EUR/USD

4 hour

The EUR/USD retested the 138.2% Fibonacci level for the 3rd time, but has so far been unable to break below the support. This makes the wave WXY (blue) still the most likely scenario.

1 hour

The EUR/USD is moving sideways and is substantially slowing down as indicated by the purple trend lines. Both support and resistance trend lines are nearby and offer breakout levels.

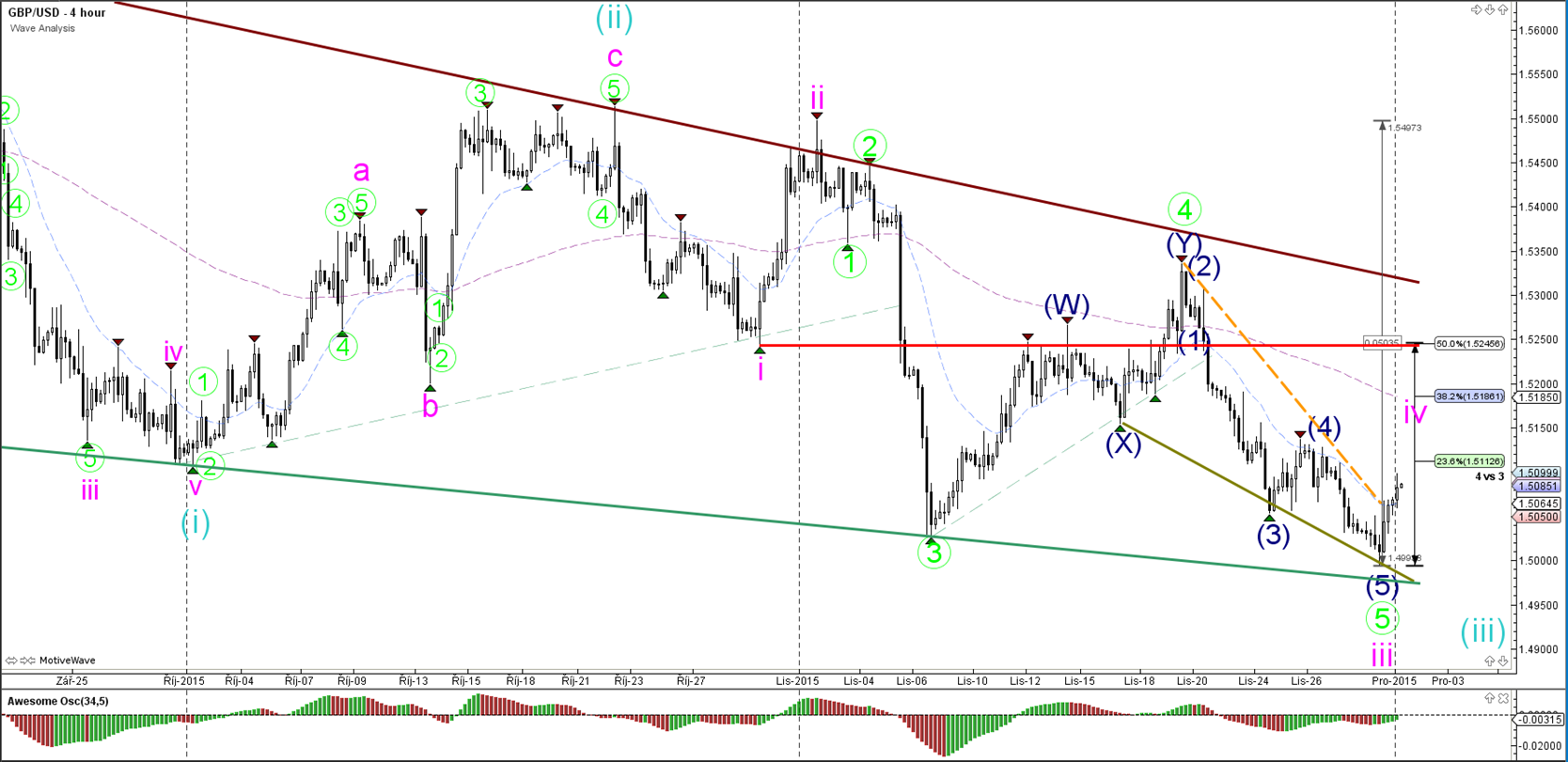

GBP/USD

4 hour

The GBP/USD respected the support trend lines (green) and the 1.50 round level. Price made a bullish bounce and looks to have completed the wave 3 (pink). A wave 4 retracement should not cross the bottom of wave 1 (red line).

