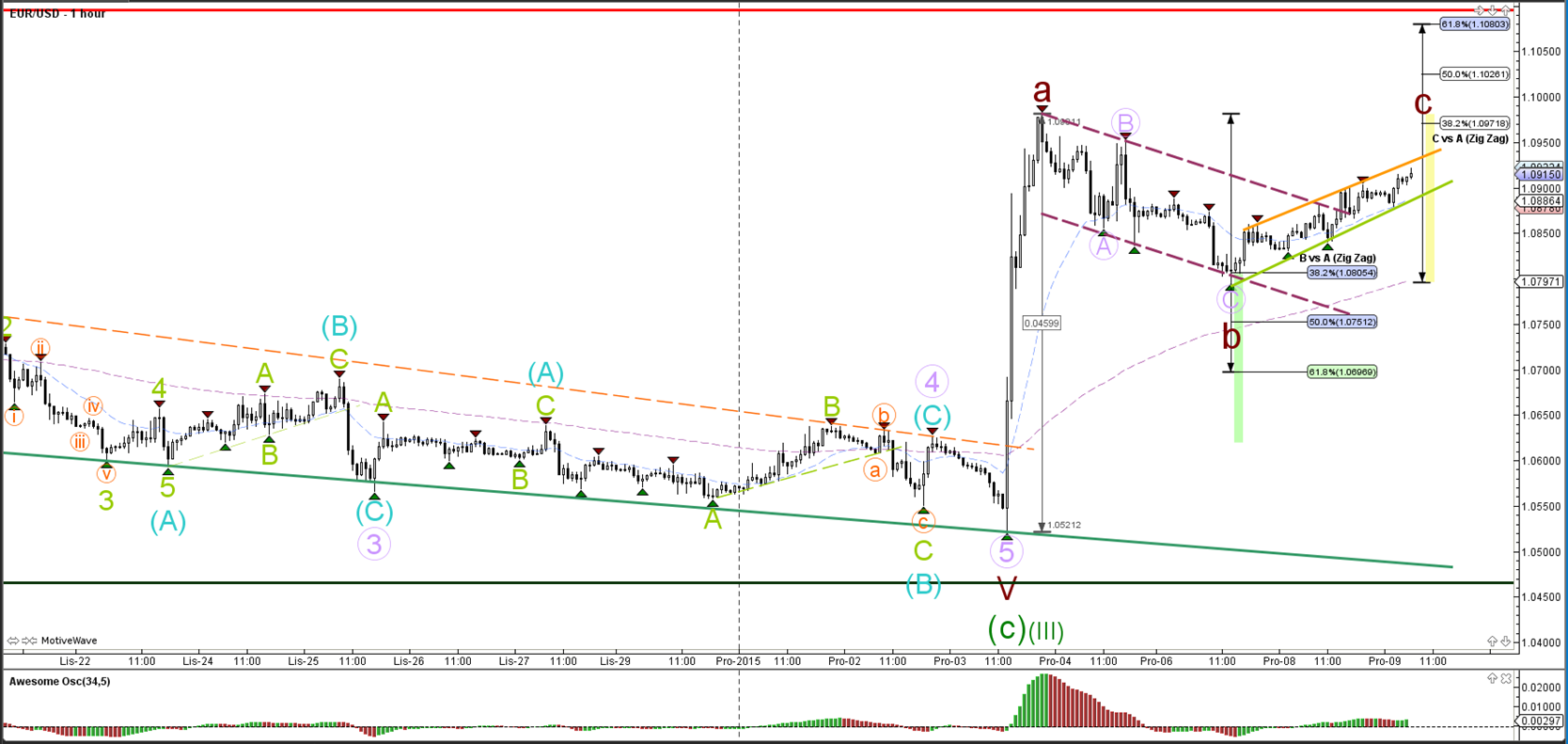

EUR/USD

4 hour

The EUR/USD bounced at the 38.2% Fibonacci level. which acted as support and provided a bullish bounce. A bullish rally would confirm the development of an ABC rally (brown).

1 hour

The EUR/USD broke above the bull flag (dotted purple) but price action has been slow and choppy so far. Price will need to break above the current resistance (orange) before a bigger impulse could occur. A break below support (green) could indicate the chance of a larger bearish correction to the 50% Fibonacci level.

