EUR/USD

4 hour

The EUR/USD is showing light signals of bearish momentum but so far the downside pressure has been mild. Price could build a larger correction and move towards lower Fibs levels but these levels has a high chance of acting as s support as well.

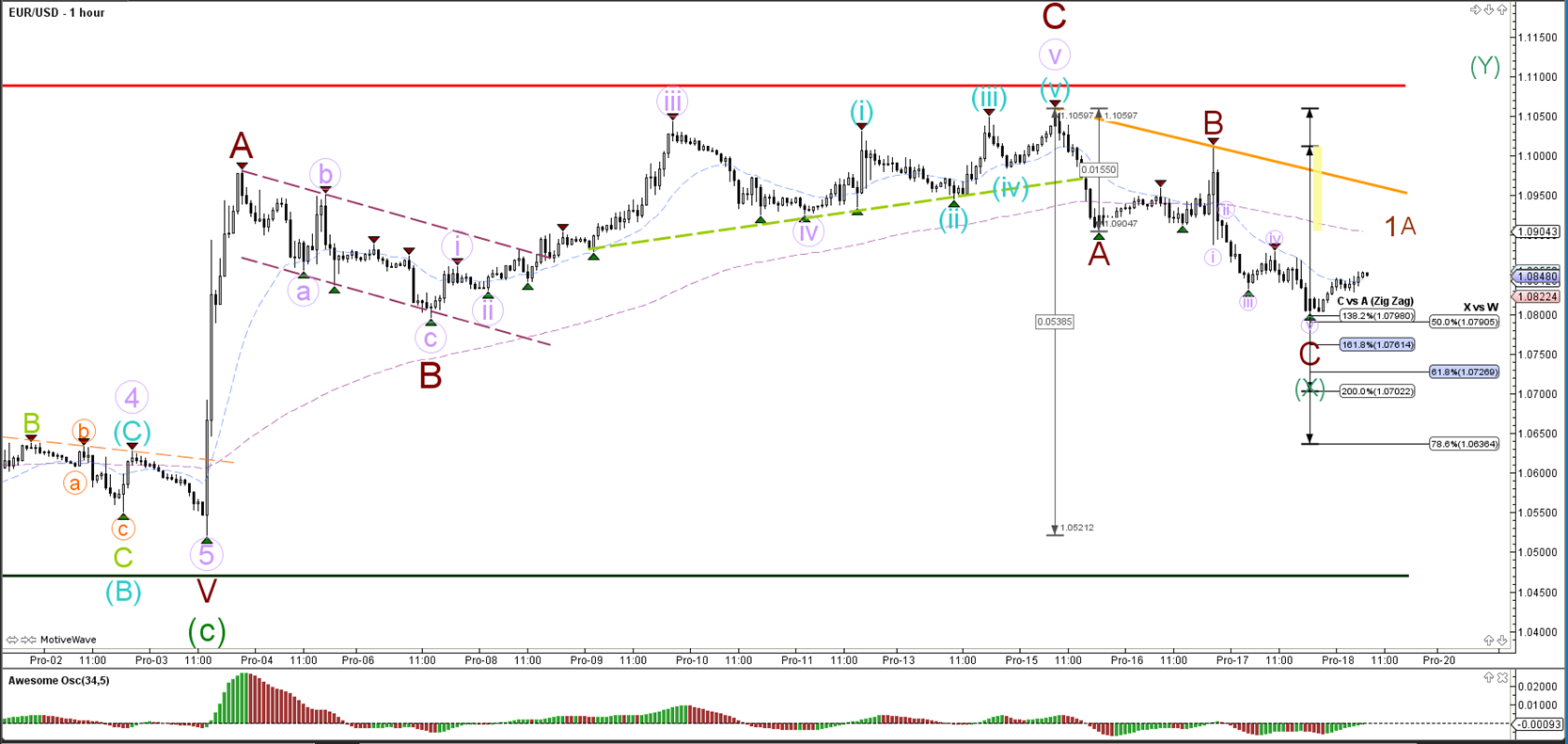

1 hour

The EUR/USD fell towards the Fibonacci levels of wave X versus wave Y (green) and bounced at the 50% Fib. If price shows bullish momentum then price could start a wave A or wave 1 (brown).

GBP/USD

4 hour

The GBP/USD bearish price action almost reached the bottom of the downtrend channel (green). Price seems to be building a bullish retracement at the 61.8% Fibonacci target, which could be part of a wave 4 correction (blue). Typically waves 4 respect the 23.6, 38.2% and 50% Fib levels after which one more bearish push for wave 5 could bring price to the bottom of the channel.

