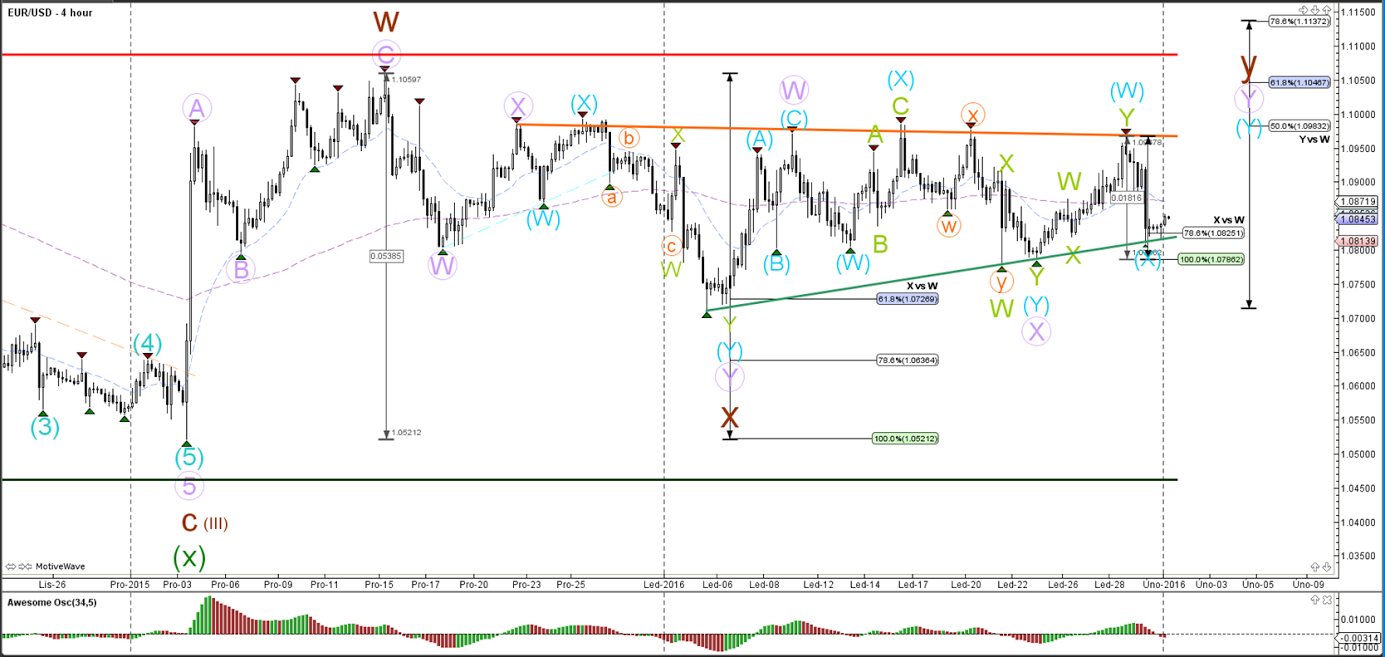

EUR/USD

4 hour

The EUR/USD stayed again with the range of the narrow triangle formation by respecting the resistance trend line (orange) and falling back towards support (green). A break of support could see price fall back towards the Fibonacci levels of wave X (brown). A bounce at support could see price go back towards resistance.