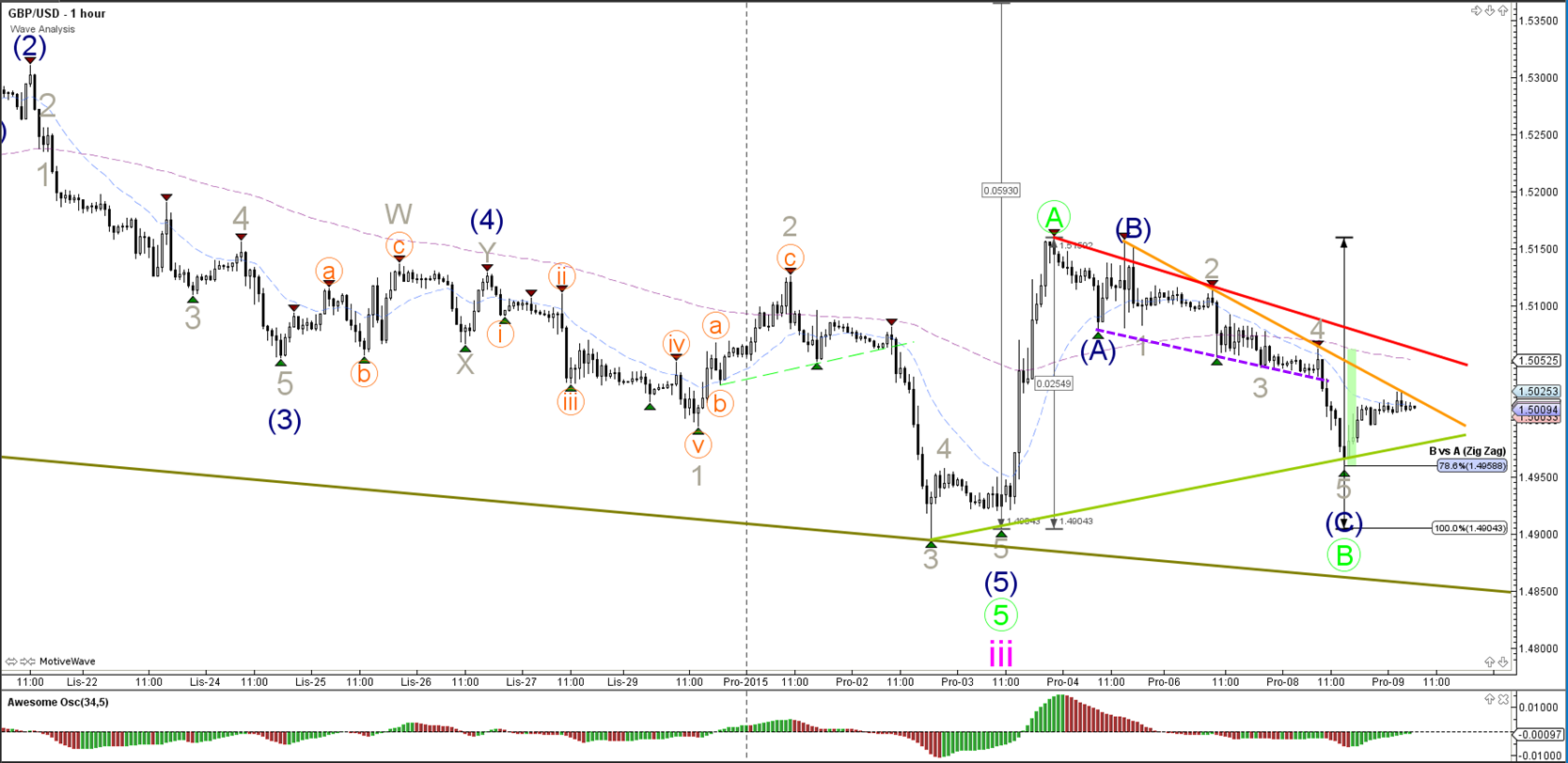

GBP/USD

4 hour

The GBP/USD bullish momentum (wave A) increases the chance of a larger ABC (green) zigzag correction, which could see support at the 78.6% Fibonacci level and resistance at the wave 4 (pink) Fib levels.

