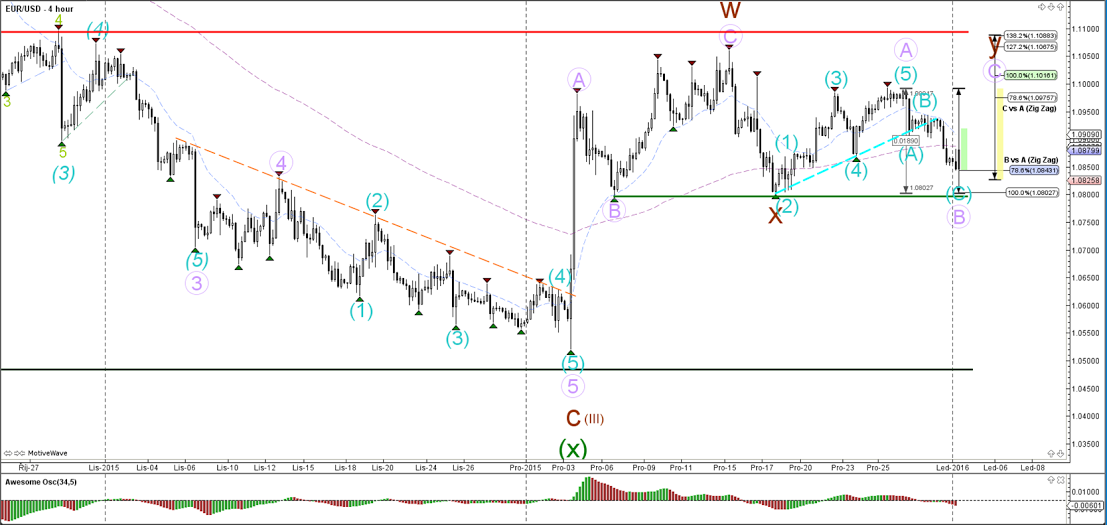

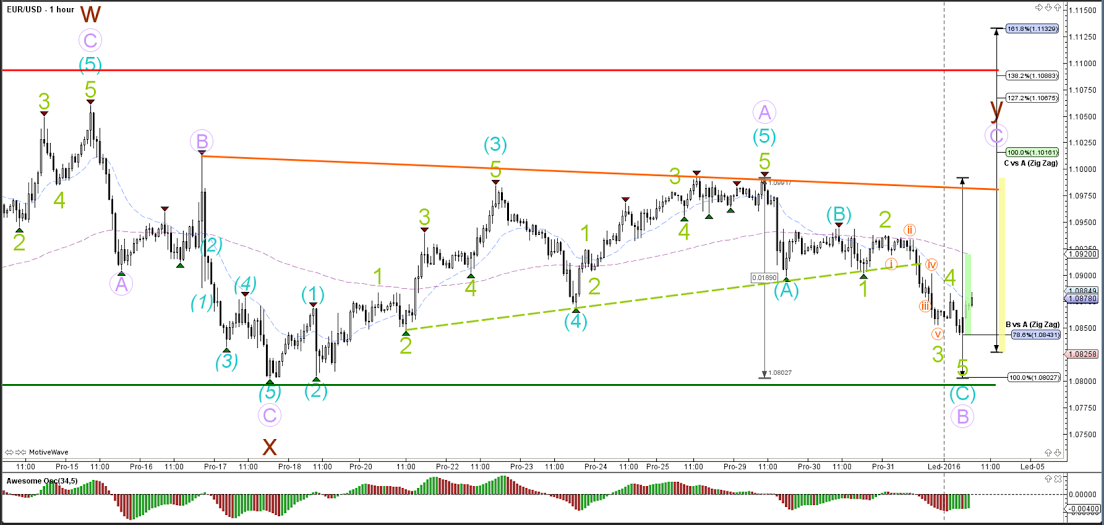

EUR/USD

4 hour

The EUR/USD is most likely in a wave B of a larger ABC (purple) zigzag. The wave count is invalidated if price breaks below the horizontal support (lighter green).

1 hour

The EUR/USD made a bearish break below the support trend line (dotted green) as part of a 5th wave (green), which could potential complete a wave C (blue) of a wave B (purple). Price has bounced at the 78.6% Fib and a break below the 100% mark invalidates this wave count.