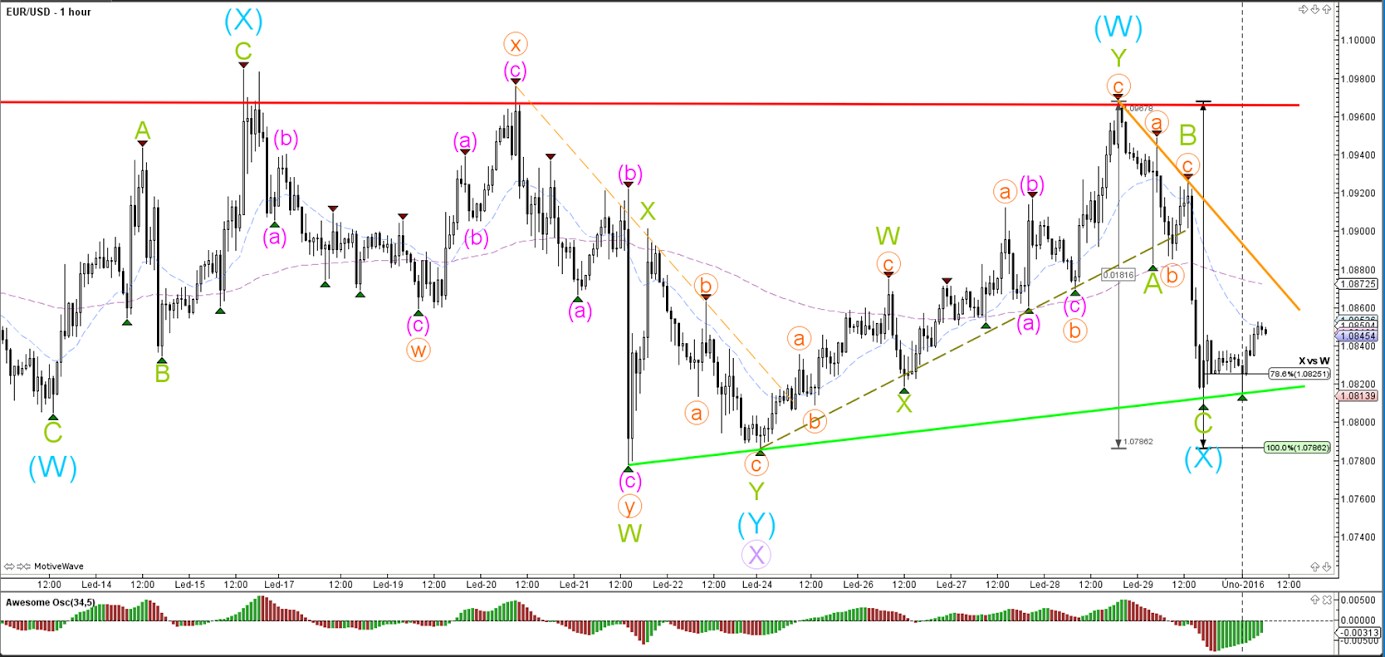

1 hour

The EUR/USD could have completed a bearish ABC zigzag if price manages to break the inner resistance trend line (orange).

GBP/USD

4 hour

The GBP/USD has hit the 23.6% Fibonacci level of wave 4 (purple) and has shown a strong bearish turn at the resistance after which price managed to break support (dotted green).

1 hour

The GBP/USD bearish action could either be part of an ABC correction (blue) which expands wave 4 (purple) or a new 1-2 bearish impulse which restarts the downtrend. For the moment an ABC has been placed on the chart.

