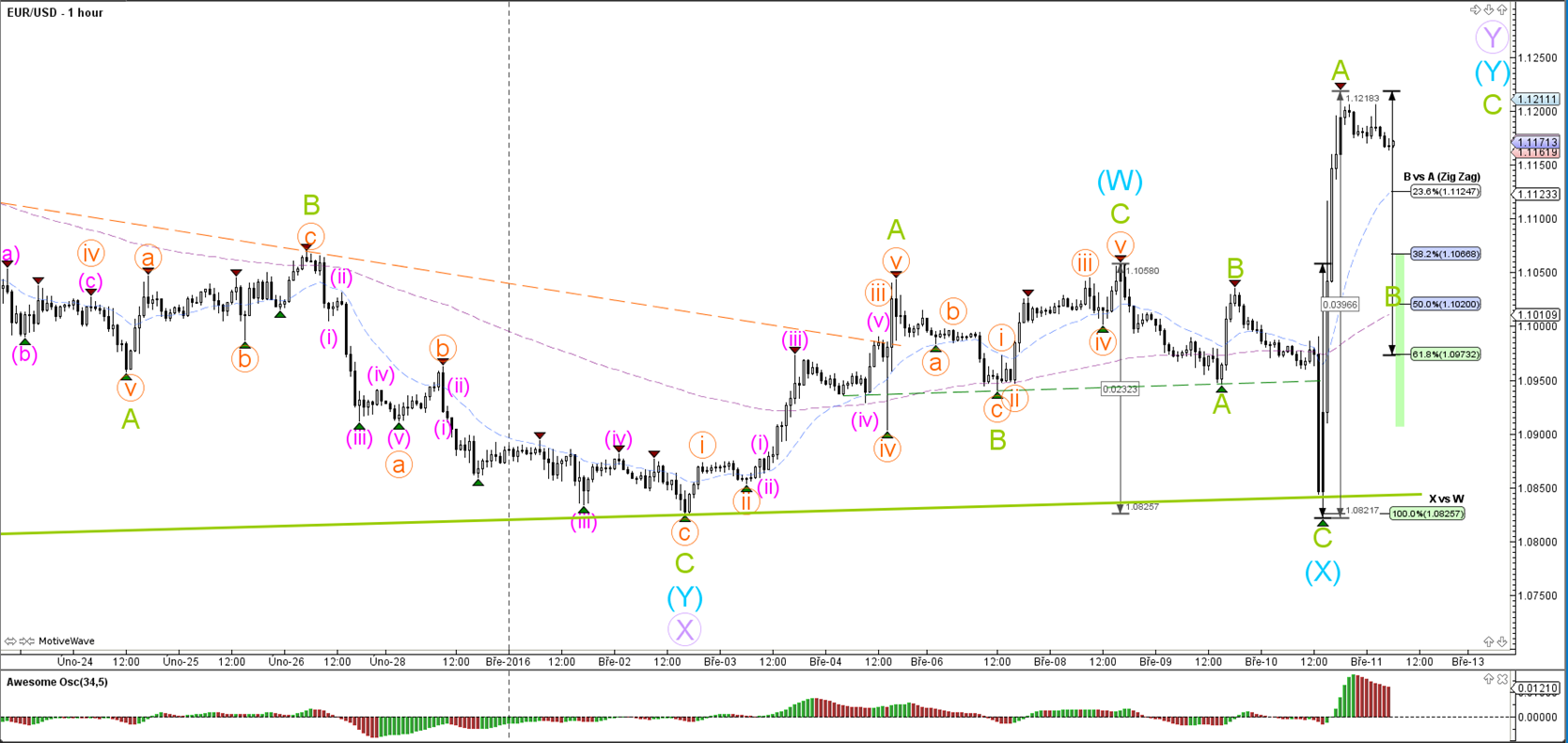

1 hour

The bullish bounce at the 100% Fibonacci level was very impulsive. It seems most likely that price will build an ABC bullish zigzag (green).