1 hour

The GBP/USD is showing a bullish impulse, which broke above the resistance trend line (orange dotted). The Fibonacci levels of wave 4 (pink) should act as resistance points.

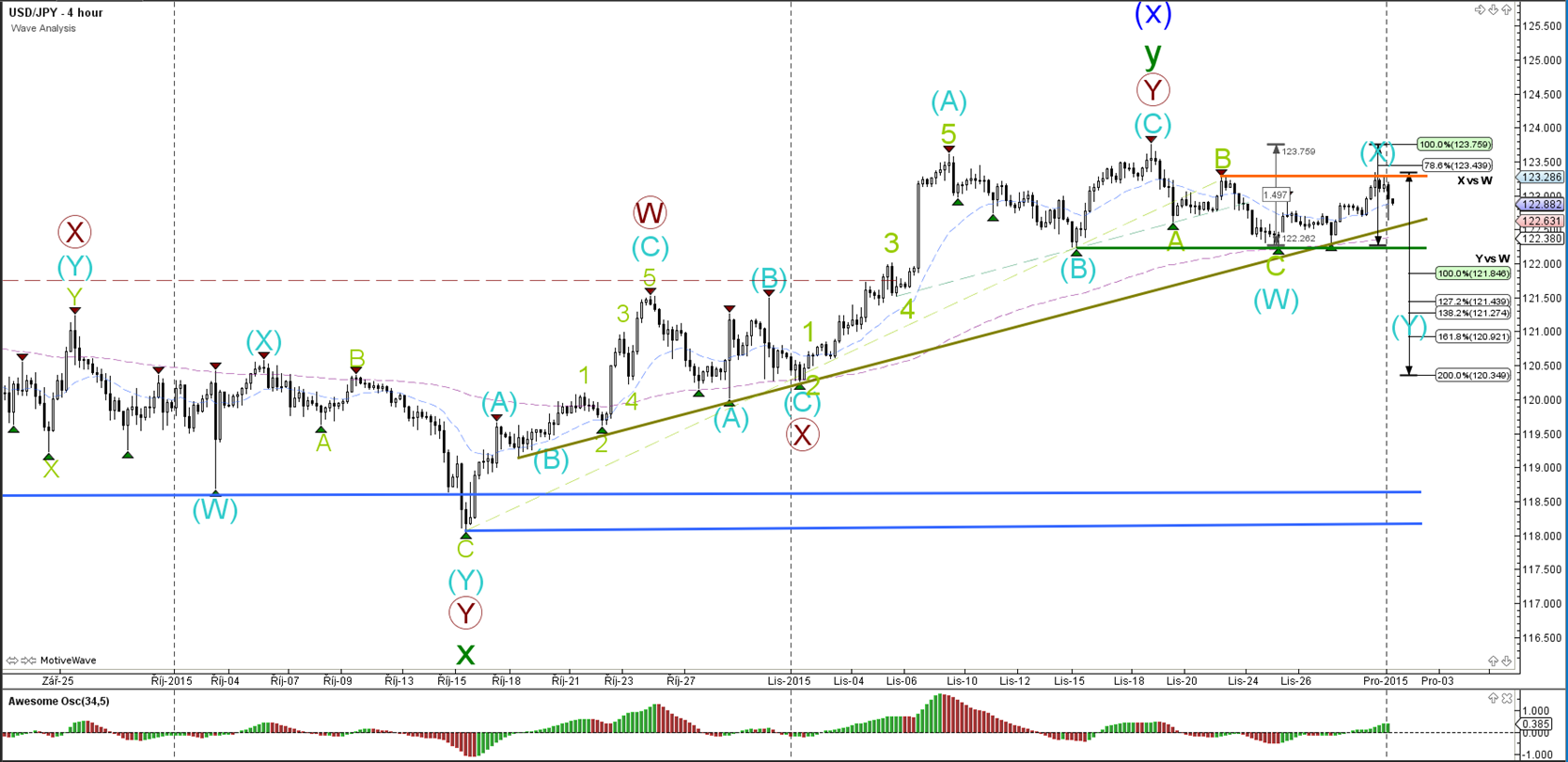

USD/JPY

4 hour

The USD/JPY price action has slowed down and price is caught in a narrow range (see trend lines). Price seems to have stopped at the 78.6% resistance Fibonacci level, which could be part of a wave X (blue).