1 hour

The GBP/USD seems to be building an ABC (grey) bullish zigzag within wave 4 (blue), which is invalidated if price breaks above resistance (red/orange).

USD/JPY

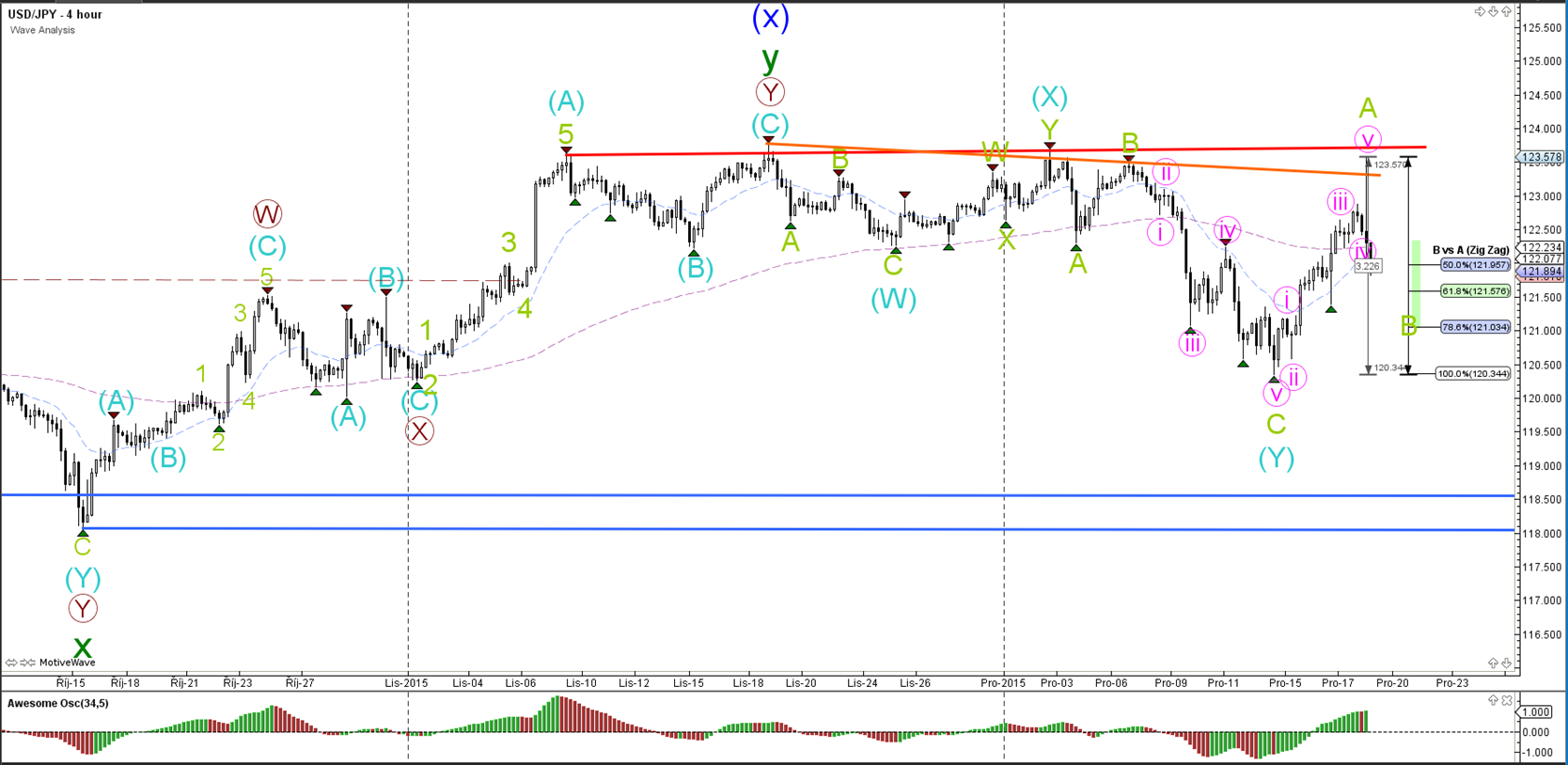

4 hour

The USD/JPY built a bullish rally but price has stopped at the confluence of resistance trend lines around 123.50 (orange/red).

1 hour

Price has fallen quickly from this resistance zone, which could indicate a bearish momentum such as a wave A (pink). An ABC seems the most likely path at the moment. A break below the 100% invalidates the current wave A-B structure (green).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.