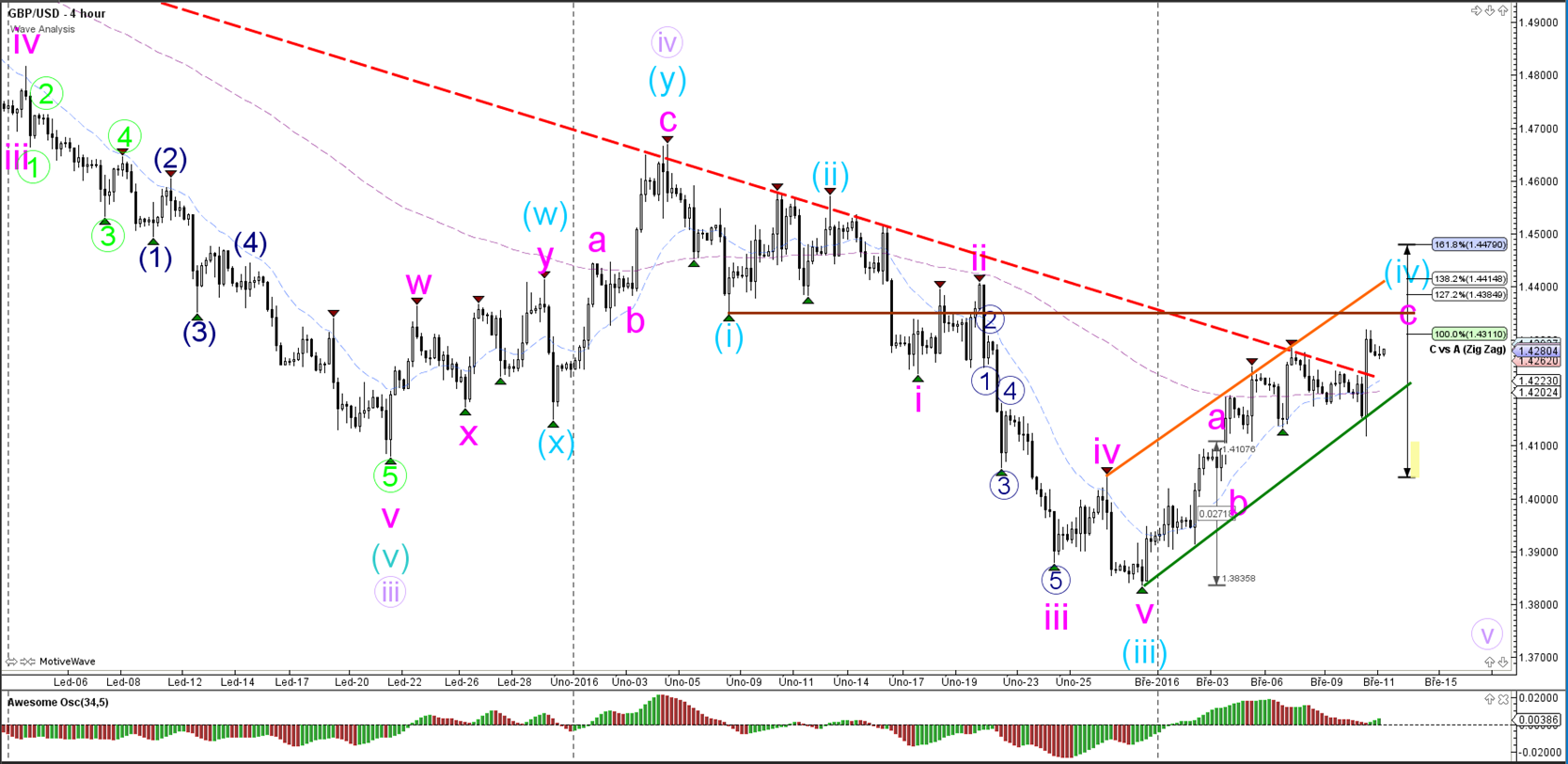

GBP/USD

4 hour

The GBP/USD broke above the resistance trend line (dotted red) for an extended bullish run. A push above the resistance (brown) trend line invalidates wave 4 (blue). In such a case, the alternative wave count could have wave 5 (blue) end at the current spot of wave 3.