1 hour

The GBP/USD made a bearish break below the bull flag (dotted purple). Price fell towards the 78.6% Fibonacci level of wave B (green) and then bounced at this support level. A break above the resistance (orange/red) confirms the completion of wave B (green). A break below the support line (green) could see price make small drops towards the 100% level.

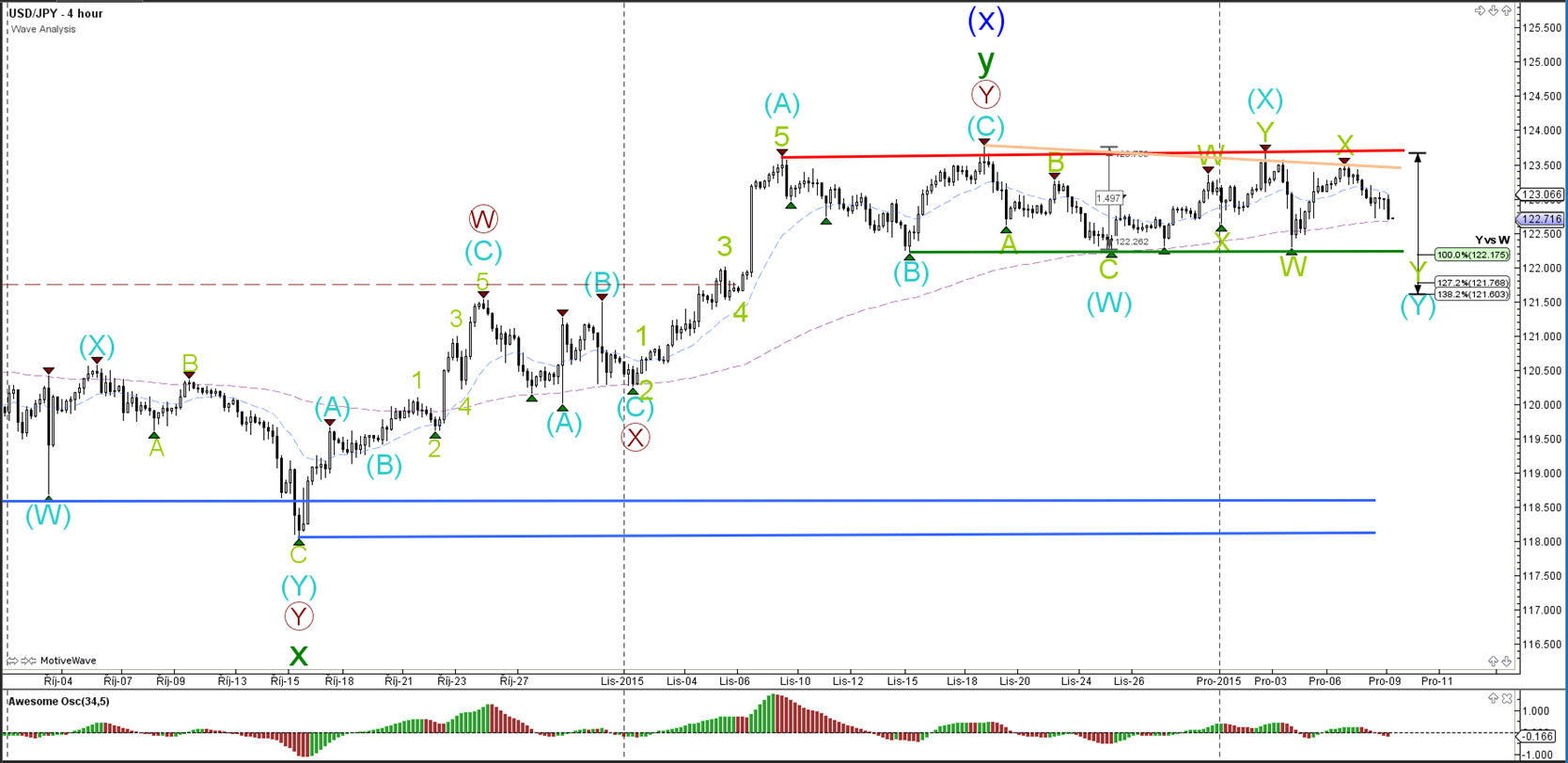

USD/JPY

4 hour

The USD/JPY bounced at the resistance (red) zone of the consolidation range (red/green). Price is now half way the range could fall to the bottom to complete the correction. A break of the zone is needed before a larger move can be expected.