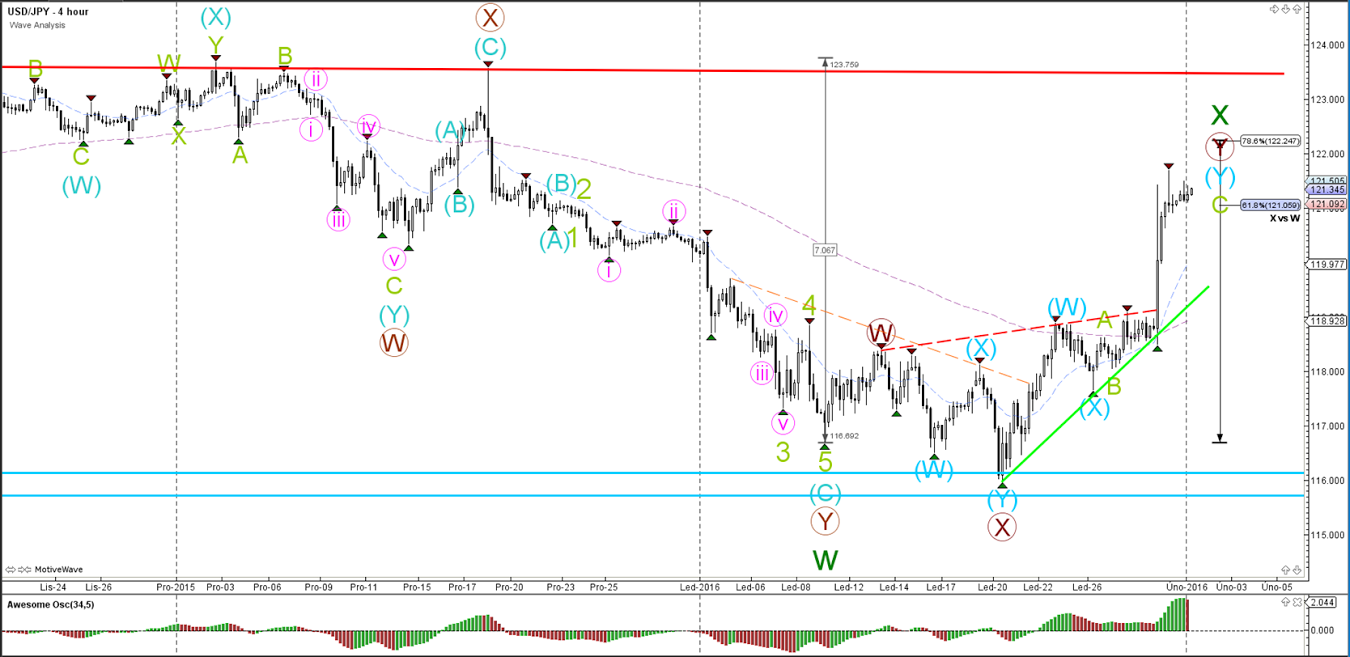

USD/JPY

4 hour

The USD/JPY broke the resistance trend line (dotted red) and showed a large bullish momentum to the resistance Fibonacci levels. The wave count is vulnerable to change if price breaks above resistance (red) or if it shows a bullish correction pattern in the near future.

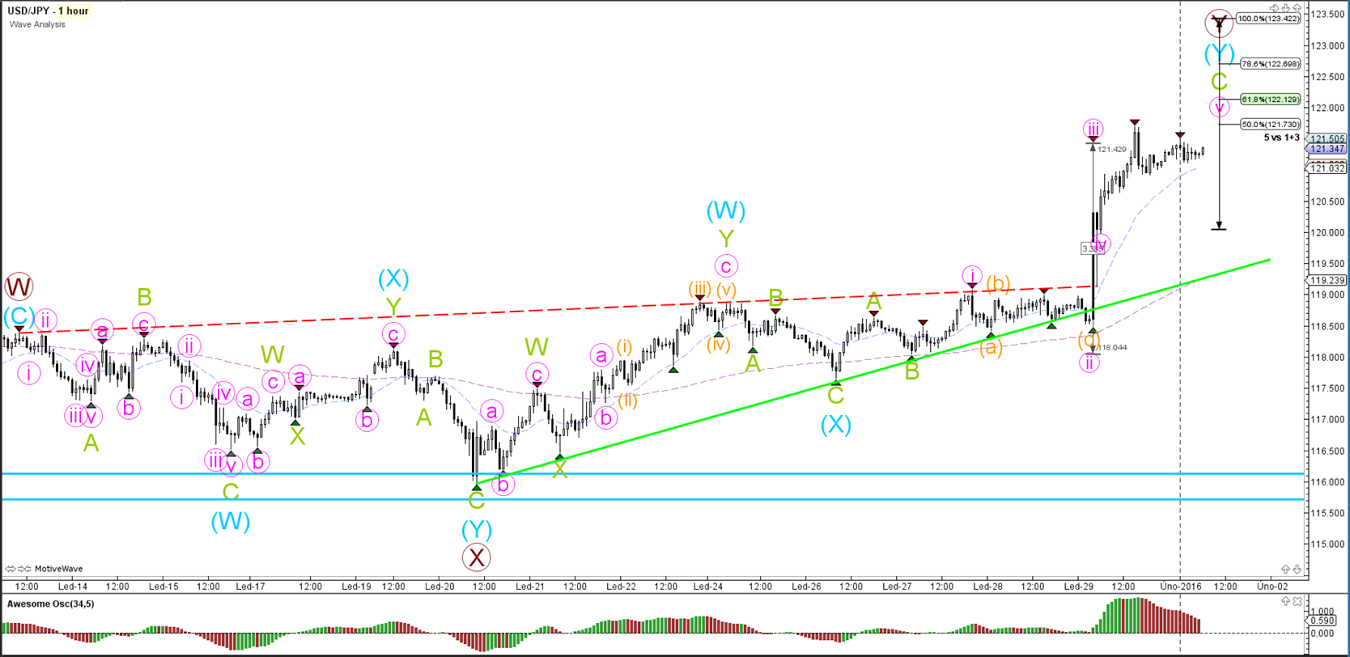

1 hour

The USD/JPY has completed a wave 4 (pink) within the wave C (green) and could now be headed towards the Fibonacci targets of wave 5.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.