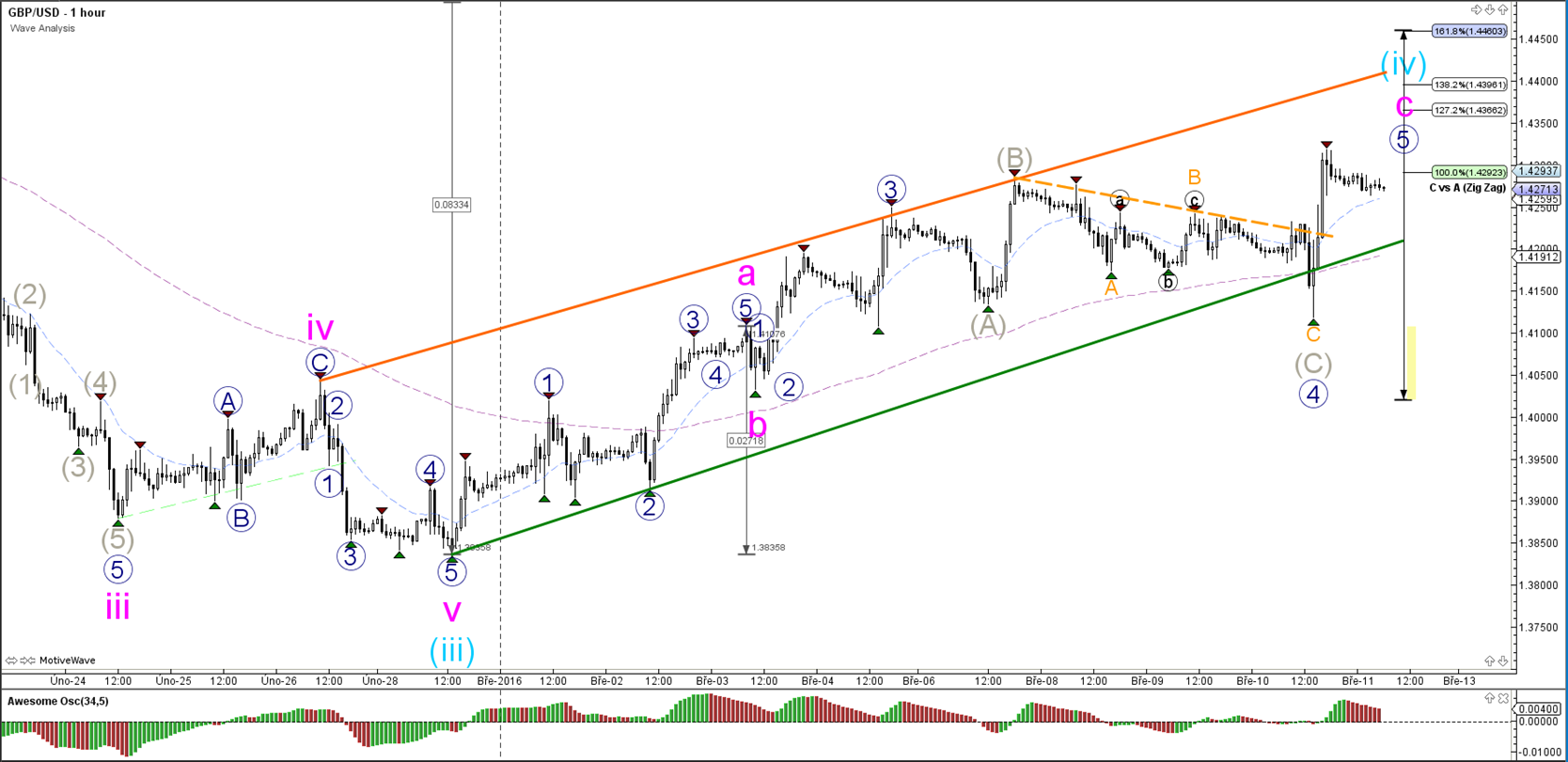

1 hour

The GBP/USD could be in a wave 5 (blue) of wave C (pink).