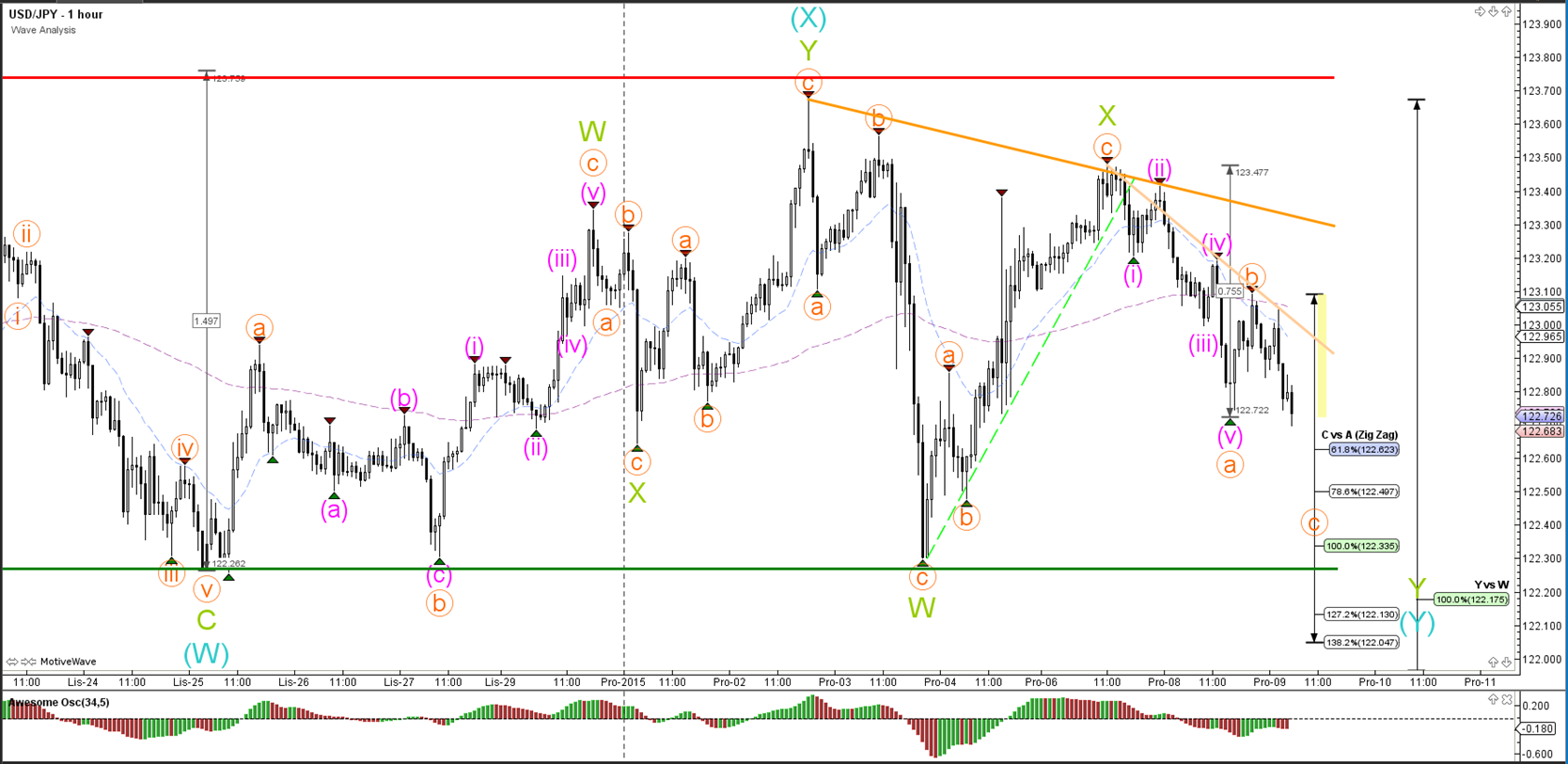

1 hour

The USD/JPY seems to be completing a bearish ABC (orange) zigzag within the consolidation zone.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak. Indeed the mind games intensify even further as investors cling to their rate cut hopes.