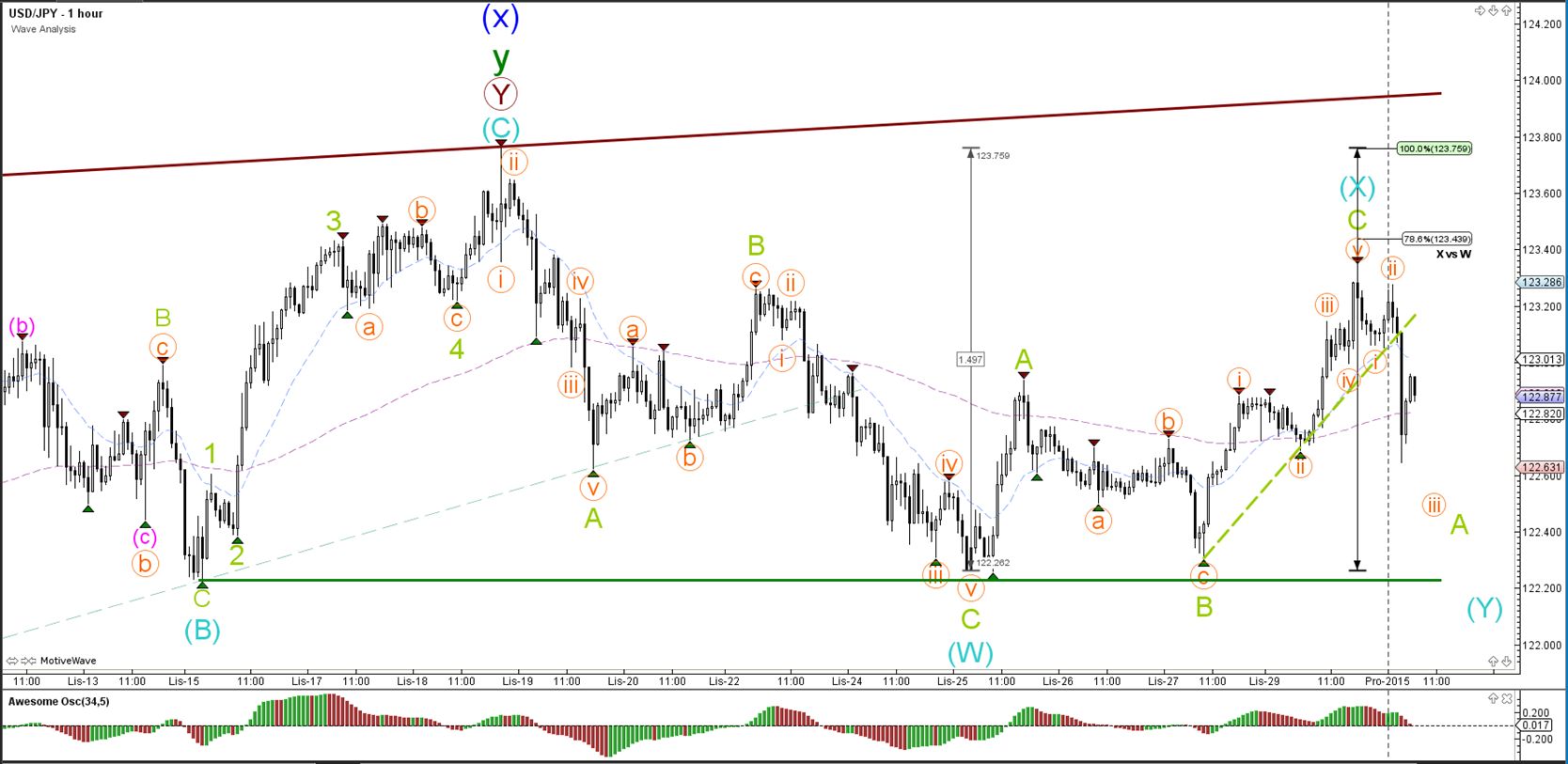

1 hour

The USD/JPY wave count was changed and the wave C (green) has been placed at the most recent lower low due to the bigger correction that followed afterwards (wave X).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.