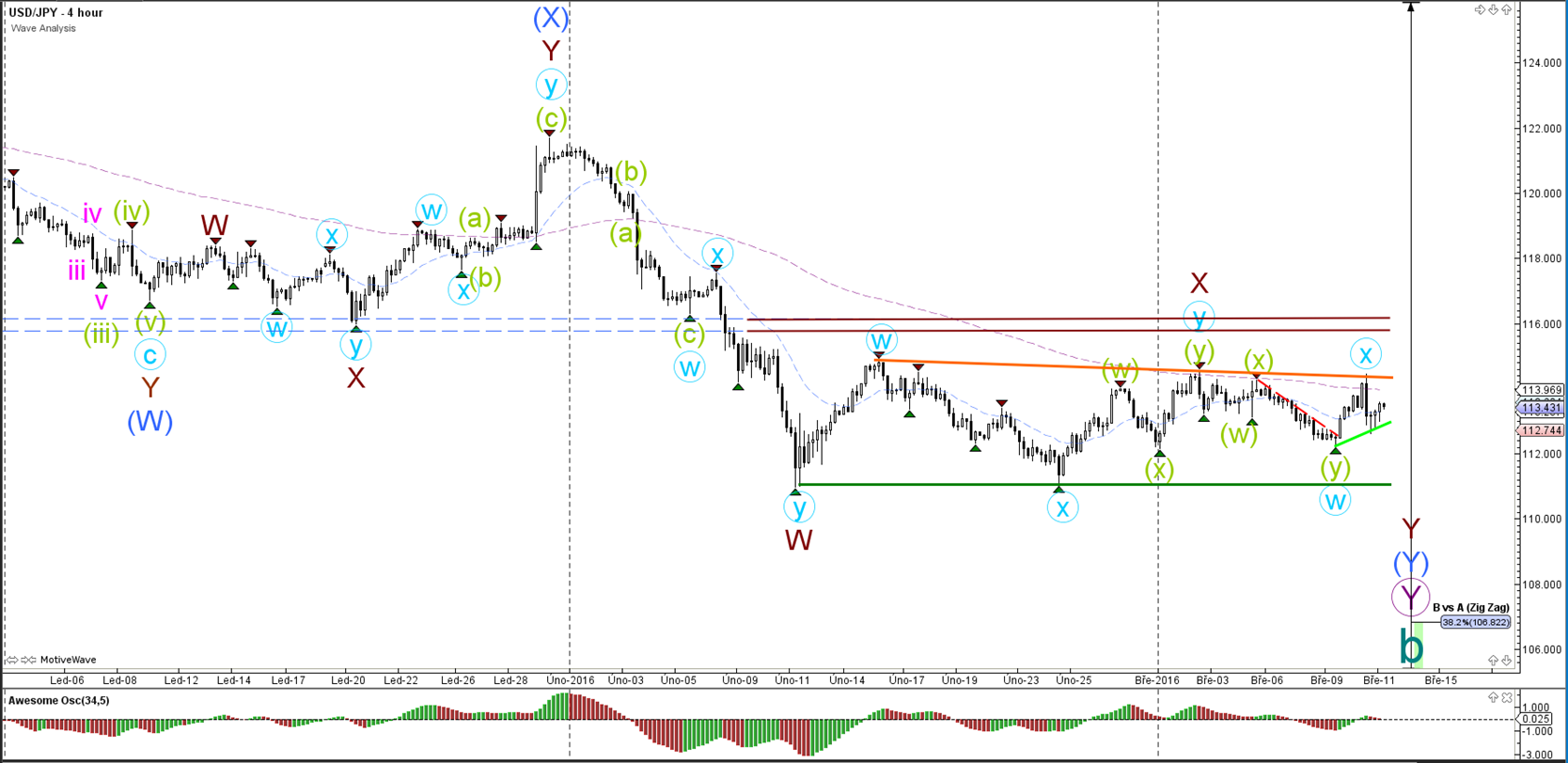

USD/JPY

4 hour

The USD/JPY made a bearish bounce at the resistance trend line (orange) and price remains in a larger sideways correction (orange/green).