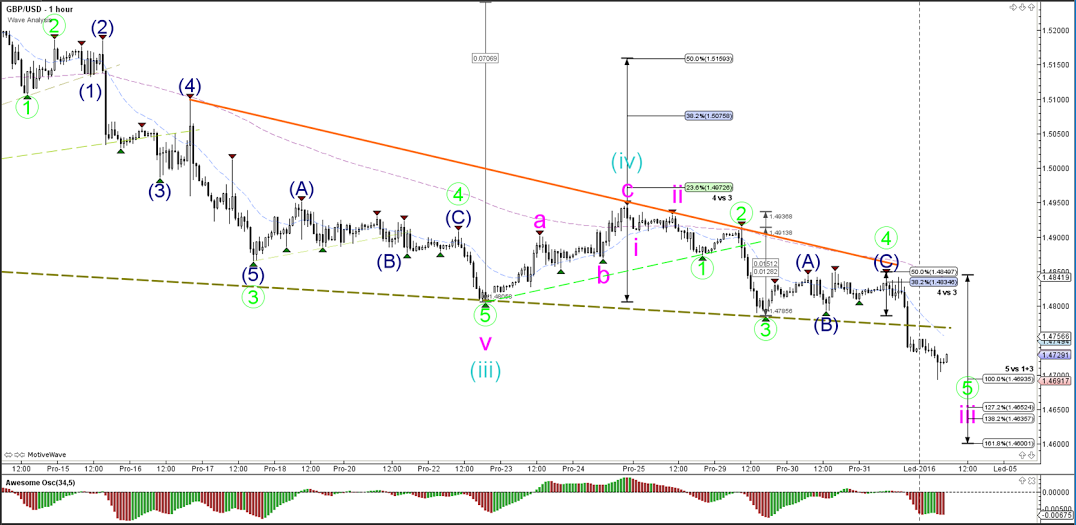

GBP/USD

4 hour

The GBP/USD is attempting to break below the downtrend channel, which could indicate wave 3 (pink) continuation.

1 hour

The GBP/USD broke below the support trend line (dotted green), which confirmed the completion of a shallow wave 4 (green) at the 50% Fibonacci level. Price has now moved down lower towards the Fibonacci targets of wave 5 (green).

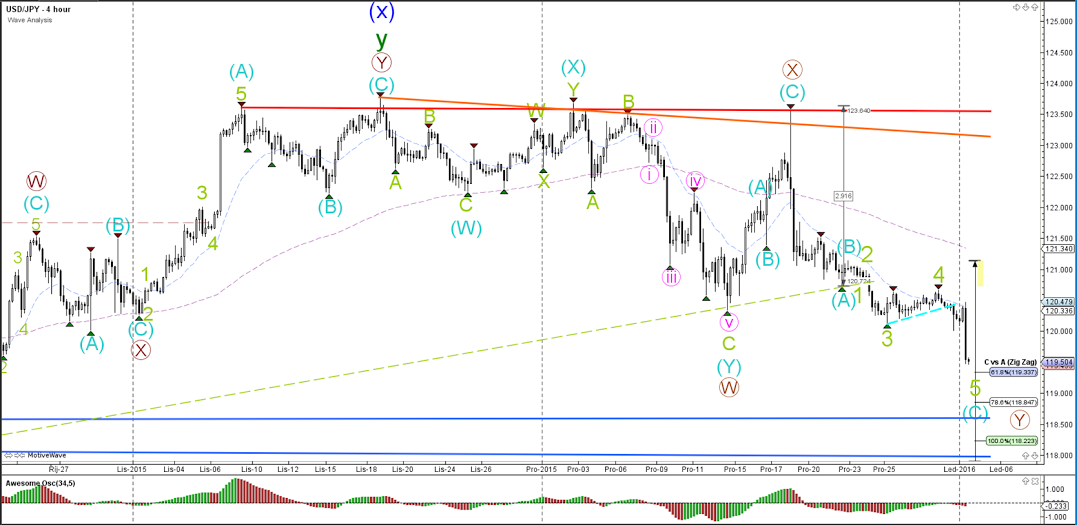

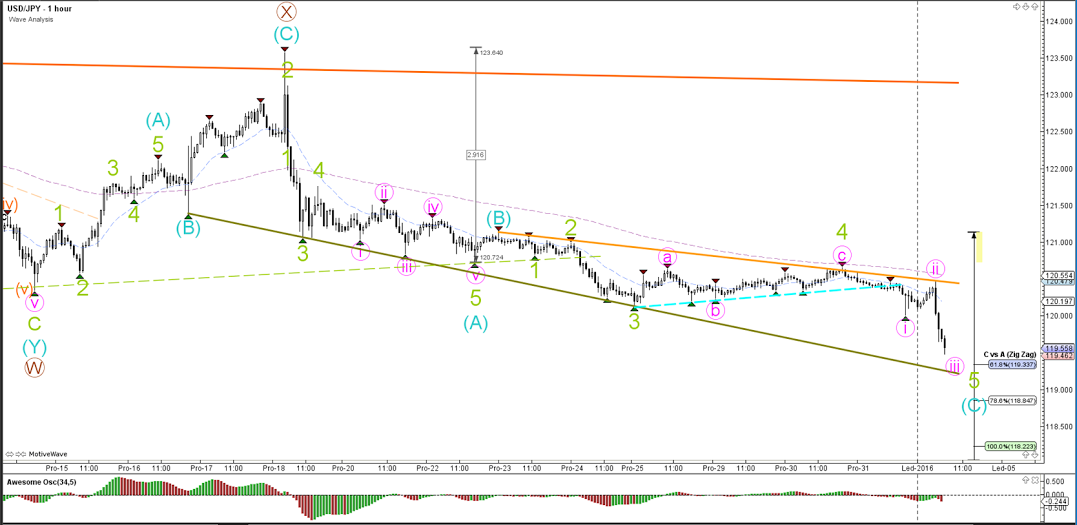

USD/JPY

4 hour

The USD/JPY is showing signs of bearish trend continuation as price keeps pushing to make lower lows. The blue support levels are support levels from the daily chart.

1 hour

The USD/JPY has completed a shallow wave 4 (green) correction before breaking the support (blue) trend line and continuing lower as part of wave 5.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.