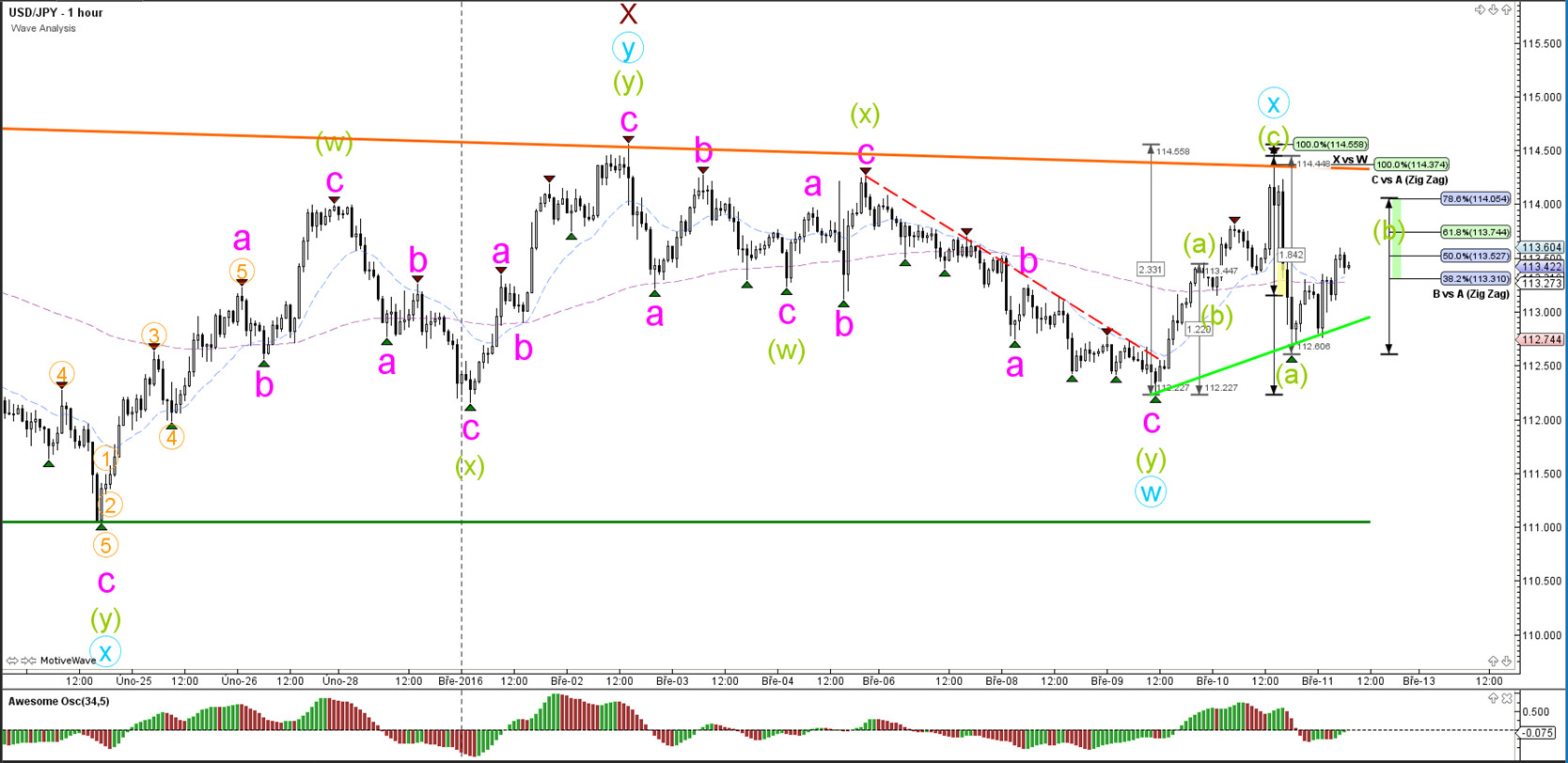

1 hour

The USD/JPY turned at the 100% Fibonacci targets and dropped substantially after the bearish bounce. The momentum could indicate a bearish wave A (green), which is followed by an entire bearish ABC zigzag.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.